in a Dynamic Environment - Tata Consultancy Services

in a Dynamic Environment - Tata Consultancy Services

in a Dynamic Environment - Tata Consultancy Services

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

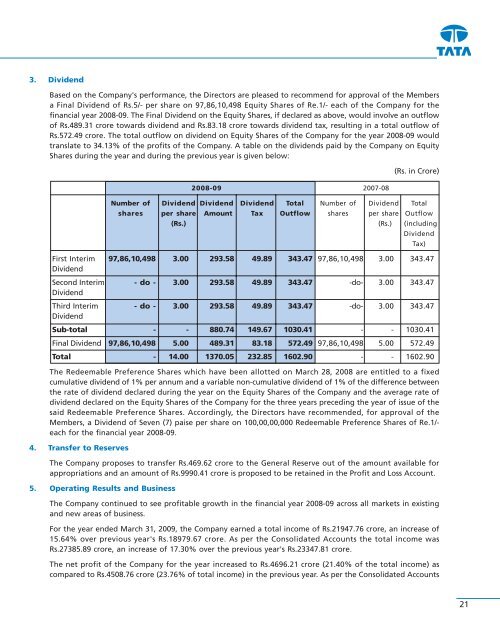

3. Dividend<br />

Based on the Company's performance, the Directors are pleased to recommend for approval of the Members<br />

a F<strong>in</strong>al Dividend of Rs.5/- per share on 97,86,10,498 Equity Shares of Re.1/- each of the Company for the<br />

f<strong>in</strong>ancial year 2008-09. The F<strong>in</strong>al Dividend on the Equity Shares, if declared as above, would <strong>in</strong>volve an outflow<br />

of Rs.489.31 crore towards dividend and Rs.83.18 crore towards dividend tax, result<strong>in</strong>g <strong>in</strong> a total outflow of<br />

Rs.572.49 crore. The total outflow on dividend on Equity Shares of the Company for the year 2008-09 would<br />

translate to 34.13% of the profits of the Company. A table on the dividends paid by the Company on Equity<br />

Shares dur<strong>in</strong>g the year and dur<strong>in</strong>g the previous year is given below:<br />

2008-09 2007-08<br />

(Rs. <strong>in</strong> Crore)<br />

Number of Dividend Dividend Dividend Total Number of Dividend Total<br />

shares per share Amount Tax Outflow shares per share Outflow<br />

(Rs.) (Rs.) (<strong>in</strong>clud<strong>in</strong>g<br />

Dividend<br />

Tax)<br />

First Interim<br />

Dividend<br />

97,86,10,498 3.00 293.58 49.89 343.47 97,86,10,498 3.00 343.47<br />

Second Interim<br />

Dividend<br />

- do - 3.00 293.58 49.89 343.47 -do- 3.00 343.47<br />

Third Interim<br />

Dividend<br />

- do - 3.00 293.58 49.89 343.47 -do- 3.00 343.47<br />

Sub-total - - 880.74 149.67 1030.41 - - 1030.41<br />

F<strong>in</strong>al Dividend 97,86,10,498 5.00 489.31 83.18 572.49 97,86,10,498 5.00 572.49<br />

Total - 14.00 1370.05 232.85 1602.90 - - 1602.90<br />

The Redeemable Preference Shares which have been allotted on March 28, 2008 are entitled to a fixed<br />

cumulative dividend of 1% per annum and a variable non-cumulative dividend of 1% of the difference between<br />

the rate of dividend declared dur<strong>in</strong>g the year on the Equity Shares of the Company and the average rate of<br />

dividend declared on the Equity Shares of the Company for the three years preced<strong>in</strong>g the year of issue of the<br />

said Redeemable Preference Shares. Accord<strong>in</strong>gly, the Directors have recommended, for approval of the<br />

Members, a Dividend of Seven (7) paise per share on 100,00,00,000 Redeemable Preference Shares of Re.1/each<br />

for the f<strong>in</strong>ancial year 2008-09.<br />

4. Transfer to Reserves<br />

The Company proposes to transfer Rs.469.62 crore to the General Reserve out of the amount available for<br />

appropriations and an amount of Rs.9990.41 crore is proposed to be reta<strong>in</strong>ed <strong>in</strong> the Profit and Loss Account.<br />

5. Operat<strong>in</strong>g Results and Bus<strong>in</strong>ess<br />

The Company cont<strong>in</strong>ued to see profitable growth <strong>in</strong> the f<strong>in</strong>ancial year 2008-09 across all markets <strong>in</strong> exist<strong>in</strong>g<br />

and new areas of bus<strong>in</strong>ess.<br />

For the year ended March 31, 2009, the Company earned a total <strong>in</strong>come of Rs.21947.76 crore, an <strong>in</strong>crease of<br />

15.64% over previous year's Rs.18979.67 crore. As per the Consolidated Accounts the total <strong>in</strong>come was<br />

Rs.27385.89 crore, an <strong>in</strong>crease of 17.30% over the previous year's Rs.23347.81 crore.<br />

The net profit of the Company for the year <strong>in</strong>creased to Rs.4696.21 crore (21.40% of the total <strong>in</strong>come) as<br />

compared to Rs.4508.76 crore (23.76% of total <strong>in</strong>come) <strong>in</strong> the previous year. As per the Consolidated Accounts<br />

21