Understanding Stocks

Understanding Stocks

Understanding Stocks

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

LET’S GET TECHNICAL: INTRODUCTION TO TECHNICAL ANALYSIS 121<br />

has stopped at the top of the trend, and it is about to reverse direction.<br />

Notice the head and the right and left shoulders. The point where the<br />

shoulders meet is the neckline.<br />

Analysis: The stock moves higher but pulls back to form the left<br />

shoulder. It then moves higher to form the head, which seems bullish. It<br />

then falls back to its support level or neckline, which is the alignment<br />

of the two support levels. The stock rises again to form the right shoulder<br />

but fails to break resistance. Keep your eye on the neckline, because<br />

the stock is doomed in the short term if it breaks below the neckline<br />

(which it did in Figure 11-10). The broken neckline confirms that the<br />

upward trend of the stock has been reversed.<br />

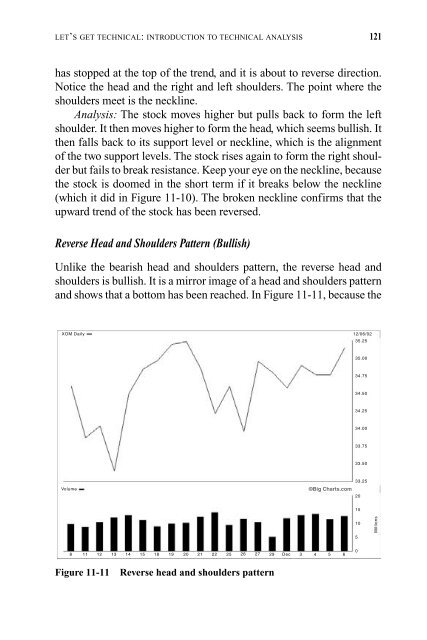

Reverse Head and Shoulders Pattern (Bullish)<br />

Unlike the bearish head and shoulders pattern, the reverse head and<br />

shoulders is bullish. It is a mirror image of a head and shoulders pattern<br />

and shows that a bottom has been reached. In Figure 11-11, because the<br />

XOM Daily<br />

Volume<br />

8 11 12 13 14 15 18 19 20 21 22 25 26 27 29 Dec 3 4 5 6<br />

Figure 11-11 Reverse head and shoulders pattern<br />

©Big Charts.com<br />

12/06/02<br />

35.25<br />

35.00<br />

34.75<br />

34.50<br />

34.25<br />

34.00<br />

33.75<br />

33.50<br />

33.25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Millions