Issue No. 25

In this issue, visit France from home - Gascony, and Provence, fabulous day trips from Paris, captivating Toulouse and charming Northern France. Recipes, guides and a whole heap more to entertain and inspire...

In this issue, visit France from home - Gascony, and Provence, fabulous day trips from Paris, captivating Toulouse and charming Northern France. Recipes, guides and a whole heap more to entertain and inspire...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Eligibility: French banks look in detail for<br />

proof of income and the total amount of<br />

household debt. This debt ratio determines<br />

whether they feel your mortgage is<br />

affordable. In the UK the affordability criteria<br />

is generally three times your income.<br />

Consumer protection: The French<br />

mortgage market is heavily regulated.<br />

Buyers are required to pay for mortgage<br />

protection insurance. The UK market,<br />

despite some tightening in recent years, has<br />

lighter regulations.<br />

The French mortgage market is open<br />

to both residents and to nonresidents.<br />

French mortgage lenders have become far<br />

more prepared to offer loans to non-resident<br />

buyers in recent years. Lenders have an<br />

option of taking out a Euro mortgage rather<br />

than a loan in sterling from a UK bank. An<br />

important first step is opening a French<br />

bank account; this will enable you to deposit<br />

and transfer funds regularly.<br />

Proving that you have a stable income is a<br />

key test for French home buyers. Lenders<br />

will not discriminate against you if you are<br />

self-employed but you must supply three<br />

years’ tax returns and your earnings over<br />

that period determines the amount you can<br />

borrow.<br />

Types of French mortgage<br />

In France, the majority of home buyers opt<br />

for a standard capital repayment loan in<br />

where you repay both the capital and the<br />

interest.<br />

Interest only loans are less common and<br />

are mostly taken out by landlords who want<br />

to minimise their outgoings.<br />

rates increase and are generally fixed for<br />

the entire duration of the mortgage.<br />

However, redemption fees can be<br />

expensive. So, if you want to repay early,<br />

remember to take this into consideration.<br />

Borrowing a maximum of 80% of the<br />

property’s value is the norm, though it may<br />

vary up to 85%. How much you can borrow<br />

depends on your financial circumstances<br />

and credit rating.<br />

Equity release isn't common in France but is<br />

possible if you don't have an existing<br />

mortgage on your property. The amount of<br />

household debt must not exceed 33% of<br />

your annual income.<br />

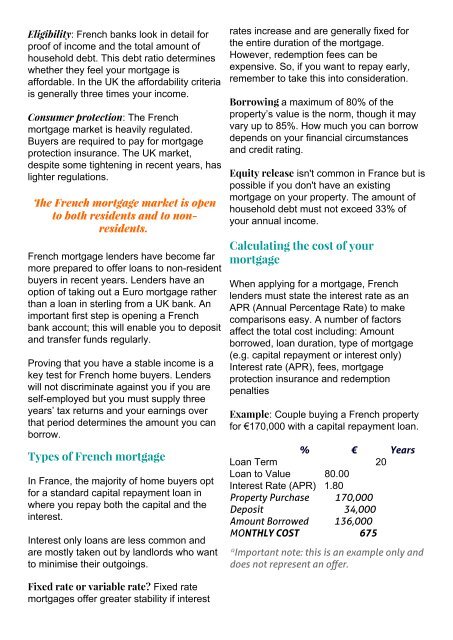

Calculating the cost of your<br />

mortgage<br />

When applying for a mortgage, French<br />

lenders must state the interest rate as an<br />

APR (Annual Percentage Rate) to make<br />

comparisons easy. A number of factors<br />

affect the total cost including: Amount<br />

borrowed, loan duration, type of mortgage<br />

(e.g. capital repayment or interest only)<br />

Interest rate (APR), fees, mortgage<br />

protection insurance and redemption<br />

penalties<br />

Example: Couple buying a French property<br />

for €170,000 with a capital repayment loan.<br />

% € Years<br />

Loan Term 20<br />

Loan to Value 80.00<br />

Interest Rate (APR) 1.80<br />

Property Purchase 170,000<br />

Deposit 34,000<br />

Amount Borrowed 136,000<br />

MONTHLY COST 675<br />

*Important note: this is an example only and<br />

does not represent an offer.<br />

Fixed rate or variable rate? Fixed rate<br />

mortgages offer greater stability if interest