Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Christopher Wood christopher.wood@clsa.com +852 2600 8516<br />

Figure 2<br />

FANG stocks index<br />

210<br />

190<br />

170<br />

150<br />

(End 2016=100)<br />

FANG stocks index<br />

50-day mov. avg.<br />

200-day mov. avg.<br />

130<br />

110<br />

90<br />

70<br />

Jan 16<br />

Mar 16<br />

May 16<br />

Jul 16<br />

Sep 16<br />

Nov 16<br />

Jan 17<br />

Mar 17<br />

May 17<br />

Jul 17<br />

Sep 17<br />

Nov 17<br />

Jan 18<br />

Mar 18<br />

May 18<br />

Jul 18<br />

Sep 18<br />

Nov 18<br />

Note: Market cap weighted at the end of 2016. Include Facebook, Amazon, Netflix and Google/Alphabet. Source: CLSA, Bloomberg<br />

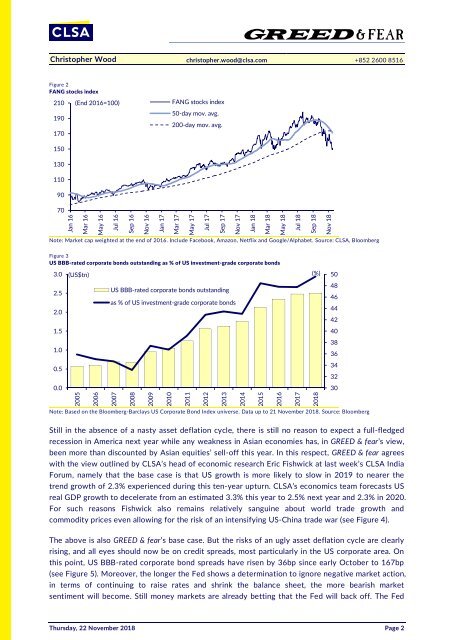

Figure 3<br />

US BBB-rated corporate bonds outstanding as % of US investment-grade corporate bonds<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

(US$tn) (%)<br />

US BBB-rated corporate bonds outstanding<br />

as % of US investment-grade corporate bonds<br />

50<br />

48<br />

46<br />

44<br />

42<br />

40<br />

38<br />

36<br />

34<br />

32<br />

0.0<br />

30<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

2015<br />

2016<br />

2017<br />

2018<br />

Note: Based on the Bloomberg-Barclays US Corporate Bond Index universe. Data up to 21 November 2018. Source: Bloomberg<br />

Still in the absence of a nasty asset deflation cycle, there is still no reason to expect a full-fledged<br />

recession in America next year while any weakness in Asian economies has, in GREED & fear’s view,<br />

been more than discounted by Asian equities’ sell-off this year. In this respect, GREED & fear agrees<br />

with the view outlined by CLSA’s head of economic research Eric Fishwick at last week’s CLSA India<br />

Forum, namely that the base case is that US growth is more likely to slow in 2019 to nearer the<br />

trend growth of 2.3% experienced during this ten-year upturn. CLSA’s economics team forecasts US<br />

real GDP growth to decelerate from an estimated 3.3% this year to 2.5% next year and 2.3% in 2020.<br />

For such reasons Fishwick also remains relatively sanguine about world trade growth and<br />

commodity prices even allowing for the risk of an intensifying US-China trade war (see Figure 4).<br />

The above is also GREED & fear’s base case. But the risks of an ugly asset deflation cycle are clearly<br />

rising, and all eyes should now be on credit spreads, most particularly in the US corporate area. On<br />

this point, US BBB-rated corporate bond spreads have risen by 36bp since early October to 167bp<br />

(see Figure 5). Moreover, the longer the Fed shows a determination to ignore negative market action,<br />

in terms of continuing to raise rates and shrink the balance sheet, the more bearish market<br />

sentiment will become. Still money markets are already betting that the Fed will back off. The Fed<br />

Thursday, 22 November 2018 Page 2