in a Dynamic Environment - Tata Consultancy Services

in a Dynamic Environment - Tata Consultancy Services

in a Dynamic Environment - Tata Consultancy Services

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

obligations under f<strong>in</strong>ance lease was Rs.36.44 crore as at<br />

March 31, 2009 (Rs.8.80 crore as at March 31, 2008) and<br />

these are also secured aga<strong>in</strong>st fixed assets obta<strong>in</strong>ed under<br />

f<strong>in</strong>ance lease arrangements.<br />

Unsecured loans as at March 31, 2009 were<br />

Rs.525.32 crore (Rs.436.95 crore as at March 31, 2008).<br />

Loans from banks as at March 31, 2009 were at<br />

Rs.512.37 crore (Rs.422.29 crore as at March 31, 2008).<br />

These were commercial borrow<strong>in</strong>gs taken by the Company<br />

and by its North American subsidiary. Loans repayable<br />

with<strong>in</strong> one year are Rs.513.63 crore as at March 31, 2009<br />

(Rs.22.44 crore as at March 31, 2008). Other unsecured<br />

loans were Rs.12.95 crore as at March 31, 2009 (Rs.14.66<br />

crore as at March 31, 2008).<br />

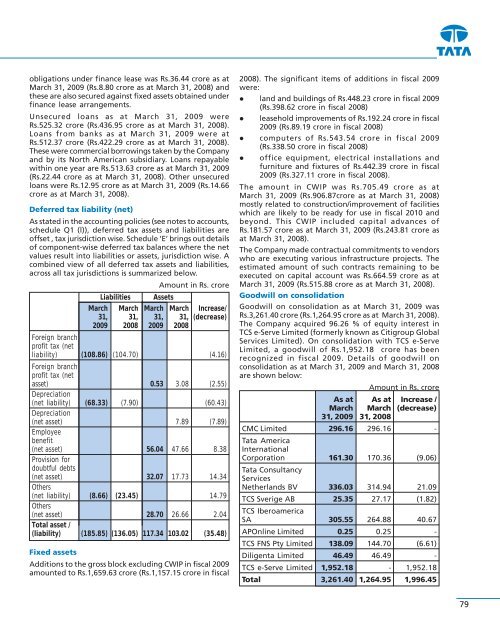

Deferred tax liability (net)<br />

As stated <strong>in</strong> the account<strong>in</strong>g policies (see notes to accounts,<br />

schedule Q1 (l)), deferred tax assets and liabilities are<br />

offset , tax jurisdiction wise. Schedule ‘E’ br<strong>in</strong>gs out details<br />

of component-wise deferred tax balances where the net<br />

values result <strong>in</strong>to liabilities or assets, jurisdiction wise. A<br />

comb<strong>in</strong>ed view of all deferred tax assets and liabilities,<br />

across all tax jurisdictions is summarized below.<br />

Amount <strong>in</strong> Rs. crore<br />

Liabilities Assets<br />

March March March March Increase/<br />

31, 31, 31, 31, (decrease)<br />

2009 2008 2009 2008<br />

Foreign branch<br />

profit tax (net<br />

liability)<br />

Foreign branch<br />

profit tax (net<br />

(108.86) (104.70) (4.16)<br />

asset)<br />

Depreciation<br />

0.53 3.08 (2.55)<br />

(net liability)<br />

Depreciation<br />

(68.33) (7.90) (60.43)<br />

(net asset)<br />

Employee<br />

benefit<br />

7.89 (7.89)<br />

(net asset)<br />

Provision for<br />

doubtful debts<br />

56.04 47.66 8.38<br />

(net asset)<br />

Others<br />

32.07 17.73 14.34<br />

(net liability)<br />

Others<br />

(8.66) (23.45) 14.79<br />

(net asset)<br />

Total asset /<br />

28.70 26.66 2.04<br />

(liability) (185.85) (136.05) 117.34 103.02 (35.48)<br />

Fixed assets<br />

Additions to the gross block exclud<strong>in</strong>g CWIP <strong>in</strong> fiscal 2009<br />

amounted to Rs.1,659.63 crore (Rs.1,157.15 crore <strong>in</strong> fiscal<br />

2008). The significant items of additions <strong>in</strong> fiscal 2009<br />

were:<br />

� land and build<strong>in</strong>gs of Rs.448.23 crore <strong>in</strong> fiscal 2009<br />

(Rs.398.62 crore <strong>in</strong> fiscal 2008)<br />

� leasehold improvements of Rs.192.24 crore <strong>in</strong> fiscal<br />

2009 (Rs.89.19 crore <strong>in</strong> fiscal 2008)<br />

� computers of Rs.543.54 crore <strong>in</strong> fiscal 2009<br />

(Rs.338.50 crore <strong>in</strong> fiscal 2008)<br />

� office equipment, electrical <strong>in</strong>stallations and<br />

furniture and fixtures of Rs.442.39 crore <strong>in</strong> fiscal<br />

2009 (Rs.327.11 crore <strong>in</strong> fiscal 2008).<br />

The amount <strong>in</strong> CWIP was Rs.705.49 crore as at<br />

March 31, 2009 (Rs.906.87crore as at March 31, 2008)<br />

mostly related to construction/improvement of facilities<br />

which are likely to be ready for use <strong>in</strong> fiscal 2010 and<br />

beyond. This CWIP <strong>in</strong>cluded capital advances of<br />

Rs.181.57 crore as at March 31, 2009 (Rs.243.81 crore as<br />

at March 31, 2008).<br />

The Company made contractual commitments to vendors<br />

who are execut<strong>in</strong>g various <strong>in</strong>frastructure projects. The<br />

estimated amount of such contracts rema<strong>in</strong><strong>in</strong>g to be<br />

executed on capital account was Rs.664.59 crore as at<br />

March 31, 2009 (Rs.515.88 crore as at March 31, 2008).<br />

Goodwill on consolidation<br />

Goodwill on consolidation as at March 31, 2009 was<br />

Rs.3,261.40 crore (Rs.1,264.95 crore as at March 31, 2008).<br />

The Company acquired 96.26 % of equity <strong>in</strong>terest <strong>in</strong><br />

TCS e-Serve Limited (formerly known as Citigroup Global<br />

<strong>Services</strong> Limited). On consolidation with TCS e-Serve<br />

Limited, a goodwill of Rs.1,952.18 crore has been<br />

recognized <strong>in</strong> fiscal 2009. Details of goodwill on<br />

consolidation as at March 31, 2009 and March 31, 2008<br />

are shown below:<br />

Amount <strong>in</strong> Rs. crore<br />

As at As at Increase /<br />

March March (decrease)<br />

31, 2009 31, 2008<br />

CMC Limited<br />

<strong>Tata</strong> America<br />

International<br />

296.16 296.16 -<br />

Corporation<br />

<strong>Tata</strong> <strong>Consultancy</strong><br />

<strong>Services</strong><br />

161.30 170.36 (9.06)<br />

Netherlands BV 336.03 314.94 21.09<br />

TCS Sverige AB<br />

TCS Iberoamerica<br />

25.35 27.17 (1.82)<br />

SA 305.55 264.88 40.67<br />

APOnl<strong>in</strong>e Limited 0.25 0.25 -<br />

TCS FNS Pty Limited 138.09 144.70 (6.61)<br />

Diligenta Limited 46.49 46.49 -<br />

TCS e-Serve Limited 1,952.18 - 1,952.18<br />

Total 3,261.40 1,264.95 1,996.45<br />

79