NRF Annual Report 2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

PART D: ANNUAL FINANCIAL STATEMENTS<br />

35. Change in estimate<br />

Property, plant and equipment<br />

A change in the depreciation estimate, due to a change in the residual values and useful lives of certain assets, had an<br />

impact of R 0,2m decrease for the current and future periods.<br />

36. Risk management<br />

Financial risk management<br />

The entity’s activities expose it to a variety of financial risks: market risk (including currency risk and cash flow interest rate<br />

risk), credit risk and liquidity risk.<br />

The entity’s overall risk management program focuses on the unpredictability of financial markets and seeks to minimise<br />

potential adverse effects on the entity’s financial performance. Risk management is carried out by a central treasury<br />

department under policies approved by the board. Entity treasury identifies, evaluates and hedges financial risks in close<br />

co-operation with the entity’s business units. The board provides written principles for overall risk management, as well<br />

as written policies covering specific areas, such as foreign exchange risk, interest rate risk, credit risk and investment of<br />

excess liquidity.<br />

Liquidity risk<br />

Prudent liquidity risk management implies maintaining sufficient cash and the availability of funding.<br />

The entity’s risk to liquidity is a result of the funds available to cover future commitments. The entity manages liquidity risk<br />

through an ongoing review of future commitments, through proper management of working capital, capital expenditure and<br />

actual vs. forecasted cash flows and its investment policy. Adequate reserves and liquid resources are also maintained.<br />

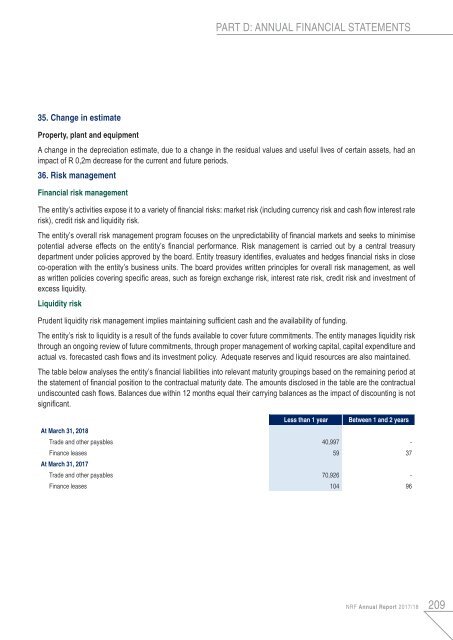

The table below analyses the entity’s financial liabilities into relevant maturity groupings based on the remaining period at<br />

the statement of financial position to the contractual maturity date. The amounts disclosed in the table are the contractual<br />

undiscounted cash flows. Balances due within 12 months equal their carrying balances as the impact of discounting is not<br />

significant.<br />

Less than 1 year Between 1 and 2 years<br />

At March 31, <strong>2018</strong><br />

Trade and other payables 40,997 -<br />

Finance leases 59 37<br />

At March 31, 2017<br />

Trade and other payables 70,926 -<br />

Finance leases 104 96<br />

<strong>NRF</strong> <strong>Annual</strong> <strong>Report</strong> 2017/18 209