Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Christopher Wood christopher.wood@clsa.com +852 2600 8516<br />

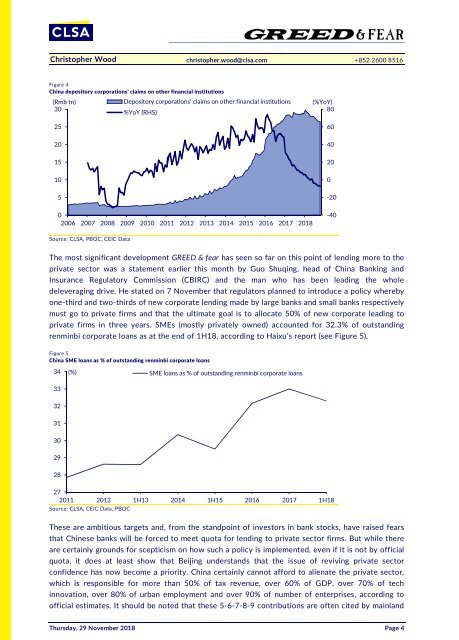

Figure 4<br />

China depository corporations’ claims on other financial institutions<br />

(Rmb tn)<br />

Depository corporations' claims on other financial institutions<br />

30<br />

%YoY (RHS)<br />

25<br />

20<br />

15<br />

10<br />

5<br />

(%YoY)<br />

80<br />

60<br />

40<br />

20<br />

0<br />

-20<br />

0<br />

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018<br />

-40<br />

Source: CLSA, PBOC, CEIC Data<br />

The most significant development GREED & fear has seen so far on this point of lending more to the<br />

private sector was a statement earlier this month by Guo Shuqing, head of China Banking and<br />

Insurance Regulatory Commission (CBIRC) and the man who has been leading the whole<br />

deleveraging drive. He stated on 7 November that regulators planned to introduce a policy whereby<br />

one-third and two-thirds of new corporate lending made by large banks and small banks respectively<br />

must go to private firms and that the ultimate goal is to allocate 50% of new corporate leading to<br />

private firms in three years. SMEs (mostly privately owned) accounted for 32.3% of outstanding<br />

renminbi corporate loans as at the end of 1H18, according to Haixu’s report (see Figure 5).<br />

Figure 5<br />

China SME loans as % of outstanding renminbi corporate loans<br />

34<br />

(%) SME loans as % of outstanding renminbi corporate loans<br />

33<br />

32<br />

31<br />

30<br />

29<br />

28<br />

27<br />

2011 2012 1H13 2014 1H15 2016 2017 1H18<br />

Source: CLSA, CEIC Data, PBOC<br />

These are ambitious targets and, from the standpoint of investors in bank stocks, have raised fears<br />

that Chinese banks will be forced to meet quota for lending to private sector firms. But while there<br />

are certainly grounds for scepticism on how such a policy is implemented, even if it is not by official<br />

quota, it does at least show that Beijing understands that the issue of reviving private sector<br />

confidence has now become a priority. China certainly cannot afford to alienate the private sector,<br />

which is responsible for more than 50% of tax revenue, over 60% of GDP, over 70% of tech<br />

innovation, over 80% of urban employment and over 90% of number of enterprises, according to<br />

official estimates. It should be noted that these 5-6-7-8-9 contributions are often cited by mainland<br />

Thursday, 29 November 2018 Page 4