Understanding Stocks

Understanding Stocks

Understanding Stocks

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

WANT TO MAKE MONEY SLOWLY? TRY THESE INVESTMENT STRATEGIES 75<br />

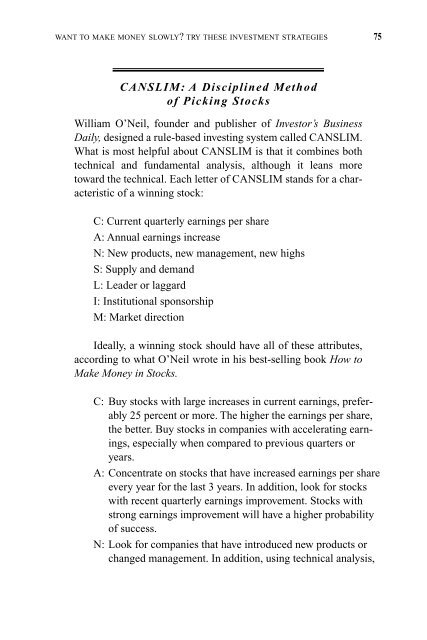

CANSLIM: A Disciplined Method<br />

of Picking <strong>Stocks</strong><br />

William O’Neil, founder and publisher of Investor’s Business<br />

Daily, designed a rule-based investing system called CANSLIM.<br />

What is most helpful about CANSLIM is that it combines both<br />

technical and fundamental analysis, although it leans more<br />

toward the technical. Each letter of CANSLIM stands for a characteristic<br />

of a winning stock:<br />

C: Current quarterly earnings per share<br />

A: Annual earnings increase<br />

N: New products, new management, new highs<br />

S: Supply and demand<br />

L: Leader or laggard<br />

I: Institutional sponsorship<br />

M: Market direction<br />

Ideally, a winning stock should have all of these attributes,<br />

according to what O’Neil wrote in his best-selling book How to<br />

Make Money in <strong>Stocks</strong>.<br />

C: Buy stocks with large increases in current earnings, preferably<br />

25 percent or more. The higher the earnings per share,<br />

the better. Buy stocks in companies with accelerating earnings,<br />

especially when compared to previous quarters or<br />

years.<br />

A: Concentrate on stocks that have increased earnings per share<br />

every year for the last 3 years. In addition, look for stocks<br />

with recent quarterly earnings improvement. <strong>Stocks</strong> with<br />

strong earnings improvement will have a higher probability<br />

of success.<br />

N: Look for companies that have introduced new products or<br />

changed management. In addition, using technical analysis,