Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Christopher Wood christopher.wood@clsa.com +852 2600 8516<br />

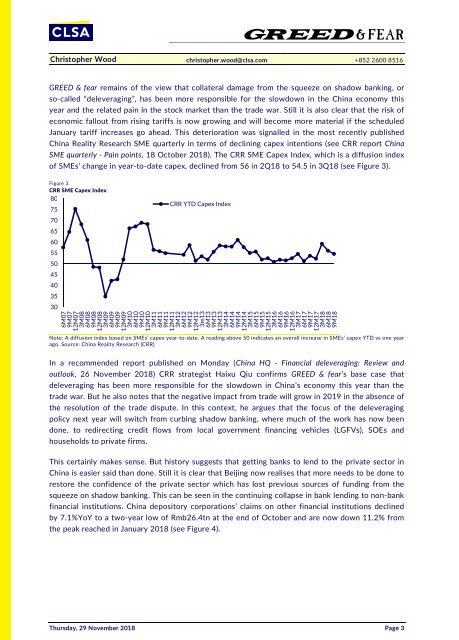

GREED & fear remains of the view that collateral damage from the squeeze on shadow banking, or<br />

so-called “deleveraging”, has been more responsible for the slowdown in the China economy this<br />

year and the related pain in the stock market than the trade war. Still it is also clear that the risk of<br />

economic fallout from rising tariffs is now growing and will become more material if the scheduled<br />

January tariff increases go ahead. This deterioration was signalled in the most recently published<br />

China Reality Research SME quarterly in terms of declining capex intentions (see CRR report China<br />

SME quarterly - Pain points, 18 October 2018). The CRR SME Capex Index, which is a diffusion index<br />

of SMEs’ change in year-to-date capex, declined from 56 in 2Q18 to 54.5 in 3Q18 (see Figure 3).<br />

Figure 3<br />

CRR SME Capex Index<br />

80<br />

75<br />

70<br />

65<br />

60<br />

55<br />

50<br />

45<br />

40<br />

35<br />

30<br />

CRR YTD Capex Index<br />

6M07<br />

9M07<br />

12M07<br />

3M08<br />

6M08<br />

9M08<br />

12M08<br />

3M09<br />

6M09<br />

9M09<br />

12M09<br />

3M10<br />

6M10<br />

9M10<br />

12M10<br />

3M11<br />

6M11<br />

9M11<br />

12M11<br />

3M12<br />

6M12<br />

9M12<br />

12M12<br />

3m13<br />

6M13<br />

9M13<br />

12M13<br />

3M14<br />

6M14<br />

9M14<br />

12M14<br />

3M15<br />

6M15<br />

9M15<br />

12M15<br />

3M16<br />

6M16<br />

9M16<br />

12M16<br />

3M17<br />

6M17<br />

9M17<br />

12M17<br />

3M18<br />

6M18<br />

9M18<br />

Note: A diffusion index based on SMEs’ capex year-to-date. A reading above 50 indicates an overall increase in SMEs’ capex YTD vs one year<br />

ago. Source: China Reality Research (CRR)<br />

In a recommended report published on Monday (China HQ - Financial deleveraging: Review and<br />

outlook, 26 November 2018) CRR strategist Haixu Qiu confirms GREED & fear’s base case that<br />

deleveraging has been more responsible for the slowdown in China’s economy this year than the<br />

trade war. But he also notes that the negative impact from trade will grow in 2019 in the absence of<br />

the resolution of the trade dispute. In this context, he argues that the focus of the deleveraging<br />

policy next year will switch from curbing shadow banking, where much of the work has now been<br />

done, to redirecting credit flows from local government financing vehicles (LGFVs), SOEs and<br />

households to private firms.<br />

This certainly makes sense. But history suggests that getting banks to lend to the private sector in<br />

China is easier said than done. Still it is clear that Beijing now realises that more needs to be done to<br />

restore the confidence of the private sector which has lost previous sources of funding from the<br />

squeeze on shadow banking. This can be seen in the continuing collapse in bank lending to non-bank<br />

financial institutions. China depository corporations’ claims on other financial institutions declined<br />

by 7.1%YoY to a two-year low of Rmb26.4tn at the end of October and are now down 11.2% from<br />

the peak reached in January 2018 (see Figure 4).<br />

Thursday, 29 November 2018 Page 3