Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

M<br />

FOUNDATION<br />

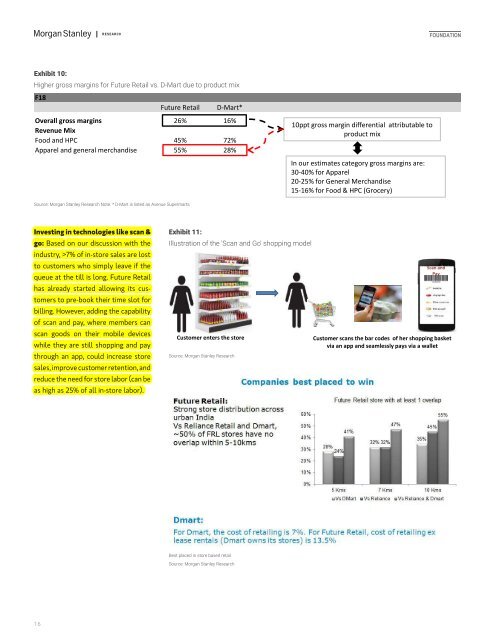

Exhibit 10:<br />

Higher gross margins for Future Retail vs. D-Mart due to product mix<br />

F18<br />

Future Retail<br />

D-Mart*<br />

Overall gross margins 26% 16%<br />

Revenue Mix<br />

Food and HPC 45% 72%<br />

Apparel and general merchandise 55% 28%<br />

10ppt gross margin differential attributable to<br />

product mix<br />

In our estimates category gross margins are:<br />

30-40% for Apparel<br />

20-25% for General Merchandise<br />

15-16% for Food & HPC (Grocery)<br />

Source: Morgan Stanley Research Note: * D-Mart is listed as Avenue Supermarts<br />

Investing in technologies like scan &<br />

go: Based on our discussion with the<br />

industry, >7% of in-store sales are lost<br />

to customers who simply leave if the<br />

queue at the till is long. Future Retail<br />

has already started allowing its customers<br />

to pre-book their time slot for<br />

billing. However, adding the capability<br />

of scan and pay, where members can<br />

scan goods on their mobile devices<br />

while they are still shopping and pay<br />

through an app, could increase store<br />

sales, improve customer retention, and<br />

reduce the need for store labor (can be<br />

as high as 25% of all in-store labor).<br />

Exhibit 11:<br />

Illustration of the 'Scan and Go' shopping model<br />

Customer enters the store<br />

Source: Morgan Stanley Research<br />

Scan and<br />

Pay<br />

Customer scans the bar codes of her shopping basket<br />

via an app and seamlessly pays via a wallet<br />

Best placed in store based retail<br />

Source: Morgan Stanley Research<br />

16