Annual Report and Accounts 2012 - Speedy Hire plc

Annual Report and Accounts 2012 - Speedy Hire plc

Annual Report and Accounts 2012 - Speedy Hire plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements 65<br />

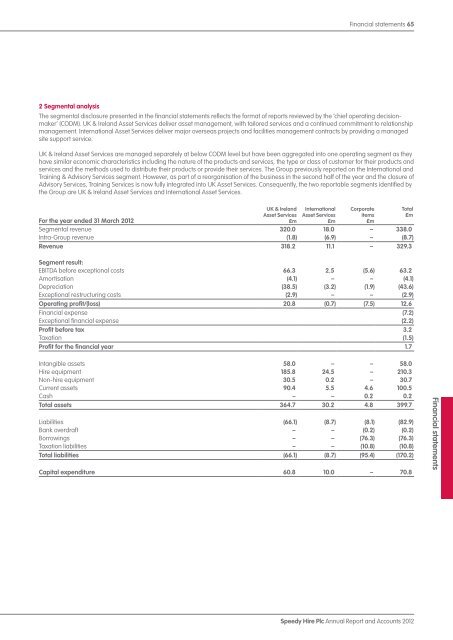

2 Segmental analysis<br />

The segmental disclosure presented in the financial statements reflects the format of reports reviewed by the ‘chief operating decisionmaker’<br />

(CODM). UK & Irel<strong>and</strong> Asset Services deliver asset management, with tailored services <strong>and</strong> a continued commitment to relationship<br />

management. International Asset Services deliver major overseas projects <strong>and</strong> facilities management contracts by providing a managed<br />

site support service.<br />

UK & Irel<strong>and</strong> Asset Services are managed separately at below CODM level but have been aggregated into one operating segment as they<br />

have similar economic characteristics including the nature of the products <strong>and</strong> services, the type or class of customer for their products <strong>and</strong><br />

services <strong>and</strong> the methods used to distribute their products or provide their services. The Group previously reported on the International <strong>and</strong><br />

Training & Advisory Services segment. However, as part of a reorganisation of the business in the second half of the year <strong>and</strong> the closure of<br />

Advisory Services, Training Services is now fully integrated into UK Asset Services. Consequently, the two reportable segments identified by<br />

the Group are UK & Irel<strong>and</strong> Asset Services <strong>and</strong> International Asset Services.<br />

For the year ended 31 March <strong>2012</strong><br />

UK & Irel<strong>and</strong><br />

Asset Services<br />

£m<br />

International<br />

Asset Services<br />

£m<br />

Corporate<br />

items<br />

£m<br />

Segmental revenue 320.0 18.0 – 338.0<br />

Intra-Group revenue (1.8) (6.9) – (8.7)<br />

Revenue 318.2 11.1 – 329.3<br />

Segment result:<br />

EBITDA before exceptional costs 66.3 2.5 (5.6) 63.2<br />

Amortisation (4.1) – – (4.1)<br />

Depreciation (38.5) (3.2) (1.9) (43.6)<br />

Exceptional restructuring costs (2.9) – – (2.9)<br />

Operating profit/(loss) 20.8 (0.7) (7.5) 12.6<br />

Financial expense (7.2)<br />

Exceptional financial expense (2.2)<br />

Profit before tax 3.2<br />

Taxation (1.5)<br />

Profit for the financial year 1.7<br />

Intangible assets 58.0 – – 58.0<br />

<strong>Hire</strong> equipment 185.8 24.5 – 210.3<br />

Non-hire equipment 30.5 0.2 – 30.7<br />

Current assets 90.4 5.5 4.6 100.5<br />

Cash – – 0.2 0.2<br />

Total assets 364.7 30.2 4.8 399.7<br />

Liabilities (66.1) (8.7) (8.1) (82.9)<br />

Bank overdraft – – (0.2) (0.2)<br />

Borrowings – – (76.3) (76.3)<br />

Taxation liabilities – – (10.8) (10.8)<br />

Total liabilities (66.1) (8.7) (95.4) (170.2)<br />

Capital expenditure 60.8 10.0 – 70.8<br />

Total<br />

£m<br />

<strong>Speedy</strong> <strong>Hire</strong> Plc <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong><br />

Financial statements