20645_Scapa_AR_160504

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES ON THE ACCOUNTS CONTINUED<br />

24. RETIREMENT BENEFIT OBLIGATIONS CONTINUED<br />

– Funding arrangement<br />

On 11 March 2013 <strong>Scapa</strong> Group plc agreed an asset-backed funding arrangement with the Trustees of the UK Pension Funds to help<br />

address the UK pension funding deficit. The asset backed funding structure provided £3.75 million cash per annum to the UK Pension<br />

Funds. The present value of this funding stream is recognised as an investment of the UK Pension Funds and removes the funding deficit<br />

on actuarial valuation.<br />

The contributions under the asset backed structure are as follows:<br />

<br />

<br />

<br />

the arrangement provides a cash flow of £3.75m per year subject to RPI indexation<br />

the company pays £0.35m per year subject to RPI indexation, towards the administration costs of the scheme<br />

the company pays non-administration costs as agreed on a project by project basis with the trustee<br />

Total cash payments in the year, including both deficit repair and expenses, were £4.4m (2015: £4.2m).<br />

b) Overseas schemes<br />

The Group operates a number of pension schemes in different countries. There are several small defined benefit schemes and a number of<br />

defined contribution schemes. In addition, in certain countries, the Group must provide for various employee termination benefits. These are<br />

accounted for as if they were defined benefit pension schemes. The total defined benefit pension charge to operating profit for the Group in<br />

respect of overseas pension schemes for the year ended 31 March 2016 was [£0.4m] (2015: £0.4m), excluding settlement gains. The forecast<br />

future contributions into these schemes are expected to be similar to the current year contributions, but are subject to the number and nature of<br />

leavers in any period.<br />

Details of the Group’s material overseas defined benefit schemes are as follows:<br />

– North America<br />

The Group operates three pension plans in North America, a funded defined benefit scheme and two unfunded pension plans. The defined<br />

benefit scheme was closed during the prior year and all three schemes are therefore now closed to new members and future accrual. The<br />

disclosures are based on the most recent actuarial valuations of liabilities and asset market values at 31 March 2016. During the year a lump<br />

sum initiative was made available to certain deferred members. These members were able to elect to withdraw the value of their pension funds<br />

from the scheme and place into private control. The value of the liabilities extinguished during this exercise were lower than the carrying value of<br />

the assets transferred out of the scheme; the resulting gain has been treated as an exceptional settlement gain in the income statement.<br />

– France<br />

The Group operates an unfunded statutory retirement benefit scheme in France with liabilities of £3.8m (2015: £3.5m), with payments made to<br />

employees on retirement.<br />

– Italy<br />

There is an unfunded statutory termination indemnity plan in Italy, with payments made to employees on retirement or termination of service.<br />

The Italian scheme is closed to future accrual following changes in local legislation in 2013. It has liabilities of £0.5m (2015: £0.7m).<br />

– Switzerland<br />

The Group has an insured retirement fund in Switzerland that is accounted for under IAS 19.<br />

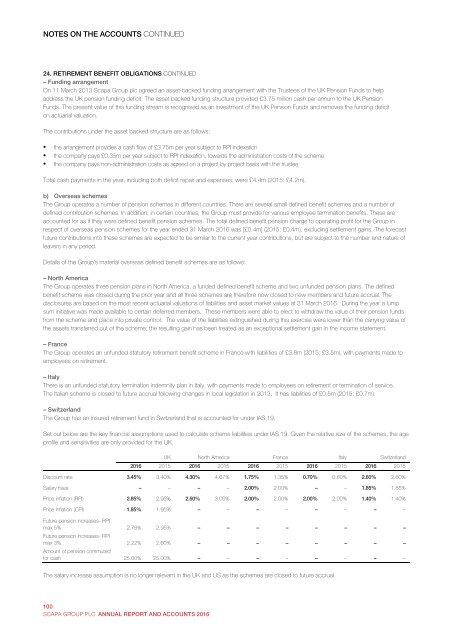

Set out below are the key financial assumptions used to calculate scheme liabilities under IAS 19. Given the relative size of the schemes, the age<br />

profile and sensitivities are only provided for the UK.<br />

UK North America France Italy Switzerland<br />

2016 2015 2016 2015 2016 2015 2016 2015 2016 2015<br />

Discount rate 3.45% 3.40% 4.30% 4.67% 1.75% 1.35% 0.70% 0.60% 2.60% 2.60%<br />

Salary rises – – – – 2.00% 2.00% – – 1.85% 1.85%<br />

Price inflation (RPI) 2.85% 2.95% 2.50% 3.00% 2.00% 2.00% 2.00% 2.00% 1.40% 1.40%<br />

Price inflation (CPI) 1.85% 1.95% – – – – – – – –<br />

Future pension increases- RPI<br />

max 5% 2.78% 2.95% – – – – – – – –<br />

Future pension increases- RPI<br />

max 3% 2.22% 2.60% – – – – – – – –<br />

Amount of pension commuted<br />

for cash 25.00% 25.00% – – – – – – – –<br />

The salary increase assumption is no longer relevant in the UK and US as the schemes are closed to future accrual.<br />

100<br />

SCAPA GROUP PLC ANNUAL REPORT AND ACCOUNTS 2016<br />

95<br />

Annual Report and Accounts 2016 <strong>Scapa</strong> Group plc