Understanding Stocks

Understanding Stocks

Understanding Stocks

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

94 UNDERSTANDING STOCKS<br />

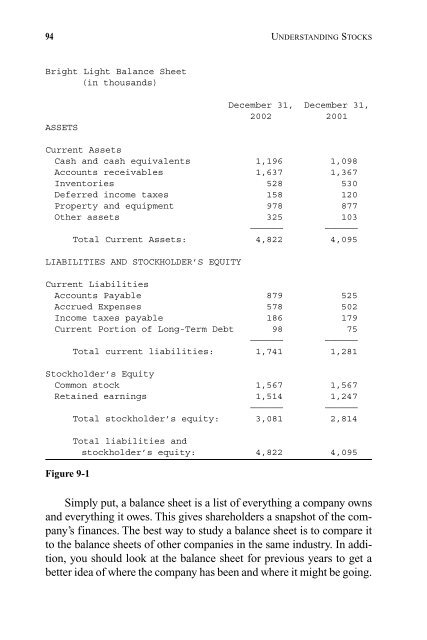

Bright Light Balance Sheet<br />

(in thousands)<br />

ASSETS<br />

December 31, December 31,<br />

2002 2001<br />

Current Assets<br />

Cash and cash equivalents 1,196 1,098<br />

Accounts receivables 1,637 1,367<br />

Inventories 528 530<br />

Deferred income taxes 158 120<br />

Property and equipment 978 877<br />

Other assets 325 103<br />

—————— ——————<br />

Total Current Assets: 4,822 4,095<br />

LIABILITIES AND STOCKHOLDER’S EQUITY<br />

Current Liabilities<br />

Accounts Payable 879 525<br />

Accrued Expenses 578 502<br />

Income taxes payable 186 179<br />

Current Portion of Long-Term Debt 98 75<br />

—————— ——————<br />

Total current liabilities: 1,741 1,281<br />

Stockholder’s Equity<br />

Common stock 1,567 1,567<br />

Retained earnings 1,514 1,247<br />

—————— ——————<br />

Total stockholder’s equity: 3,081 2,814<br />

Figure 9-1<br />

Total liabilities and<br />

stockholder’s equity: 4,822 4,095<br />

Simply put, a balance sheet is a list of everything a company owns<br />

and everything it owes. This gives shareholders a snapshot of the company’s<br />

finances. The best way to study a balance sheet is to compare it<br />

to the balance sheets of other companies in the same industry. In addition,<br />

you should look at the balance sheet for previous years to get a<br />

better idea of where the company has been and where it might be going.