- Page 2 and 3:

UNDERSTANDING STOCKS Michael Sincer

- Page 4 and 5:

For more information about. this ti

- Page 6 and 7:

Acknowledgments I’d like to give

- Page 8 and 9:

Introduction This book will be diff

- Page 10 and 11:

INTRODUCTION ix losing money (Part

- Page 12 and 13:

PART ONE WHAT YOU NEED TO KNOW FIRS

- Page 14 and 15:

1 C H A P T E R Welcome to the Stoc

- Page 16 and 17:

WELCOME TO THE STOCK MARKET 5 techn

- Page 18 and 19:

WELCOME TO THE STOCK MARKET 7 was c

- Page 20 and 21:

WELCOME TO THE STOCK MARKET 9 long

- Page 22 and 23:

WELCOME TO THE STOCK MARKET 11 Jone

- Page 24 and 25:

WELCOME TO THE STOCK MARKET 13 10,1

- Page 26 and 27:

WELCOME TO THE STOCK MARKET 15 For

- Page 28 and 29:

WELCOME TO THE STOCK MARKET 17 McDo

- Page 30 and 31:

2 C H A P T E R Stocks: Not Your On

- Page 32 and 33:

STOCKS: NOT YOUR ONLY INVESTMENT 21

- Page 34 and 35:

STOCKS: NOT YOUR ONLY INVESTMENT 23

- Page 36 and 37:

STOCKS: NOT YOUR ONLY INVESTMENT 25

- Page 38 and 39:

STOCKS: NOT YOUR ONLY INVESTMENT 27

- Page 40 and 41:

3 C H A P T E R How to Classify Sto

- Page 42 and 43:

HOW TO CLASSIFY STOCKS 31 dividend

- Page 44 and 45:

HOW TO CLASSIFY STOCKS 33 Penny Sto

- Page 46 and 47:

HOW TO CLASSIFY STOCKS 35 run fairl

- Page 48 and 49:

4 C H A P T E R Fun Things You Can

- Page 50 and 51:

FUN THINGS YOU CAN DO (WITH STOCKS)

- Page 52 and 53:

FUN THINGS YOU CAN DO (WITH STOCKS)

- Page 54 and 55:

FUN THINGS YOU CAN DO (WITH STOCKS)

- Page 56 and 57:

FUN THINGS YOU CAN DO (WITH STOCKS)

- Page 58 and 59:

FUN THINGS YOU CAN DO (WITH STOCKS)

- Page 60 and 61:

5 C H A P T E R Understanding Stock

- Page 62 and 63:

UNDERSTANDING STOCK PRICES 51 Views

- Page 64 and 65:

UNDERSTANDING STOCK PRICES 53 After

- Page 66 and 67:

6 C H A P T E R Where to Buy Stocks

- Page 68 and 69:

WHERE TO BUY STOCKS 57 whether a fu

- Page 70 and 71:

WHERE TO BUY STOCKS 59 Market Order

- Page 72 and 73:

WHERE TO BUY STOCKS 61 Some people

- Page 74 and 75:

WHERE TO BUY STOCKS 63 market, avoi

- Page 76 and 77:

WHERE TO BUY STOCKS 65 ways was eer

- Page 78 and 79:

PART TWO MONEY-MAKING STRATEGIES Co

- Page 80 and 81:

7 C H A P T E R Want to Make Money

- Page 82 and 83:

WANT TO MAKE MONEY SLOWLY? TRY THES

- Page 84 and 85:

WANT TO MAKE MONEY SLOWLY? TRY THES

- Page 86 and 87: WANT TO MAKE MONEY SLOWLY? TRY THES

- Page 88 and 89: 8 C H A P T E R Want to Make Money

- Page 90 and 91: WANT TO MAKE MONEY FAST? TRY THESE

- Page 92 and 93: WANT TO MAKE MONEY FAST? TRY THESE

- Page 94 and 95: WANT TO MAKE MONEY FAST? TRY THESE

- Page 96 and 97: WANT TO MAKE MONEY FAST? TRY THESE

- Page 98 and 99: PART THREE FINDING STOCKS TO BUY AN

- Page 100 and 101: 9 C H A P T E R It’s Really Funda

- Page 102 and 103: IT’S REALLY FUNDAMENTAL: INTRODUC

- Page 104 and 105: IT’S REALLY FUNDAMENTAL: INTRODUC

- Page 106 and 107: IT’S REALLY FUNDAMENTAL: INTRODUC

- Page 108 and 109: 10 C H A P T E R Fundamental Analys

- Page 110 and 111: FUNDAMENTAL ANALYSIS: TOOLS AND TAC

- Page 112 and 113: FUNDAMENTAL ANALYSIS: TOOLS AND TAC

- Page 114 and 115: FUNDAMENTAL ANALYSIS: TOOLS AND TAC

- Page 116 and 117: FUNDAMENTAL ANALYSIS: TOOLS AND TAC

- Page 118 and 119: 11 C H A P T E R Let’s Get Techni

- Page 120 and 121: LET’S GET TECHNICAL: INTRODUCTION

- Page 122 and 123: LET’S GET TECHNICAL: INTRODUCTION

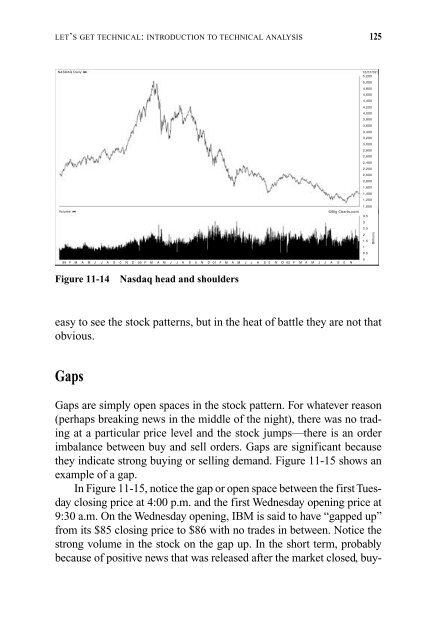

- Page 124 and 125: LET’S GET TECHNICAL: INTRODUCTION

- Page 126 and 127: LET’S GET TECHNICAL: INTRODUCTION

- Page 128 and 129: LET’S GET TECHNICAL: INTRODUCTION

- Page 130 and 131: LET’S GET TECHNICAL: INTRODUCTION

- Page 132 and 133: LET’S GET TECHNICAL: INTRODUCTION

- Page 134 and 135: LET’S GET TECHNICAL: INTRODUCTION

- Page 138 and 139: LET’S GET TECHNICAL: INTRODUCTION

- Page 140 and 141: LET’S GET TECHNICAL: INTRODUCTION

- Page 142 and 143: 12 C H A P T E R Technical Analysis

- Page 144 and 145: TECHNICAL ANALYSIS: TOOLS AND TACTI

- Page 146 and 147: TECHNICAL ANALYSIS: TOOLS AND TACTI

- Page 148 and 149: TECHNICAL ANALYSIS: TOOLS AND TACTI

- Page 150 and 151: TECHNICAL ANALYSIS: TOOLS AND TACTI

- Page 152 and 153: 13 C H A P T E R The Psychology of

- Page 154 and 155: THE PSYCHOLOGY OF STOCKS: INTRODUCT

- Page 156 and 157: THE PSYCHOLOGY OF STOCKS: INTRODUCT

- Page 158 and 159: PART FOUR UNCOMMON ADVICE Copyright

- Page 160 and 161: 14 C H A P T E R What Makes Stocks

- Page 162 and 163: WHAT MAKES STOCKS GO UP OR DOWN 151

- Page 164 and 165: WHAT MAKES STOCKS GO UP OR DOWN 153

- Page 166 and 167: WHAT MAKES STOCKS GO UP OR DOWN 155

- Page 168 and 169: 15 C H A P T E R Why Investors Lose

- Page 170 and 171: WHY INVESTORS LOSE MONEY 159 Mistak

- Page 172 and 173: WHY INVESTORS LOSE MONEY 161 nies w

- Page 174 and 175: WHY INVESTORS LOSE MONEY 163 Mistak

- Page 176 and 177: WHY INVESTORS LOSE MONEY 165 bly wi

- Page 178 and 179: WHY INVESTORS LOSE MONEY 167 2. Tra

- Page 180 and 181: WHY INVESTORS LOSE MONEY 169 As wit

- Page 182 and 183: 16 C H A P T E R What I Really Thin

- Page 184 and 185: WHAT I REALLY THINK ABOUT THE STOCK

- Page 186 and 187:

WHAT I REALLY THINK ABOUT THE STOCK

- Page 188 and 189:

WHAT I REALLY THINK ABOUT THE STOCK

- Page 190 and 191:

WHAT I REALLY THINK ABOUT THE STOCK

- Page 192 and 193:

WHAT I REALLY THINK ABOUT THE STOCK

- Page 194 and 195:

WHAT I REALLY THINK ABOUT THE STOCK

- Page 196 and 197:

WHAT I REALLY THINK ABOUT THE STOCK

- Page 198 and 199:

WHAT I REALLY THINK ABOUT THE STOCK

- Page 200 and 201:

Index AAA bonds, 20-21 Advice, 164-

- Page 202 and 203:

INDEX 191 Environment, 149-155 defl

- Page 204 and 205:

INDEX 193 Mutual fund redemptions,

- Page 206 and 207:

INDEX 195 Specialists, 14, 62 Split

- Page 208:

About the Author Michael Sincere be