Annual Report 2008 - Office National des Hydrocarbures et des Mines

Annual Report 2008 - Office National des Hydrocarbures et des Mines

Annual Report 2008 - Office National des Hydrocarbures et des Mines

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

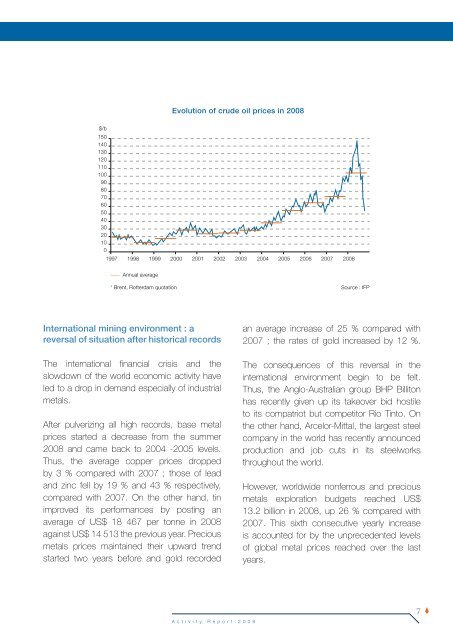

$/b<br />

150<br />

140<br />

130<br />

120<br />

110<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Evolution of crude oil prices in <strong>2008</strong><br />

1997 1998 1999 2000 2001 2002 2003 2004<br />

<strong>Annual</strong> average<br />

* Brent, Rotterdam quotation<br />

International mining environment : a<br />

reversal of situation after historical records<br />

The international financial crisis and the<br />

slowdown of the world economic activity have<br />

led to a drop in demand especially of industrial<br />

m<strong>et</strong>als.<br />

After pulverizing all high records, base m<strong>et</strong>al<br />

prices started a decrease from the summer<br />

<strong>2008</strong> and came back to 2004 -2005 levels.<br />

Thus, the average copper prices dropped<br />

by 3 % compared with 2007 ; those of lead<br />

and zinc fell by 19 % and 43 % respectively,<br />

compared with 2007. On the other hand, tin<br />

improved its performances by posting an<br />

average of US$ 18 467 per tonne in <strong>2008</strong><br />

against US$ 14 513 the previous year. Precious<br />

m<strong>et</strong>als prices maintained their upward trend<br />

started two years before and gold recorded<br />

Activity <strong>Report</strong> <strong>2008</strong><br />

2005 2006 2007 <strong>2008</strong><br />

Source : IFP<br />

an average increase of 25 % compared with<br />

2007 ; the rates of gold increased by 12 %.<br />

The consequences of this reversal in the<br />

international environment begin to be felt.<br />

Thus, the Anglo-Australian group BHP Billiton<br />

has recently given up its takeover bid hostile<br />

to its compatriot but comp<strong>et</strong>itor Rio Tinto. On<br />

the other hand, Arcelor-Mittal, the largest steel<br />

company in the world has recently announced<br />

production and job cuts in its steelworks<br />

throughout the world.<br />

However, worldwide nonferrous and precious<br />

m<strong>et</strong>als exploration budg<strong>et</strong>s reached US$<br />

13.2 billion in <strong>2008</strong>, up 26 % compared with<br />

2007. This sixth consecutive yearly increase<br />

is accounted for by the unprecedented levels<br />

of global m<strong>et</strong>al prices reached over the last<br />

years.<br />

7