1 - Cash Registers

1 - Cash Registers

1 - Cash Registers

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

20<br />

Tax status shift<br />

The machine allows you to shift the programmed tax status of each department or the PLU key by pressing the<br />

T and/or U keys before those keys. After each entry is completed, the programmed tax status of each<br />

key is resumed.<br />

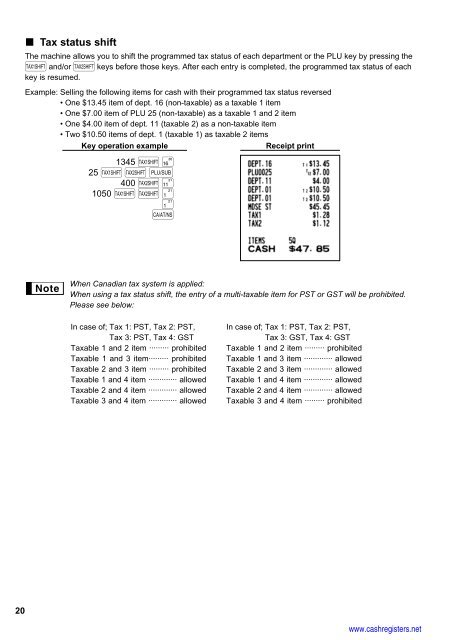

Example: Selling the following items for cash with their programmed tax status reversed<br />

• One $13.45 item of dept. 16 (non-taxable) as a taxable 1 item<br />

• One $7.00 item of PLU 25 (non-taxable) as a taxable 1 and 2 item<br />

• One $4.00 item of dept. 11 (taxable 2) as a non-taxable item<br />

• Two $10.50 items of dept. 1 (taxable 1) as taxable 2 items<br />

Key operation example<br />

Receipt print<br />

1345 T¥<br />

25 TUp<br />

400 Uœ<br />

1050 TU¡ ¡A<br />

When Canadian tax system is applied:<br />

When using a tax status shift, the entry of a multi-taxable item for PST or GST will be prohibited.<br />

Please see below:<br />

In case of; Tax 1: PST, Tax 2: PST,<br />

Tax 3: PST, Tax 4: GST<br />

Taxable 1 and 2 item ········· prohibited<br />

Taxable 1 and 3 item········· prohibited<br />

Taxable 2 and 3 item ········· prohibited<br />

Taxable 1 and 4 item ············· allowed<br />

Taxable 2 and 4 item ············· allowed<br />

Taxable 3 and 4 item ············· allowed<br />

In case of; Tax 1: PST, Tax 2: PST,<br />

Tax 3: GST, Tax 4: GST<br />

Taxable 1 and 2 item ········· prohibited<br />

Taxable 1 and 3 item ············· allowed<br />

Taxable 2 and 3 item ············· allowed<br />

Taxable 1 and 4 item ············· allowed<br />

Taxable 2 and 4 item ············· allowed<br />

Taxable 3 and 4 item ········· prohibited<br />

www.cashregisters.net