Understanding Stocks

Understanding Stocks

Understanding Stocks

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

98 UNDERSTANDING STOCKS<br />

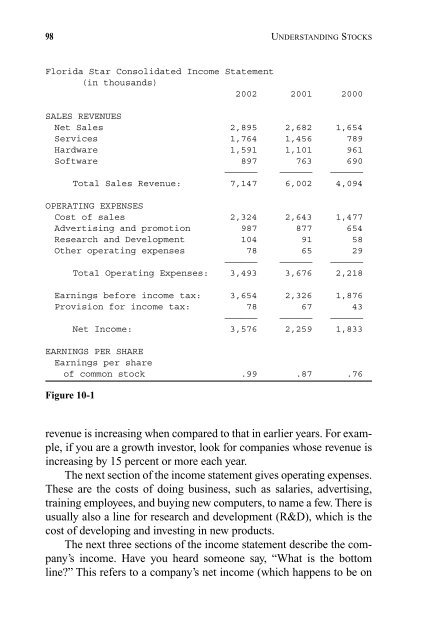

Florida Star Consolidated Income Statement<br />

(in thousands)<br />

2002 2001 2000<br />

SALES REVENUES<br />

Net Sales 2,895 2,682 1,654<br />

Services 1,764 1,456 789<br />

Hardware 1,591 1,101 961<br />

Software 897 763 690<br />

—————— —————— ——————<br />

Total Sales Revenue: 7,147 6,002 4,094<br />

OPERATING EXPENSES<br />

Cost of sales 2,324 2,643 1,477<br />

Advertising and promotion 987 877 654<br />

Research and Development 104 91 58<br />

Other operating expenses 78 65 29<br />

—————— —————— ——————<br />

Total Operating Expenses: 3,493 3,676 2,218<br />

Earnings before income tax: 3,654 2,326 1,876<br />

Provision for income tax: 78 67 43<br />

—————— —————— ——————<br />

Net Income: 3,576 2,259 1,833<br />

EARNINGS PER SHARE<br />

Earnings per share<br />

of common stock .99 .87 .76<br />

Figure 10-1<br />

revenue is increasing when compared to that in earlier years. For example,<br />

if you are a growth investor, look for companies whose revenue is<br />

increasing by 15 percent or more each year.<br />

The next section of the income statement gives operating expenses.<br />

These are the costs of doing business, such as salaries, advertising,<br />

training employees, and buying new computers, to name a few. There is<br />

usually also a line for research and development (R&D), which is the<br />

cost of developing and investing in new products.<br />

The next three sections of the income statement describe the company’s<br />

income. Have you heard someone say, “What is the bottom<br />

line?” This refers to a company’s net income (which happens to be on