20645_Scapa_AR_160504

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CORPORATE GOVERNANCE<br />

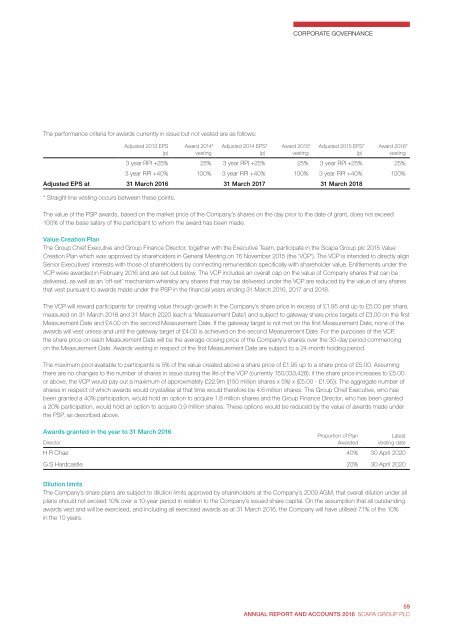

The performance criteria for awards currently in issue but not vested are as follows:<br />

Adjusted 2013 EPS<br />

(p)<br />

Award 2014*<br />

vesting<br />

Adjusted 2014 EPS*<br />

(p)<br />

Award 2015*<br />

vesting<br />

Adjusted 2015 EPS*<br />

(p)<br />

Award 2016*<br />

vesting<br />

3 year RPI +25% 25% 3 year RPI +25% 25% 3 year RPI +25% 25%<br />

3 year RPI +40% 100% 3 year RPI +40% 100% 3 year RPI +40% 100%<br />

Adjusted EPS at 31 March 2016 31 March 2017 31 March 2018<br />

* Straight line vesting occurs between these points.<br />

The value of the PSP awards, based on the market price of the Company’s shares on the day prior to the date of grant, does not exceed<br />

100% of the base salary of the participant to whom the award has been made.<br />

Value Creation Plan<br />

The Group Chief Executive and Group Finance Director, together with the Executive Team, participate in the <strong>Scapa</strong> Group plc 2015 Value<br />

Creation Plan which was approved by shareholders in General Meeting on 16 November 2015 (the ‘VCP’). The VCP is intended to directly align<br />

Senior Executives’ interests with those of shareholders by connecting remuneration specifically with shareholder value. Entitlements under the<br />

VCP were awarded in February 2016 and are set out below. The VCP includes an overall cap on the value of Company shares that can be<br />

delivered, as well as an ‘off-set’ mechanism whereby any shares that may be delivered under the VCP are reduced by the value of any shares<br />

that vest pursuant to awards made under the PSP in the financial years ending 31 March 2016, 2017 and 2018.<br />

The VCP will reward participants for creating value through growth in the Company’s share price in excess of £1.95 and up to £5.00 per share,<br />

measured on 31 March 2018 and 31 March 2020 (each a ‘Measurement Date’) and subject to gateway share price targets of £3.00 on the first<br />

Measurement Date and £4.00 on the second Measurement Date. If the gateway target is not met on the first Measurement Date, none of the<br />

awards will vest unless and until the gateway target of £4.00 is achieved on the second Measurement Date. For the purposes of the VCP,<br />

the share price on each Measurement Date will be the average closing price of the Company’s shares over the 30-day period commencing<br />

on the Measurement Date. Awards vesting in respect of the first Measurement Date are subject to a 24-month holding period.<br />

The maximum pool available to participants is 5% of the value created above a share price of £1.95 up to a share price of £5.00. Assuming<br />

there are no changes to the number of shares in issue during the life of the VCP (currently 150,033,428), if the share price increases to £5.00<br />

or above, the VCP would pay out a maximum of approximately £22.9m ((150 million shares x 5%) x (£5.00 - £1.95)). The aggregate number of<br />

shares in respect of which awards would crystallise at that time would therefore be 4.6 million shares. The Group Chief Executive, who has<br />

been granted a 40% participation, would hold an option to acquire 1.8 million shares and the Group Finance Director, who has been granted<br />

a 20% participation, would hold an option to acquire 0.9 million shares. These options would be reduced by the value of awards made under<br />

the PSP, as described above.<br />

Awards granted in the year to 31 March 2016<br />

Director<br />

Proportion of Plan<br />

Awarded<br />

Latest<br />

Vesting date<br />

H R Chae 40% 30 April 2020<br />

G S Hardcastle 20% 30 April 2020<br />

Dilution limits<br />

The Company’s share plans are subject to dilution limits approved by shareholders at the Company’s 2009 AGM, that overall dilution under all<br />

plans should not exceed 10% over a 10-year period in relation to the Company’s issued share capital. On the assumption that all outstanding<br />

awards vest and will be exercised, and including all exercised awards as at 31 March 2016, the Company will have utilised 7.1% of the 10%<br />

in the 10 years.<br />

59<br />

ANNUAL REPORT AND ACCOUNTS 2016 SCAPA GROUP PLC