Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Sep-09<br />

Sep-10<br />

Sep-11<br />

Sep-12<br />

Sep-13<br />

Sep-14<br />

Sep-15<br />

Sep-16<br />

Sep-17<br />

Sep-18<br />

2019 Global Economic and Market Outlook<br />

Larry Hu, PhD<br />

+852 3922 3778<br />

larry.hu@macquarie.com<br />

Irene Wu<br />

+852 3922 3796<br />

irene.wu@macquarie.com<br />

China: All eyes on property again<br />

In a nutshell, the economic cycle in China is the property cycle. As such, while the key words for<br />

2018 have been “Deleveraging” and “Trade war”, for 2019 it could once again be “Property”, just<br />

as seen in 2012 and 2015.<br />

Over the past two years, thanks to the shanty town renovation program, the property sector<br />

surprised to the upside, especially on the investment side. While sales growth (in floor space)<br />

slowed to 2% yoy in Jan-Oct 2018 from 8% in 2017, investment and new starts were up 10% and<br />

16% yoy during this period, compared with 7% growth for both in 2017. Looking ahead into 2019,<br />

given the cut on the shanty town renovation program, as well as the frontloading of housing<br />

purchases amid the latest housing up-cycle, the year of 2019 could see housing data softening<br />

across the board. Specifically, we expect sales and new starts to drop around 5% next year, while<br />

investment growth could slow to around 3%.<br />

Less and less helicopter money<br />

The shanty town renovation program has played a pivotal role in driving the current housing upcycle<br />

since 2015, especially in lower-tier cities (other than the 27 tier-1/2 cities). The program<br />

boosted sales, lowered inventory and thereby led to higher prices, which in turn strengthened<br />

expectations of more price increases and thereby led to even more sales. This positive feedback<br />

loop is the key behind the housing boom over the past years.<br />

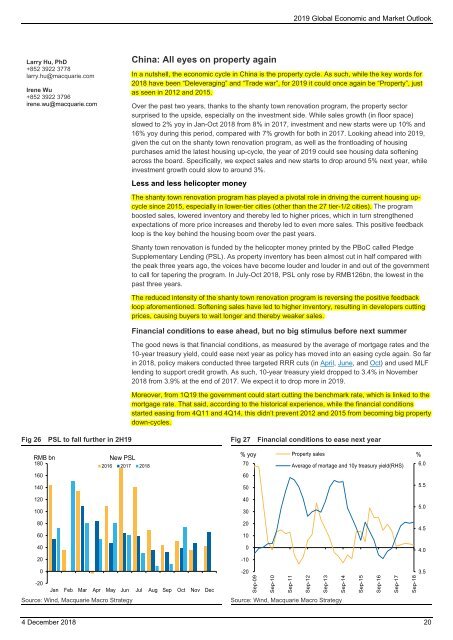

Shanty town renovation is funded by the helicopter money printed by the PBoC called Pledge<br />

Supplementary Lending (PSL). As property inventory has been almost cut in half compared with<br />

the peak three years ago, the voices have become louder and louder in and out of the government<br />

to call for tapering the program. In July-Oct 2018, PSL only rose by RMB126bn, the lowest in the<br />

past three years.<br />

The reduced intensity of the shanty town renovation program is reversing the positive feedback<br />

loop aforementioned. Softening sales have led to higher inventory, resulting in developers cutting<br />

prices, causing buyers to wait longer and thereby weaker sales.<br />

Financial conditions to ease ahead, but no big stimulus before next summer<br />

The good news is that financial conditions, as measured by the average of mortgage rates and the<br />

10-year treasury yield, could ease next year as policy has moved into an easing cycle again. So far<br />

in 2018, policy makers conducted three targeted RRR cuts (in April, June, and Oct) and used MLF<br />

lending to support credit growth. As such, 10-year treasury yield dropped to 3.4% in November<br />

2018 from 3.9% at the end of 2017. We expect it to drop more in 2019.<br />

Moreover, from 1Q19 the government could start cutting the benchmark rate, which is linked to the<br />

mortgage rate. That said, according to the historical experience, while the financial conditions<br />

started easing from 4Q11 and 4Q14, this didn’t prevent 2012 and 2015 from becoming big property<br />

down-cycles.<br />

Fig 26 PSL to fall further in 2H19<br />

Fig 27 Financial conditions to ease next year<br />

RMB bn<br />

180<br />

New PSL<br />

2016 2017 2018<br />

% yoy<br />

70<br />

Property sales<br />

Average of mortage and 10y treasury yield(RHS)<br />

%<br />

6.0<br />

160<br />

60<br />

140<br />

50<br />

5.5<br />

120<br />

100<br />

40<br />

30<br />

5.0<br />

80<br />

60<br />

20<br />

10<br />

4.5<br />

40<br />

0<br />

4.0<br />

20<br />

-10<br />

0<br />

-20<br />

3.5<br />

-20<br />

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec<br />

Source: Wind, Macquarie Macro Strategy<br />

Source: Wind, Macquarie Macro Strategy<br />

4 December 2018 20