in a Dynamic Environment - Tata Consultancy Services

in a Dynamic Environment - Tata Consultancy Services

in a Dynamic Environment - Tata Consultancy Services

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

112<br />

Annual Report 2008-09<br />

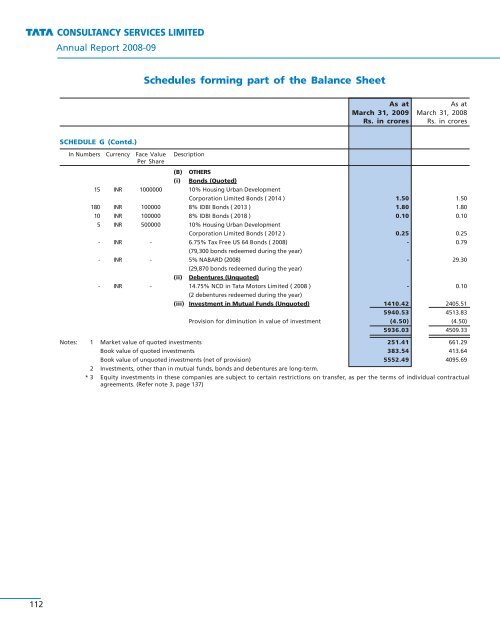

SCHEDULE G (Contd.)<br />

Schedules form<strong>in</strong>g part of the Balance Sheet<br />

As at As at<br />

March 31, 2009 March 31, 2008<br />

Rs. <strong>in</strong> crores Rs. <strong>in</strong> crores<br />

In Numbers Currency Face Value<br />

Per Share<br />

Description<br />

(B) OTHERS<br />

(i) Bonds (Quoted)<br />

15 INR 1000000 10% Hous<strong>in</strong>g Urban Development<br />

Corporation Limited Bonds ( 2014 ) 1.50 1.50<br />

180 INR 100000 8% IDBI Bonds ( 2013 ) 1.80 1.80<br />

10 INR 100000 8% IDBI Bonds ( 2018 ) 0.10 0.10<br />

5 INR 500000 10% Hous<strong>in</strong>g Urban Development<br />

Corporation Limited Bonds ( 2012 ) 0.25 0.25<br />

- INR - 6.75% Tax Free US 64 Bonds ( 2008)<br />

(79,300 bonds redeemed dur<strong>in</strong>g the year)<br />

- 0.79<br />

- INR - 5% NABARD (2008)<br />

(29,870 bonds redeemed dur<strong>in</strong>g the year)<br />

- 29.30<br />

(ii) Debentures (Unquoted)<br />

- INR - 14.75% NCD <strong>in</strong> <strong>Tata</strong> Motors Limited ( 2008 )<br />

(2 debentures redeemed dur<strong>in</strong>g the year)<br />

- 0.10<br />

(iii) Investment <strong>in</strong> Mutual Funds (Unquoted) 1410.42 2405.51<br />

5940.53 4513.83<br />

Provision for dim<strong>in</strong>ution <strong>in</strong> value of <strong>in</strong>vestment (4.50) (4.50)<br />

5936.03 4509.33<br />

Notes: 1 Market value of quoted <strong>in</strong>vestments 251.41 661.29<br />

Book value of quoted <strong>in</strong>vestments 383.54 413.64<br />

Book value of unquoted <strong>in</strong>vestments (net of provision) 5552.49 4095.69<br />

2 Investments, other than <strong>in</strong> mutual funds, bonds and debentures are long-term.<br />

* 3 Equity <strong>in</strong>vestments <strong>in</strong> these companies are subject to certa<strong>in</strong> restrictions on transfer, as per the terms of <strong>in</strong>dividual contractual<br />

agreements. (Refer note 3, page 137)