Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

India<br />

Agri-inputs / Automobiles<br />

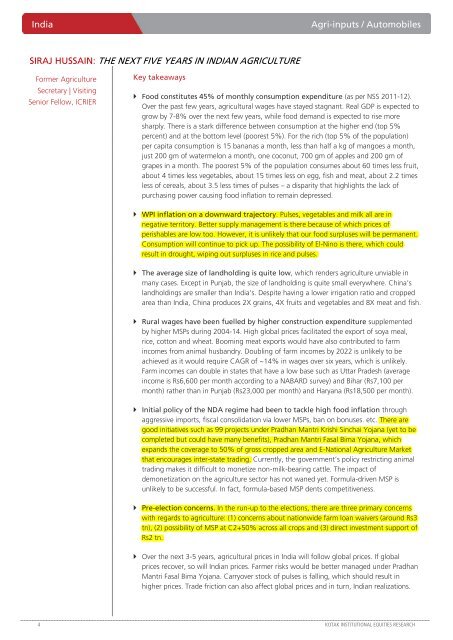

SIRAJ HUSSAIN: THE NEXT FIVE YEARS IN INDIAN AGRICULTURE<br />

Former Agriculture<br />

Secretary | Visiting<br />

Senior Fellow, ICRIER<br />

Key takeaways<br />

Food constitutes 45% of monthly consumption expenditure (as per NSS 2011-12).<br />

Over the past few years, agricultural wages have stayed stagnant. Real GDP is expected to<br />

grow by 7-8% over the next few years, while food demand is expected to rise more<br />

sharply. There is a stark difference between consumption at the higher end (top 5%<br />

percent) and at the bottom level (poorest 5%). For the rich (top 5% of the population)<br />

per capita consumption is 15 bananas a month, less than half a kg of mangoes a month,<br />

just 200 gm of watermelon a month, one coconut, 700 gm of apples and 200 gm of<br />

grapes in a month. The poorest 5% of the population consumes about 60 times less fruit,<br />

about 4 times less vegetables, about 15 times less on egg, fish and meat, about 2.2 times<br />

less of cereals, about 3.5 less times of pulses – a disparity that highlights the lack of<br />

purchasing power causing food inflation to remain depressed.<br />

WPI inflation on a downward trajectory. Pulses, vegetables and milk all are in<br />

negative territory. Better supply management is there because of which prices of<br />

perishables are low too. However, it is unlikely that our food surpluses will be permanent.<br />

Consumption will continue to pick up. The possibility of El-Nino is there, which could<br />

result in drought, wiping out surpluses in rice and pulses.<br />

The average size of landholding is quite low, which renders agriculture unviable in<br />

many cases. Except in Punjab, the size of landholding is quite small everywhere. China’s<br />

landholdings are smaller than India’s. Despite having a lower irrigation ratio and cropped<br />

area than India, China produces 2X grains, 4X fruits and vegetables and 8X meat and fish.<br />

Rural wages have been fuelled by higher construction expenditure supplemented<br />

by higher MSPs during 2004-14. High global prices facilitated the export of soya meal,<br />

rice, cotton and wheat. Booming meat exports would have also contributed to farm<br />

incomes from animal husbandry. Doubling of farm incomes by 2022 is unlikely to be<br />

achieved as it would require CAGR of ~14% in wages over six years, which is unlikely.<br />

Farm incomes can double in states that have a low base such as Uttar Pradesh (average<br />

income is Rs6,600 per month according to a NABARD survey) and Bihar (Rs7,100 per<br />

month) rather than in Punjab (Rs23,000 per month) and Haryana (Rs18,500 per month).<br />

Initial policy of the NDA regime had been to tackle high food inflation through<br />

aggressive imports, fiscal consolidation via lower MSPs, ban on bonuses. etc. There are<br />

good initiatives such as 99 projects under Pradhan Mantri Krishi Sinchai Yojana (yet to be<br />

completed but could have many benefits), Pradhan Mantri Fasal Bima Yojana, which<br />

expands the coverage to 50% of gross cropped area and E-National Agriculture Market<br />

that encourages inter-state trading. Currently, the government’s policy restricting animal<br />

trading makes it difficult to monetize non-milk-bearing cattle. The impact of<br />

demonetization on the agriculture sector has not waned yet. Formula-driven MSP is<br />

unlikely to be successful. In fact, formula-based MSP dents competitiveness.<br />

Pre-election concerns. In the run-up to the elections, there are three primary concerns<br />

with regards to agriculture: (1) concerns about nationwide farm loan waivers (around Rs3<br />

tn), (2) possibility of MSP at C2+50% across all crops and (3) direct investment support of<br />

Rs2 tn.<br />

Over the next 3-5 years, agricultural prices in India will follow global prices. If global<br />

prices recover, so will Indian prices. Farmer risks would be better managed under Pradhan<br />

Mantri Fasal Bima Yojana. Carryover stock of pulses is falling, which should result in<br />

higher prices. Trade friction can also affect global prices and in turn, Indian realizations.<br />

4 KOTAK INSTITUTIONAL EQUITIES RESEARCH