20645_Scapa_AR_160504

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES ON THE ACCOUNTS CONTINUED<br />

FINANCIAL STATEMENTS<br />

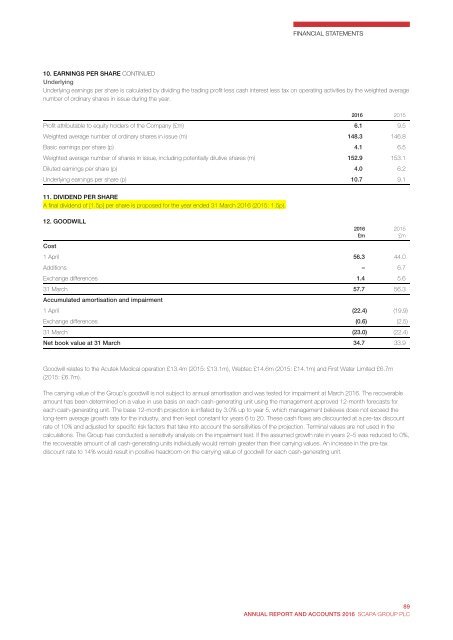

10. E<strong>AR</strong>NINGS PER SH<strong>AR</strong>E CONTINUED<br />

Underlying<br />

Underlying earnings per share is calculated by dividing the trading profit less cash interest less tax on operating activities by the weighted average<br />

number of ordinary shares in issue during the year.<br />

2016 2015<br />

Profit attributable to equity holders of the Company (£m) 6.1 9.5<br />

Weighted average number of ordinary shares in issue (m) 148.3 146.8<br />

Basic earnings per share (p) 4.1 6.5<br />

Weighted average number of shares in issue, including potentially dilutive shares (m) 152.9 153.1<br />

Diluted earnings per share (p) 4.0 6.2<br />

Underlying earnings per share (p) 10.7 9.1<br />

11. DIVIDEND PER SH<strong>AR</strong>E<br />

A final dividend of [1.5p] per share is proposed for the year ended 31 March 2016 (2015: 1.5p).<br />

12. GOODWILL<br />

Cost<br />

1 April 56.3 44.0<br />

Additions – 6.7<br />

Exchange differences 1.4 5.6<br />

31 March 57.7 56.3<br />

Accumulated amortisation and impairment<br />

1 April (22.4) (19.9)<br />

Exchange differences (0.6) (2.5)<br />

31 March (23.0) (22.4)<br />

Net book value at 31 March 34.7 33.9<br />

2016<br />

£m<br />

2015<br />

£m<br />

Goodwill relates to the Acutek Medical operation £13.4m (2015: £13.1m), Webtec £14.6m (2015: £14.1m) and First Water Limited £6.7m<br />

(2015: £6.7m).<br />

The carrying value of the Group’s goodwill is not subject to annual amortisation and was tested for impairment at March 2016. The recoverable<br />

amount has been determined on a value in use basis on each cash-generating unit using the management approved 12-month forecasts for<br />

each cash-generating unit. The base 12-month projection is inflated by 3.0% up to year 5, which management believes does not exceed the<br />

long-term average growth rate for the industry, and then kept constant for years 6 to 20. These cash flows are discounted at a pre-tax discount<br />

rate of 10% and adjusted for specific risk factors that take into account the sensitivities of the projection. Terminal values are not used in the<br />

calculations. The Group has conducted a sensitivity analysis on the impairment test. If the assumed growth rate in years 2–5 was reduced to 0%,<br />

the recoverable amount of all cash-generating units individually would remain greater than their carrying values. An increase in the pre-tax<br />

discount rate to 14% would result in positive headroom on the carrying value of goodwill for each cash-generating unit.<br />

84<br />

<strong>Scapa</strong> Group plc Annual Report and Accounts 2016<br />

89<br />

ANNUAL REPORT AND ACCOUNTS 2016 SCAPA GROUP PLC