in a Dynamic Environment - Tata Consultancy Services

in a Dynamic Environment - Tata Consultancy Services

in a Dynamic Environment - Tata Consultancy Services

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

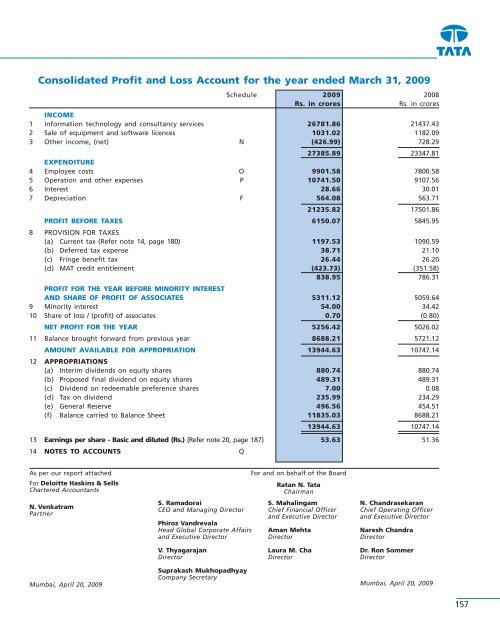

Consolidated Profit and Loss Account for the year ended March 31, 2009<br />

Schedule 2009 2008<br />

Rs. <strong>in</strong> crores Rs. <strong>in</strong> crores<br />

1<br />

INCOME<br />

Information technology and consultancy services 26781.86 21437.43<br />

2 Sale of equipment and software licences 1031.02 1182.09<br />

3 Other <strong>in</strong>come, (net) N (426.99) 728.29<br />

EXPENDITURE<br />

27385.89 23347.81<br />

4 Employee costs O 9901.58 7800.58<br />

5 Operation and other expenses P 10741.50 9107.56<br />

6 Interest 28.66 30.01<br />

7 Depreciation F 564.08 563.71<br />

21235.82 17501.86<br />

PROFIT BEFORE TAXES 6150.07 5845.95<br />

8 PROVISION FOR TAXES<br />

(a) Current tax (Refer note 14, page 180) 1197.53 1090.59<br />

(b) Deferred tax expense 38.71 21.10<br />

(c) Fr<strong>in</strong>ge benefit tax 26.44 26.20<br />

(d) MAT credit entitlement (423.73) (351.58)<br />

838.95 786.31<br />

PROFIT FOR THE YEAR BEFORE MINORITY INTEREST<br />

AND SHARE OF PROFIT OF ASSOCIATES 5311.12 5059.64<br />

9 M<strong>in</strong>ority <strong>in</strong>terest 54.00 34.42<br />

10 Share of loss / (profit) of associates 0.70 (0.80)<br />

NET PROFIT FOR THE YEAR 5256.42 5026.02<br />

11 Balance brought forward from previous year 8688.21 5721.12<br />

AMOUNT AVAILABLE FOR APPROPRIATION 13944.63 10747.14<br />

12 APPROPRIATIONS<br />

(a) Interim dividends on equity shares 880.74 880.74<br />

(b) Proposed f<strong>in</strong>al dividend on equity shares 489.31 489.31<br />

(c) Dividend on redeemable preference shares 7.00 0.08<br />

(d) Tax on dividend 235.99 234.29<br />

(e) General Reserve 496.56 454.51<br />

(f) Balance carried to Balance Sheet 11835.03 8688.21<br />

13944.63 10747.14<br />

13 Earn<strong>in</strong>gs per share - Basic and diluted (Rs.) (Refer note 20, page 187) 53.63 51.36<br />

14 NOTES TO ACCOUNTS Q<br />

As per our report attached<br />

For Deloitte Hask<strong>in</strong>s & Sells<br />

Chartered Accountants<br />

N. Venkatram<br />

Partner<br />

Mumbai, April 20, 2009<br />

S. Ramadorai<br />

CEO and Manag<strong>in</strong>g Director<br />

Phiroz Vandrevala<br />

Head Global Corporate Affairs<br />

and Executive Director<br />

V. Thyagarajan<br />

Director<br />

Suprakash Mukhopadhyay<br />

Company Secretary<br />

For and on behalf of the Board<br />

Ratan N. <strong>Tata</strong><br />

Chairman<br />

S. Mahal<strong>in</strong>gam<br />

Chief F<strong>in</strong>ancial Officer<br />

and Executive Director<br />

Aman Mehta<br />

Director<br />

Laura M. Cha<br />

Director<br />

N. Chandrasekaran<br />

Chief Operat<strong>in</strong>g Officer<br />

and Executive Director<br />

Naresh Chandra<br />

Director<br />

Dr. Ron Sommer<br />

Director<br />

Mumbai, April 20, 2009<br />

157