20645_Scapa_AR_160504

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES ON THE ACCOUNTS CONTINUED<br />

FINANCIAL STATEMENTS<br />

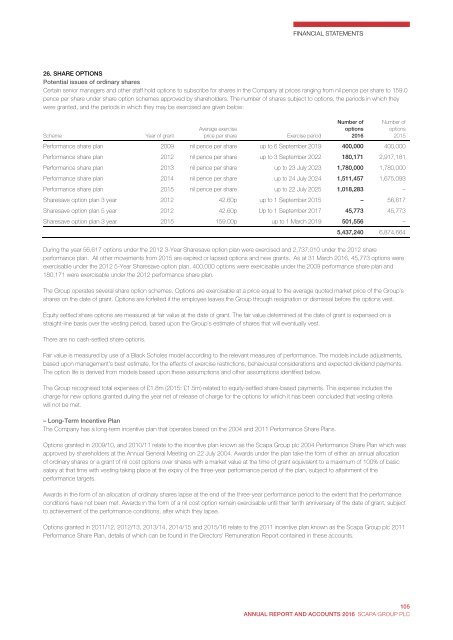

26. SH<strong>AR</strong>E OPTIONS<br />

Potential issues of ordinary shares<br />

Certain senior managers and other staff hold options to subscribe for shares in the Company at prices ranging from nil pence per share to 159.0<br />

pence per share under share option schemes approved by shareholders. The number of shares subject to options, the periods in which they<br />

were granted, and the periods in which they may be exercised are given below:<br />

Number of<br />

options<br />

2016<br />

Number of<br />

options<br />

2015<br />

Scheme<br />

Year of grant<br />

Average exercise<br />

price per share<br />

Exercise period<br />

Performance share plan 2009 nil pence per share up to 6 September 2019 400,000 400,000<br />

Performance share plan 2012 nil pence per share up to 3 September 2022 180,171 2,917,181<br />

Performance share plan 2013 nil pence per share up to 23 July 2023 1,780,000 1,780,000<br />

Performance share plan 2014 nil pence per share up to 24 July 2024 1,511,457 1,675,093<br />

Performance share plan 2015 nil pence per share up to 22 July 2025 1,018,283 –<br />

Sharesave option plan 3 year 2012 42.60p up to 1 September 2015 – 56,617<br />

Sharesave option plan 5 year 2012 42.60p Up to 1 September 2017 45,773 45,773<br />

Sharesave option plan 3 year 2015 159.00p up to 1 March 2019 501,556 –<br />

5,437,240 6,874,664<br />

During the year 56,617 options under the 2012 3-Year Sharesave option plan were exercised and 2,737,010 under the 2012 share<br />

performance plan. All other movements from 2015 are expired or lapsed options and new grants. As at 31 March 2016, 45,773 options were<br />

exercisable under the 2012 5-Year Sharesave option plan, 400,000 options were exercisable under the 2009 performance share plan and<br />

180,171 were exercisable under the 2012 performance share plan.<br />

The Group operates several share option schemes. Options are exercisable at a price equal to the average quoted market price of the Group’s<br />

shares on the date of grant. Options are forfeited if the employee leaves the Group through resignation or dismissal before the options vest.<br />

Equity settled share options are measured at fair value at the date of grant. The fair value determined at the date of grant is expensed on a<br />

straight-line basis over the vesting period, based upon the Group’s estimate of shares that will eventually vest.<br />

There are no cash-settled share options.<br />

Fair value is measured by use of a Black Scholes model according to the relevant measures of performance. The models include adjustments,<br />

based upon management’s best estimate, for the effects of exercise restrictions, behavioural considerations and expected dividend payments.<br />

The option life is derived from models based upon these assumptions and other assumptions identified below.<br />

The Group recognised total expenses of £1.8m (2015: £1.5m) related to equity-settled share-based payments. This expense includes the<br />

charge for new options granted during the year net of release of charge for the options for which it has been concluded that vesting criteria<br />

will not be met.<br />

– Long-Term Incentive Plan<br />

The Company has a long-term incentive plan that operates based on the 2004 and 2011 Performance Share Plans.<br />

Options granted in 2009/10, and 2010/11 relate to the incentive plan known as the <strong>Scapa</strong> Group plc 2004 Performance Share Plan which was<br />

approved by shareholders at the Annual General Meeting on 22 July 2004. Awards under the plan take the form of either an annual allocation<br />

of ordinary shares or a grant of nil cost options over shares with a market value at the time of grant equivalent to a maximum of 100% of basic<br />

salary at that time with vesting taking place at the expiry of the three-year performance period of the plan, subject to attainment of the<br />

performance targets.<br />

Awards in the form of an allocation of ordinary shares lapse at the end of the three-year performance period to the extent that the performance<br />

conditions have not been met. Awards in the form of a nil cost option remain exercisable until their tenth anniversary of the date of grant, subject<br />

to achievement of the performance conditions, after which they lapse.<br />

Options granted in 2011/12, 2012/13, 2013/14, 2014/15 and 2015/16 relate to the 2011 incentive plan known as the <strong>Scapa</strong> Group plc 2011<br />

Performance Share Plan, details of which can be found in the Directors’ Remuneration Report contained in these accounts.<br />

100<br />

<strong>Scapa</strong> Group plc Annual Report and Accounts 2016<br />

105<br />

ANNUAL REPORT AND ACCOUNTS 2016 SCAPA GROUP PLC