Understanding Stocks

Understanding Stocks

Understanding Stocks

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

124 UNDERSTANDING STOCKS<br />

KO Hourly<br />

Volume<br />

T 10 11 12 1 2 3 4 F 10 11 12 1 2 3 4<br />

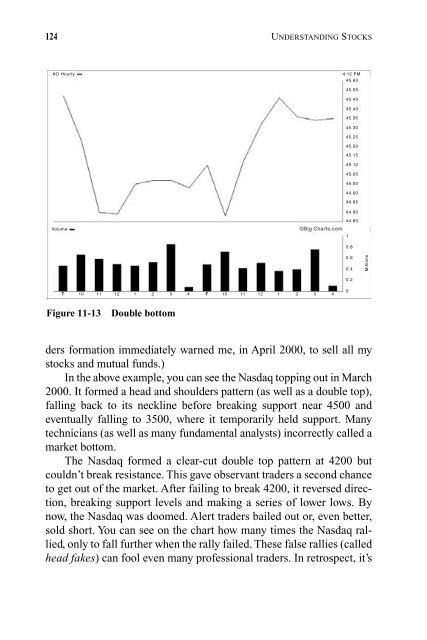

Figure 11-13 Double bottom<br />

4:12 PM<br />

45.60<br />

45.55<br />

45.45<br />

45.40<br />

45.35<br />

45.30<br />

45.25<br />

45.20<br />

ders formation immediately warned me, in April 2000, to sell all my<br />

stocks and mutual funds.)<br />

In the above example, you can see the Nasdaq topping out in March<br />

2000. It formed a head and shoulders pattern (as well as a double top),<br />

falling back to its neckline before breaking support near 4500 and<br />

eventually falling to 3500, where it temporarily held support. Many<br />

technicians (as well as many fundamental analysts) incorrectly called a<br />

market bottom.<br />

The Nasdaq formed a clear-cut double top pattern at 4200 but<br />

couldn’t break resistance. This gave observant traders a second chance<br />

to get out of the market. After failing to break 4200, it reversed direction,<br />

breaking support levels and making a series of lower lows. By<br />

now, the Nasdaq was doomed. Alert traders bailed out or, even better,<br />

sold short. You can see on the chart how many times the Nasdaq rallied,<br />

only to fall further when the rally failed. These false rallies (called<br />

head fakes) can fool even many professional traders. In retrospect, it’s<br />

45.15<br />

45.10<br />

45.05<br />

45.00<br />

44.00<br />

44.95<br />

44.90<br />

44.85<br />

©Big Charts.com<br />

1<br />

0.8<br />

0.6<br />

0.4<br />

0.2<br />

0<br />

Millions