Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

M<br />

FOUNDATION<br />

...with an epic >US$0.5tn battle for<br />

grocery retail in India<br />

...and some consumers are already seeking online fulfillment<br />

options with home delivery... Online penetration of grocery in India<br />

is amongst the lowest in the world. So should retailers make omnichannel<br />

a key organizational priority?<br />

Mom & pop (Kirana) stores in India offer a no-frills but<br />

convenient shopping experience with limited SKUs (varies<br />

but unlikely to be >1,000). They control over 95% of the<br />

grocery market in India. However, some channel shift is<br />

imminent – and here is why.<br />

Consumers may gravitate to modern format retail in search of<br />

wider assortment and better prices... Based on our price checks,<br />

we observe that prices for modern format retailers (brick & mortar<br />

as well as eCommerce) are 17%-19% lower than those in Kirana<br />

stores. In addition, as aspirations rise, consumer preferences are<br />

shifting toward a greater assortment of products based on such considerations<br />

as aspirational traits, global brands/categories, health<br />

and wellness, and natural ingredients. Modern sales channels are<br />

well placed to capitalize on this emerging consumer demand.<br />

Our view is that based on emerging global trends (Amazon's acquisition<br />

of Whole Foods and Alibaba’s New Retail model), brick and<br />

mortar grocery retailers will be wary of an accelerated shift in favor<br />

of online retailing and amidst rising competition and ever increasing<br />

customer expectations.<br />

Against this backdrop, grocers must invest in online capabilities as<br />

well as in-store experience (presentation, assortment, pricing) – or<br />

risk falling behind. In the world of retail and food retail in particular,<br />

if you lose even 10% of customers to a competitor’s online platform,<br />

it makes a material difference to your profitability.<br />

Based on our estimates, given the high fixed cost construct of storebased<br />

retail, even a 5% loss of sales will have a 15% impact on profits.<br />

In addition, online grocery (at least initially) attracts more profitable<br />

customers – who shop in higher-margin categories and prioritize convenience<br />

over price.<br />

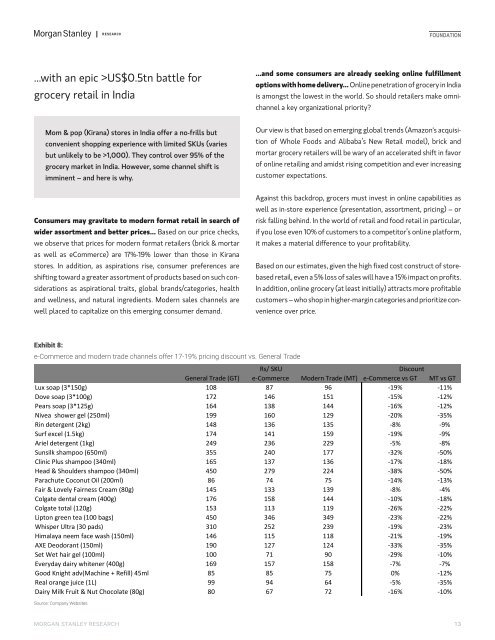

Exhibit 8:<br />

e-Commerce and modern trade channels offer 17-19% pricing discount vs. General Trade<br />

Rs/ SKU<br />

Discount<br />

General Trade (GT) e-Commerce Modern Trade (MT) e-Commerce vs GT MT vs GT<br />

Lux soap (3*150g) 108 87 96 -19% -11%<br />

Dove soap (3*100g) 172 146 151 -15% -12%<br />

Pears soap (3*125g) 164 138 144 -16% -12%<br />

Nivea shower gel (250ml) 199 160 129 -20% -35%<br />

Rin detergent (2kg) 148 136 135 -8% -9%<br />

Surf excel (1.5kg) 174 141 159 -19% -9%<br />

Ariel detergent (1kg) 249 236 229 -5% -8%<br />

Sunsilk shampoo (650ml) 355 240 177 -32% -50%<br />

Clinic Plus shampoo (340ml) 165 137 136 -17% -18%<br />

Head & Shoulders shampoo (340ml) 450 279 224 -38% -50%<br />

Parachute Coconut Oil (200ml) 86 74 75 -14% -13%<br />

Fair & Lovely Fairness Cream (80g) 145 133 139 -8% -4%<br />

Colgate dental cream (400g) 176 158 144 -10% -18%<br />

Colgate total (120g) 153 113 119 -26% -22%<br />

Lipton green tea (100 bags) 450 346 349 -23% -22%<br />

Whisper Ultra (30 pads) 310 252 239 -19% -23%<br />

Himalaya neem face wash (150ml) 146 115 118 -21% -19%<br />

AXE Deodorant (150ml) 190 127 124 -33% -35%<br />

Set Wet hair gel (100ml) 100 71 90 -29% -10%<br />

Everyday dairy whitener (400g) 169 157 158 -7% -7%<br />

Good Knight adv(Machine + Refill) 45ml 85 85 75 0% -12%<br />

Real orange juice (1L) 99 94 64 -5% -35%<br />

Dairy Milk Fruit & Nut Chocolate (80g) 80 67 72 -16% -10%<br />

Source: Company Websites<br />

MORGAN STANLEY RESEARCH 13