20645_Scapa_AR_160504

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES ON ON THE THE ACCOUNTS CONTINUED CONTINUED<br />

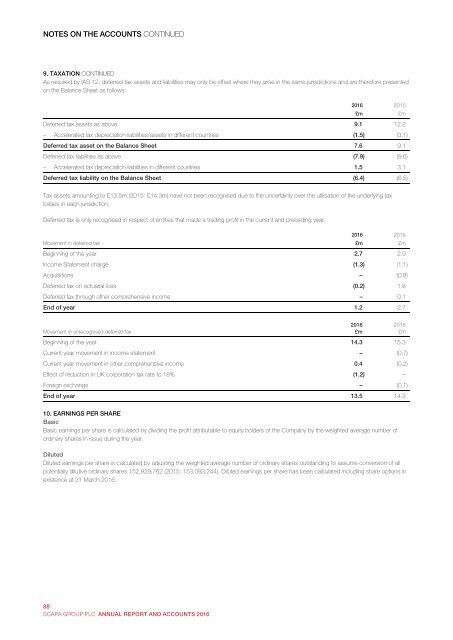

9. TAXATION CONTINUED<br />

As required by IAS 12, deferred tax assets and liabilities may only be offset where they arise in the same jurisdictions and are therefore presented<br />

on the Balance Sheet as follows:<br />

Deferred tax assets as above 9.1 12.2<br />

– Accelerated tax depreciation liabilities/assets in different countries (1.5) (3.1)<br />

Deferred tax asset on the Balance Sheet 7.6 9.1<br />

Deferred tax liabilities as above (7.9) (9.6)<br />

– Accelerated tax depreciation liabilities in different countries 1.5 3.1<br />

Deferred tax liability on the Balance Sheet (6.4) (6.5)<br />

2016<br />

£m<br />

2015<br />

£m<br />

Tax assets amounting to £13.5m (2015: £14.3m) have not been recognised due to the uncertainty over the utilisation of the underlying tax<br />

losses in each jurisdiction.<br />

Deferred tax is only recognised in respect of entities that made a trading profit in the current and preceding year.<br />

Movement in deferred tax<br />

2016<br />

£m<br />

2015<br />

£m<br />

Beginning of the year 2.7 2.9<br />

Income Statement charge (1.3) (1.1)<br />

Acquisitions – (0.8)<br />

Deferred tax on actuarial loss (0.2) 1.6<br />

Deferred tax through other comprehensive income – 0.1<br />

End of year 1.2 2.7<br />

Movement in unrecognised deferred tax<br />

2016<br />

£m<br />

2015<br />

£m<br />

Beginning of the year 14.3 15.3<br />

Current year movement in income statement – (0.7)<br />

Current year movement in other comprehensive income 0.4 (0.2)<br />

Effect of reduction in UK corporation tax rate to 18% (1.2) –<br />

Foreign exchange – (0.1)<br />

End of year 13.5 14.3<br />

10. E<strong>AR</strong>NINGS PER SH<strong>AR</strong>E<br />

Basic<br />

Basic earnings per share is calculated by dividing the profit attributable to equity holders of the Company by the weighted average number of<br />

ordinary shares in issue during the year.<br />

Diluted<br />

Diluted earnings per share is calculated by adjusting the weighted average number of ordinary shares outstanding to assume conversion of all<br />

potentially dilutive ordinary shares 152,929,762 (2015: 153,093,244). Diluted earnings per share has been calculated including share options in<br />

existence at 31 March 2016.<br />

88<br />

SCAPA GROUP PLC ANNUAL REPORT AND ACCOUNTS 2016<br />

83<br />

Annual Report and Accounts 2016 <strong>Scapa</strong> Group plc