Issue No. 25

In this issue, visit France from home - Gascony, and Provence, fabulous day trips from Paris, captivating Toulouse and charming Northern France. Recipes, guides and a whole heap more to entertain and inspire...

In this issue, visit France from home - Gascony, and Provence, fabulous day trips from Paris, captivating Toulouse and charming Northern France. Recipes, guides and a whole heap more to entertain and inspire...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

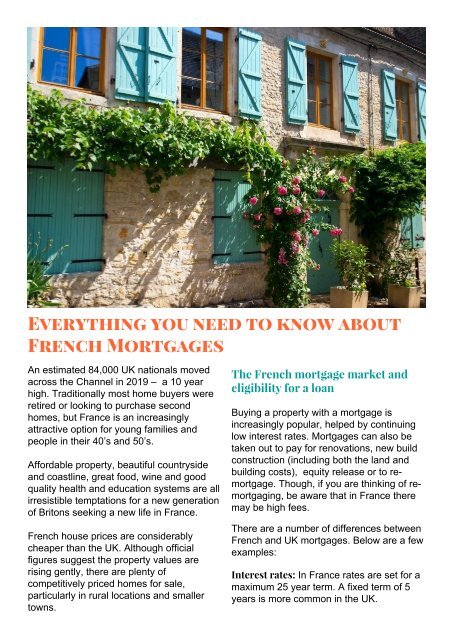

Everything you need to know about<br />

French Mortgages<br />

An estimated 84,000 UK nationals moved<br />

across the Channel in 2019 – a 10 year<br />

high. Traditionally most home buyers were<br />

retired or looking to purchase second<br />

homes, but France is an increasingly<br />

attractive option for young families and<br />

people in their 40’s and 50’s.<br />

Affordable property, beautiful countryside<br />

and coastline, great food, wine and good<br />

quality health and education systems are all<br />

irresistible temptations for a new generation<br />

of Britons seeking a new life in France.<br />

French house prices are considerably<br />

cheaper than the UK. Although official<br />

figures suggest the property values are<br />

rising gently, there are plenty of<br />

competitively priced homes for sale,<br />

particularly in rural locations and smaller<br />

towns.<br />

The French mortgage market and<br />

eligibility for a loan<br />

Buying a property with a mortgage is<br />

increasingly popular, helped by continuing<br />

low interest rates. Mortgages can also be<br />

taken out to pay for renovations, new build<br />

construction (including both the land and<br />

building costs), equity release or to remortgage.<br />

Though, if you are thinking of remortgaging,<br />

be aware that in France there<br />

may be high fees.<br />

There are a number of differences between<br />

French and UK mortgages. Below are a few<br />

examples:<br />

Interest rates: In France rates are set for a<br />

maximum <strong>25</strong> year term. A fixed term of 5<br />

years is more common in the UK.