20645_Scapa_AR_160504

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES ON THE ACCOUNTS CONTINUED<br />

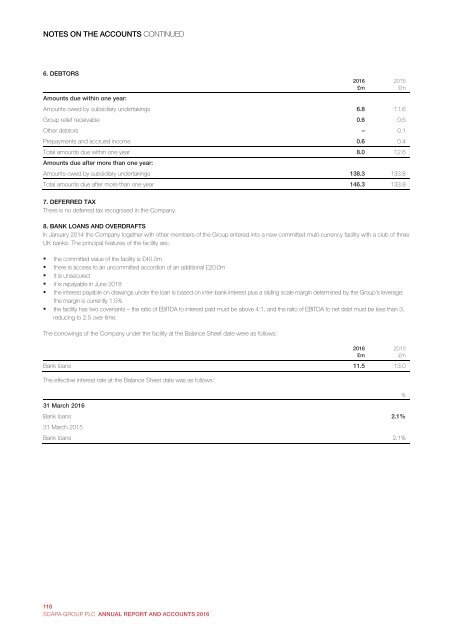

6. DEBTORS<br />

Amounts due within one year:<br />

Amounts owed by subsidiary undertakings 6.8 11.6<br />

Group relief receivable 0.6 0.5<br />

Other debtors – 0.1<br />

Prepayments and accrued income 0.6 0.4<br />

Total amounts due within one year 8.0 12.6<br />

Amounts due after more than one year:<br />

Amounts owed by subsidiary undertakings 138.3 133.8<br />

Total amounts due after more than one year 146.3 133.8<br />

2016<br />

£m<br />

2015<br />

£m<br />

7. DEFERRED TAX<br />

There is no deferred tax recognised in the Company.<br />

8. BANK LOANS AND OVERDRAFTS<br />

In January 2014 the Company together with other members of the Group entered into a new committed multi-currency facility with a club of three<br />

UK banks. The principal features of the facility are:<br />

the committed value of the facility is £40.0m<br />

there is access to an uncommitted accordion of an additional £20.0m<br />

it is unsecured<br />

it is repayable in June 2018<br />

the interest payable on drawings under the loan is based on inter-bank interest plus a sliding scale margin determined by the Group’s leverage;<br />

the margin is currently 1.5%<br />

the facility has two covenants – the ratio of EBITDA to interest paid must be above 4:1, and the ratio of EBITDA to net debt must be less than 3,<br />

reducing to 2.5 over time.<br />

The borrowings of the Company under the facility at the Balance Sheet date were as follows:<br />

Bank loans 11.5 13.0<br />

The effective interest rate at the Balance Sheet date was as follows:<br />

%<br />

31 March 2016<br />

Bank loans 2.1%<br />

31 March 2015<br />

Bank loans 2.1%<br />

2016<br />

£m<br />

2015<br />

£m<br />

118<br />

SCAPA GROUP PLC ANNUAL REPORT AND ACCOUNTS 2016<br />

113<br />

Annual Report and Accounts 2016 <strong>Scapa</strong> Group plc