Understanding Stocks

Understanding Stocks

Understanding Stocks

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

136 UNDERSTANDING STOCKS<br />

CAT Daily<br />

Realative Strength Index (14)<br />

02 Feb Mar Apr May JunAug Jul<br />

Sep Oct Nov Dec<br />

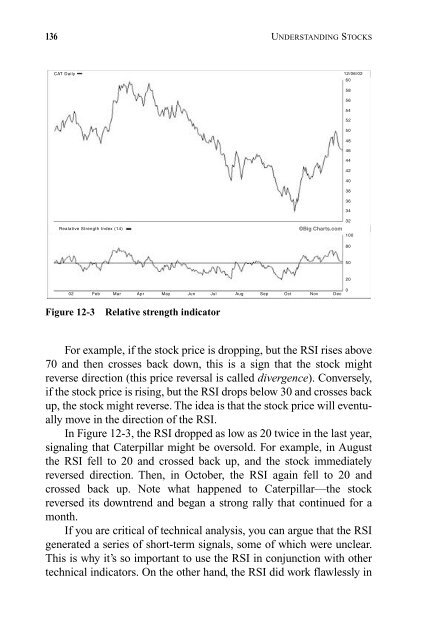

Figure 12-3 Relative strength indicator<br />

12/06/02<br />

For example, if the stock price is dropping, but the RSI rises above<br />

70 and then crosses back down, this is a sign that the stock might<br />

reverse direction (this price reversal is called divergence). Conversely,<br />

if the stock price is rising, but the RSI drops below 30 and crosses back<br />

up, the stock might reverse. The idea is that the stock price will eventually<br />

move in the direction of the RSI.<br />

In Figure 12-3, the RSI dropped as low as 20 twice in the last year,<br />

signaling that Caterpillar might be oversold. For example, in August<br />

the RSI fell to 20 and crossed back up, and the stock immediately<br />

reversed direction. Then, in October, the RSI again fell to 20 and<br />

crossed back up. Note what happened to Caterpillar—the stock<br />

reversed its downtrend and began a strong rally that continued for a<br />

month.<br />

If you are critical of technical analysis, you can argue that the RSI<br />

generated a series of short-term signals, some of which were unclear.<br />

This is why it’s so important to use the RSI in conjunction with other<br />

technical indicators. On the other hand, the RSI did work flawlessly in<br />

60<br />

58<br />

56<br />

54<br />

52<br />

50<br />

48<br />

46<br />

44<br />

42<br />

40<br />

38<br />

36<br />

34<br />

32<br />

©Big Charts.com<br />

100<br />

80<br />

50<br />

20<br />

0