Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

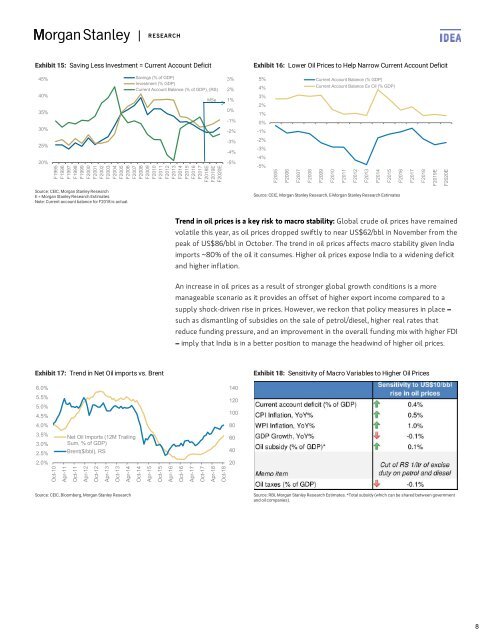

Exhibit 15: Saving Less Investment = Current Account Deficit<br />

Exhibit 16: Lower Oil Prices to Help Narrow Current Account Deficit<br />

45%<br />

40%<br />

35%<br />

30%<br />

25%<br />

20%<br />

Savings (% of GDP)<br />

Investment (% GDP)<br />

Current Account Balance (% of GDP), (RS)<br />

MSe<br />

F1995<br />

F1996<br />

F1997<br />

F1998<br />

F1999<br />

F2000<br />

F2001<br />

F2002<br />

F2003<br />

F2004<br />

F2005<br />

F2006<br />

F2007<br />

F2008<br />

F2009<br />

F2010<br />

F2011<br />

F2012<br />

F2013<br />

F2014<br />

F2015<br />

F2016<br />

F2017<br />

F2018E<br />

F2019E<br />

F2020E<br />

3%<br />

2%<br />

1%<br />

0%<br />

-1%<br />

-2%<br />

-3%<br />

-4%<br />

-5%<br />

5%<br />

4%<br />

3%<br />

2%<br />

1%<br />

0%<br />

-1%<br />

-2%<br />

-3%<br />

-4%<br />

-5%<br />

F2005<br />

F2006<br />

F2007<br />

F2008<br />

Current Account Balance (% GDP)<br />

Current Account Balance Ex Oil (% GDP)<br />

F2009<br />

F2010<br />

F2011<br />

F2012<br />

F2013<br />

F2014<br />

F2015<br />

F2016<br />

F2017<br />

F2018<br />

F2019E<br />

F2020E<br />

Source: CEIC, Morgan Stanley Research<br />

E = Morgan Stanley Research Estimates<br />

Note: Current account balance for F2018 is actual.<br />

Source: CEIC, Morgan Stanley Research, E-Morgan Stanley Research Estimates<br />

Trend in oil prices is a key risk to macro stability: Global crude oil prices have remained<br />

volatile this year, as oil prices dropped swiftly to near US$62/bbl in November from the<br />

peak of US$86/bbl in October. The trend in oil prices affects macro stability given India<br />

imports ~80% of the oil it consumes. Higher oil prices expose India to a widening deficit<br />

and higher inflation.<br />

An increase in oil prices as a result of stronger global growth conditions is a more<br />

manageable scenario as it provides an offset of higher export income compared to a<br />

supply shock-driven rise in prices. However, we reckon that policy measures in place –<br />

such as dismantling of subsidies on the sale of petrol/diesel, higher real rates that<br />

reduce funding pressure, and an improvement in the overall funding mix with higher FDI<br />

– imply that India is in a better position to manage the headwind of higher oil prices.<br />

Exhibit 17: Trend in Net Oil imports vs. Brent<br />

Exhibit 18: Sensitivity of Macro Variables to Higher Oil Prices<br />

6.0%<br />

5.5%<br />

5.0%<br />

4.5%<br />

4.0%<br />

3.5%<br />

3.0%<br />

2.5%<br />

2.0%<br />

Net Oil Imports (12M Trailing<br />

Sum, % of GDP)<br />

Brent($/bbl), RS<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

Oct-10<br />

Apr-11<br />

Oct-11<br />

Apr-12<br />

Oct-12<br />

Apr-13<br />

Oct-13<br />

Apr-14<br />

Oct-14<br />

Apr-15<br />

Oct-15<br />

Apr-16<br />

Oct-16<br />

Apr-17<br />

Oct-17<br />

Apr-18<br />

Oct-18<br />

Source: CEIC, Bloomberg, Morgan Stanley Research<br />

Source: RBI, Morgan Stanley Research Estimates. *Total subsidy (which can be shared between government<br />

and oil companies).<br />

8