You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Christopher Wood christopher.wood@clsa.com +852 2600 8516<br />

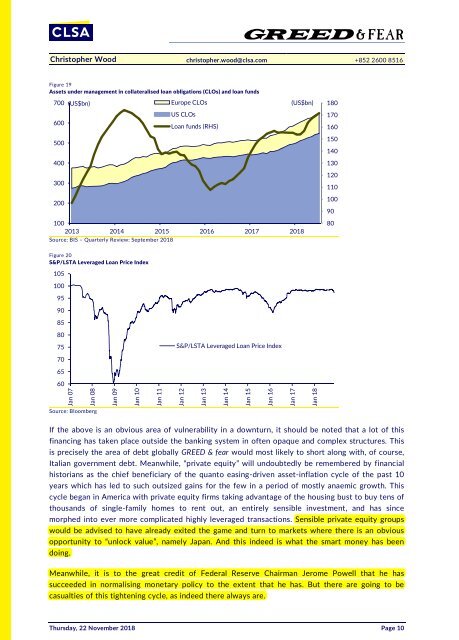

Figure 19<br />

Assets under management in collateralised loan obligations (CLOs) and loan funds<br />

700<br />

(US$bn)<br />

Europe CLOs<br />

(US$bn)<br />

180<br />

600<br />

US CLOs<br />

Loan funds (RHS)<br />

170<br />

160<br />

500<br />

150<br />

140<br />

400<br />

130<br />

300<br />

120<br />

110<br />

200<br />

100<br />

90<br />

100<br />

2013 2014 2015 2016 2017 2018<br />

Source: BIS – Quarterly Review: September 2018<br />

80<br />

Figure 20<br />

S&P/LSTA Leveraged Loan Price Index<br />

105<br />

100<br />

95<br />

90<br />

85<br />

80<br />

75<br />

S&P/LSTA Leveraged Loan Price Index<br />

70<br />

65<br />

60<br />

Jan 07<br />

Jan 08<br />

Jan 09<br />

Jan 10<br />

Jan 11<br />

Jan 12<br />

Jan 13<br />

Jan 14<br />

Jan 15<br />

Jan 16<br />

Jan 17<br />

Jan 18<br />

Source: Bloomberg<br />

If the above is an obvious area of vulnerability in a downturn, it should be noted that a lot of this<br />

financing has taken place outside the banking system in often opaque and complex structures. This<br />

is precisely the area of debt globally GREED & fear would most likely to short along with, of course,<br />

Italian government debt. Meanwhile, “private equity” will undoubtedly be remembered by financial<br />

historians as the chief beneficiary of the quanto easing-driven asset-inflation cycle of the past 10<br />

years which has led to such outsized gains for the few in a period of mostly anaemic growth. This<br />

cycle began in America with private equity firms taking advantage of the housing bust to buy tens of<br />

thousands of single-family homes to rent out, an entirely sensible investment, and has since<br />

morphed into ever more complicated highly leveraged transactions. Sensible private equity groups<br />

would be advised to have already exited the game and turn to markets where there is an obvious<br />

opportunity to “unlock value”, namely Japan. And this indeed is what the smart money has been<br />

doing.<br />

Meanwhile, it is to the great credit of Federal Reserve Chairman Jerome Powell that he has<br />

succeeded in normalising monetary policy to the extent that he has. But there are going to be<br />

casualties of this tightening cycle, as indeed there always are.<br />

Thursday, 22 November 2018 Page 10