- Page 1 and 2:

NATIONAL RESEARCH FOUNDATION ANNUAL

- Page 3 and 4:

STATEMENT OF RESPONSIBILITY To the

- Page 5 and 6:

7. PROGRAMME 1 (CORPORATE): STRATEG

- Page 7 and 8:

13. KEY PERFORMANCE INDICATOR REPOR

- Page 9 and 10:

The year ahead The penultimate year

- Page 11 and 12:

ocwaningweni, abacwaningi kanye nok

- Page 13 and 14:

Boto e dumela tlhohlo yeo e amanago

- Page 15 and 16:

Towards the goal of providing “Le

- Page 17 and 18:

UMBIKO OFINGQAYO WESIKHULU ESIPHEZU

- Page 19 and 20:

Ngeshwa inhlangano yamemezela ukuse

- Page 21 and 22:

Palomoka ya banyakišiši ba 4700 i

- Page 23 and 24:

PART A: STRATEGIC OVERVIEW NRF Annu

- Page 25 and 26:

PART A: STRATEGIC OVERVIEW 1.1.2 NR

- Page 27 and 28:

PART A: STRATEGIC OVERVIEW 2 LEGISL

- Page 29 and 30:

PART A: STRATEGIC OVERVIEW 2.3.1 Ac

- Page 31 and 32:

PART A: STRATEGIC OVERVIEW 3.2 Orga

- Page 33 and 34:

PART A: STRATEGIC OVERVIEW FIGURE 7

- Page 35 and 36:

PART A: STRATEGIC OVERVIEW FIGURE 9

- Page 37 and 38:

PART A: STRATEGIC OVERVIEW FIGURE 1

- Page 39 and 40:

PART A: STRATEGIC OVERVIEW PART B:

- Page 41 and 42:

PART B: PERFORMANCE The NRF dischar

- Page 43 and 44:

PART B: PERFORMANCE international S

- Page 45 and 46:

PART B: PERFORMANCE 6 NRF RESPONSE

- Page 47 and 48:

PART B: PERFORMANCE FIGURE 16: NRF

- Page 49 and 50:

PART B: PERFORMANCE 7 PROGRAMME 1 (

- Page 51 and 52:

PART B: PERFORMANCE • Assistance

- Page 53 and 54:

PART B: PERFORMANCE Association (SA

- Page 55 and 56:

PART B: PERFORMANCE 7.3 Performance

- Page 57 and 58:

PART B: PERFORMANCE 3A public entit

- Page 59 and 60:

PART B: PERFORMANCE 7.4 Performance

- Page 61 and 62:

PART B: PERFORMANCE Proportion of s

- Page 63 and 64:

PART B: PERFORMANCE 8 PROGRAMME 2:

- Page 65 and 66:

PART B: PERFORMANCE introduction to

- Page 67 and 68:

PART B: PERFORMANCE encourage them

- Page 69 and 70:

PART B: PERFORMANCE • SAASTA Scie

- Page 71 and 72:

PART B: PERFORMANCE 9 PROGRAMME 3 (

- Page 73 and 74:

PART B: PERFORMANCE Next generation

- Page 75 and 76:

PART B: PERFORMANCE Centres of Exce

- Page 77 and 78:

PART B: PERFORMANCE TABLE 11: PERFO

- Page 79 and 80:

PART B: PERFORMANCE South Africa/Me

- Page 81 and 82:

PART B: PERFORMANCE 9.4 Performance

- Page 83 and 84:

PART B: PERFORMANCE It is evident f

- Page 85 and 86:

PART B: PERFORMANCE 9.5 Performance

- Page 87 and 88:

PART B: PERFORMANCE 9.6 Special pro

- Page 89 and 90:

PART B: PERFORMANCE The schematic r

- Page 91 and 92:

PART B: PERFORMANCE 10.1 Nuclear sc

- Page 93 and 94:

PART B: PERFORMANCE Knowledge gener

- Page 95 and 96:

PART B: PERFORMANCE Enhance strateg

- Page 97 and 98:

PART B: PERFORMANCE GNU compiler co

- Page 99 and 100:

PART B: PERFORMANCE 10.3.2 South Af

- Page 101 and 102:

PART B: PERFORMANCE 10.4 Biodiversi

- Page 103 and 104:

PART B: PERFORMANCE and hosted by t

- Page 105 and 106:

PART B: PERFORMANCE 10.4.2 Enhance

- Page 107 and 108:

PART B: PERFORMANCE 10.4.3 Establis

- Page 109 and 110:

PART B: PERFORMANCE 10.5 Astronomy

- Page 111 and 112:

PART B: PERFORMANCE 10.6 Astronomy

- Page 113 and 114:

PART B: PERFORMANCE TABLE 22: ASTRO

- Page 115 and 116:

PART B: PERFORMANCE MeerKAT The hig

- Page 117 and 118:

PART B: PERFORMANCE 10.6.3 Establis

- Page 119 and 120:

PART C: REGULATORY REPORTING NRF An

- Page 121 and 122:

PART C: REGULATORY REPORTING 11.5 N

- Page 123 and 124:

PART C: REGULATORY REPORTING 11.10

- Page 125 and 126:

PART C: REGULATORY REPORTING 11.12

- Page 127 and 128:

PART C: REGULATORY REPORTING 11.12.

- Page 129 and 130:

PART C: REGULATORY REPORTING FIGURE

- Page 131 and 132:

PART C: REGULATORY REPORTING • Ev

- Page 133 and 134:

PART C: REGULATORY REPORTING • Go

- Page 135 and 136:

PART C: REGULATORY REPORTING TABLE

- Page 137 and 138:

PART C: REGULATORY REPORTING NRF st

- Page 139 and 140:

PART C: REGULATORY REPORTING 12.2.3

- Page 141 and 142:

PART C: REGULATORY REPORTING 12.2.5

- Page 143 and 144:

PART C: REGULATORY REPORTING 12.2.7

- Page 145 and 146:

PART C: REGULATORY REPORTING 13.3 K

- Page 147 and 148: PART C: REGULATORY REPORTING INDICA

- Page 149 and 150: PART C: REGULATORY REPORTING 14 ALI

- Page 151 and 152: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 153 and 154: PART D: ANNUAL FINANCIAL PART D: AN

- Page 155 and 156: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 157 and 158: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 159 and 160: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 161 and 162: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 163 and 164: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 165 and 166: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 167 and 168: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 169 and 170: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 171 and 172: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 173 and 174: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 175 and 176: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 177 and 178: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 179 and 180: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 181 and 182: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 183 and 184: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 185 and 186: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 187 and 188: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 189 and 190: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 191 and 192: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 193 and 194: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 195 and 196: PART D: ANNUAL FINANCIAL STATEMENTS

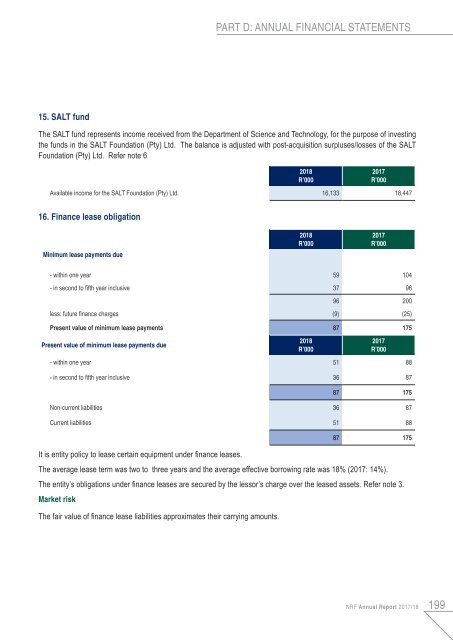

- Page 197: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 201 and 202: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 203 and 204: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 205 and 206: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 207 and 208: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 209 and 210: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 211 and 212: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 213 and 214: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 215 and 216: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 217 and 218: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 219 and 220: PART D: ANNUAL FINANCIAL STATEMENTS

- Page 221 and 222: PART D: ANNUAL FINANCIAL STATEMENTS