20645_Scapa_AR_160504

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES ON THE ACCOUNTS CONTINUED<br />

21. DERIVATIVE FINANCIAL INSTRUMENTS CONTINUED<br />

– Interest rate risk<br />

The Group is exposed to interest rate risk as it has borrowings at floating rates. Interest rate risk is evaluated periodically to consider interest rate<br />

views and defined risk appetite; to seek to ensure that reasonable economic strategies are applied, by either positioning the Balance Sheet or<br />

protecting interest expense through different interest rate cycles. Deposit risk is managed by spreading deposits across high credit rated<br />

institutions, and capping the maximum deposit with an institution at one time.<br />

– Commodity price risk<br />

The Group is exposed to commodity price risk as it buys a number of commodity products that are vital to its production process. The Group<br />

mitigates this risk by fixing pricing with its suppliers where possible. The contracts entered into continue to be held for the purpose of the<br />

receipt of the commodity in accordance with the Group’s expected purchase or usage requirements. There is no intention to re-sell the<br />

commodities bought.<br />

– Liquidity risk<br />

The Group maintains a mixture of committed long-term and short-term facilities designed to ensure that the Group has sufficient cash funds<br />

available for operations and planned investment.<br />

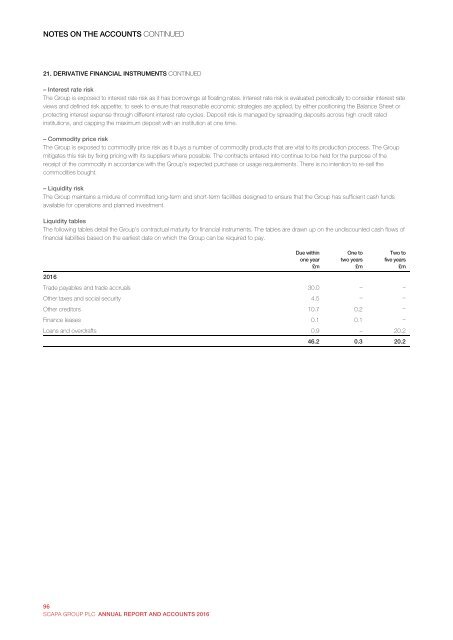

Liquidity tables<br />

The following tables detail the Group’s contractual maturity for financial instruments. The tables are drawn up on the undiscounted cash flows of<br />

financial liabilities based on the earliest date on which the Group can be required to pay.<br />

Due within<br />

one year<br />

£m<br />

One to<br />

two years<br />

£m<br />

Two to<br />

five years<br />

£m<br />

2016<br />

Trade payables and trade accruals 30.0 – –<br />

Other taxes and social security 4.5 – –<br />

Other creditors 10.7 0.2 –<br />

Finance leases 0.1 0.1 –<br />

Loans and overdrafts 0.9 – 20.2<br />

46.2 0.3 20.2<br />

96<br />

SCAPA GROUP PLC ANNUAL REPORT AND ACCOUNTS 2016<br />

91<br />

Annual Report and Accounts 2016 <strong>Scapa</strong> Group plc