20645_Scapa_AR_160504

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

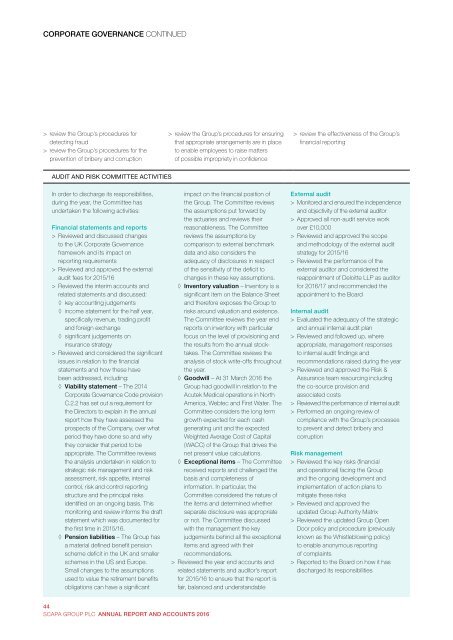

CORPORATE GOVERNANCE CONTINUED<br />

> > review the Group’s procedures for<br />

detecting fraud<br />

> > review the Group’s procedures for the<br />

prevention of bribery and corruption<br />

> > review the Group’s procedures for ensuring<br />

that appropriate arrangements are in place<br />

to enable employees to raise matters<br />

of possible impropriety in confidence<br />

> > review the effectiveness of the Group’s<br />

financial reporting<br />

AUDIT AND RISK COMMITTEE ACTIVITIES<br />

In order to discharge its responsibilities,<br />

during the year, the Committee has<br />

undertaken the following activities:<br />

Financial statements and reports<br />

> > Reviewed and discussed changes<br />

to the UK Corporate Governance<br />

framework and its impact on<br />

reporting requirements<br />

> > Reviewed and approved the external<br />

audit fees for 2015/16<br />

> > Reviewed the interim accounts and<br />

related statements and discussed:<br />

◊ key accounting judgements<br />

◊ income statement for the half year,<br />

specifically revenue, trading profit<br />

and foreign exchange<br />

◊ significant judgements on<br />

insurance strategy<br />

> > Reviewed and considered the significant<br />

issues in relation to the financial<br />

statements and how these have<br />

been addressed, including:<br />

◊ Viability statement – The 2014<br />

Corporate Governance Code provision<br />

C.2.2 has set out a requirement for<br />

the Directors to explain in the annual<br />

report how they have assessed the<br />

prospects of the Company, over what<br />

period they have done so and why<br />

they consider that period to be<br />

appropriate. The Committee reviews<br />

the analysis undertaken in relation to<br />

strategic risk management and risk<br />

assessment, risk appetite, internal<br />

control, risk and control reporting<br />

structure and the principal risks<br />

identified on an ongoing basis. This<br />

monitoring and review informs the draft<br />

statement which was documented for<br />

the first time in 2015/16.<br />

◊ Pension liabilities – The Group has<br />

a material defined benefit pension<br />

scheme deficit in the UK and smaller<br />

schemes in the US and Europe.<br />

Small changes to the assumptions<br />

used to value the retirement benefits<br />

obligations can have a significant<br />

impact on the financial position of<br />

the Group. The Committee reviews<br />

the assumptions put forward by<br />

the actuaries and reviews their<br />

reasonableness. The Committee<br />

reviews the assumptions by<br />

comparison to external benchmark<br />

data and also considers the<br />

adequacy of disclosures in respect<br />

of the sensitivity of the deficit to<br />

changes in these key assumptions.<br />

◊ Inventory valuation – Inventory is a<br />

significant item on the Balance Sheet<br />

and therefore exposes the Group to<br />

risks around valuation and existence.<br />

The Committee reviews the year end<br />

reports on inventory with particular<br />

focus on the level of provisioning and<br />

the results from the annual stocktakes.<br />

The Committee reviews the<br />

analysis of stock write-offs throughout<br />

the year.<br />

◊ Goodwill – At 31 March 2016 the<br />

Group had goodwill in relation to the<br />

Acutek Medical operations in North<br />

America, Webtec and First Water. The<br />

Committee considers the long term<br />

growth expected for each cash<br />

generating unit and the expected<br />

Weighted Average Cost of Capital<br />

(WACC) of the Group that drives the<br />

net present value calculations.<br />

◊ Exceptional items – The Committee<br />

received reports and challenged the<br />

basis and completeness of<br />

information. In particular, the<br />

Committee considered the nature of<br />

the items and determined whether<br />

separate disclosure was appropriate<br />

or not. The Committee discussed<br />

with the management the key<br />

judgements behind all the exceptional<br />

items and agreed with their<br />

recommendations.<br />

> > Reviewed the year end accounts and<br />

related statements and auditor’s report<br />

for 2015/16 to ensure that the report is<br />

fair, balanced and understandable<br />

External audit<br />

> > Monitored and ensured the independence<br />

and objectivity of the external auditor<br />

> > Approved all non-audit service work<br />

over £10,000<br />

> > Reviewed and approved the scope<br />

and methodology of the external audit<br />

strategy for 2015/16<br />

> > Reviewed the performance of the<br />

external auditor and considered the<br />

reappointment of Deloitte LLP as auditor<br />

for 2016/17 and recommended the<br />

appointment to the Board<br />

Internal audit<br />

> > Evaluated the adequacy of the strategic<br />

and annual internal audit plan<br />

> > Reviewed and followed up, where<br />

appropriate, management responses<br />

to internal audit findings and<br />

recommendations raised during the year<br />

> > Reviewed and approved the Risk &<br />

Assurance team resourcing including<br />

the co-source provision and<br />

associated costs<br />

> > Reviewed the performance of internal audit<br />

> > Performed an ongoing review of<br />

compliance with the Group’s processes<br />

to prevent and detect bribery and<br />

corruption<br />

Risk management<br />

> > Reviewed the key risks (financial<br />

and operational) facing the Group<br />

and the ongoing development and<br />

implementation of action plans to<br />

mitigate these risks<br />

> > Reviewed and approved the<br />

updated Group Authority Matrix<br />

> > Reviewed the updated Group Open<br />

Door policy and procedure (previously<br />

known as the Whistleblowing policy)<br />

to enable anonymous reporting<br />

of complaints<br />

> > Reported to the Board on how it has<br />

discharged its responsibilities<br />

44<br />

SCAPA GROUP PLC ANNUAL REPORT AND ACCOUNTS 2016