in a Dynamic Environment - Tata Consultancy Services

in a Dynamic Environment - Tata Consultancy Services

in a Dynamic Environment - Tata Consultancy Services

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

178<br />

Annual Report 2008-09<br />

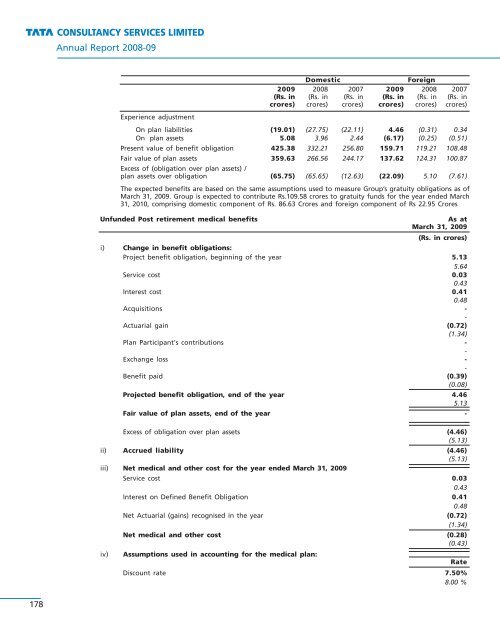

Domestic Foreign<br />

2009 2008 2007 2009 2008 2007<br />

(Rs. <strong>in</strong> (Rs. <strong>in</strong> (Rs. <strong>in</strong> (Rs. <strong>in</strong> (Rs. <strong>in</strong> (Rs. <strong>in</strong><br />

crores) crores) crores) crores) crores) crores)<br />

Experience adjustment<br />

On plan liabilities (19.01) (27.75) (22.11) 4.46 (0.31) 0.34<br />

On plan assets 5.08 3.96 2.44 (6.17) (0.25) (0.51)<br />

Present value of benefit obligation 425.38 332.21 256.80 159.71 119.21 108.48<br />

Fair value of plan assets<br />

Excess of (obligation over plan assets) /<br />

359.63 266.56 244.17 137.62 124.31 100.87<br />

plan assets over obligation (65.75) (65.65) (12.63) (22.09) 5.10 (7.61)<br />

The expected benefits are based on the same assumptions used to measure Group’s gratuity obligations as of<br />

March 31, 2009. Group is expected to contribute Rs.109.58 crores to gratuity funds for the year ended March<br />

31, 2010, compris<strong>in</strong>g domestic component of Rs. 86.63 Crores and foreign component of Rs 22.95 Crores<br />

Unfunded Post retirement medical benefits As at<br />

March 31, 2009<br />

(Rs. <strong>in</strong> crores)<br />

i) Change <strong>in</strong> benefit obligations:<br />

Project benefit obligation, beg<strong>in</strong>n<strong>in</strong>g of the year 5.13<br />

5.64<br />

Service cost 0.03<br />

0.43<br />

Interest cost 0.41<br />

0.48<br />

Acquisitions -<br />

-<br />

Actuarial ga<strong>in</strong> (0.72)<br />

(1.34)<br />

Plan Participant's contributions -<br />

-<br />

Exchange loss -<br />

-<br />

Benefit paid (0.39)<br />

(0.08)<br />

Projected benefit obligation, end of the year 4.46<br />

5.13<br />

Fair value of plan assets, end of the year -<br />

-<br />

Excess of obligation over plan assets (4.46)<br />

(5.13)<br />

ii) Accrued liability (4.46)<br />

(5.13)<br />

iii) Net medical and other cost for the year ended March 31, 2009<br />

Service cost 0.03<br />

0.43<br />

Interest on Def<strong>in</strong>ed Benefit Obligation 0.41<br />

0.48<br />

Net Actuarial (ga<strong>in</strong>s) recognised <strong>in</strong> the year (0.72)<br />

(1.34)<br />

Net medical and other cost (0.28)<br />

(0.43)<br />

iv) Assumptions used <strong>in</strong> account<strong>in</strong>g for the medical plan:<br />

Rate<br />

Discount rate 7.50%<br />

8.00 %