Annual Report and Accounts 2012 - Speedy Hire plc

Annual Report and Accounts 2012 - Speedy Hire plc

Annual Report and Accounts 2012 - Speedy Hire plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

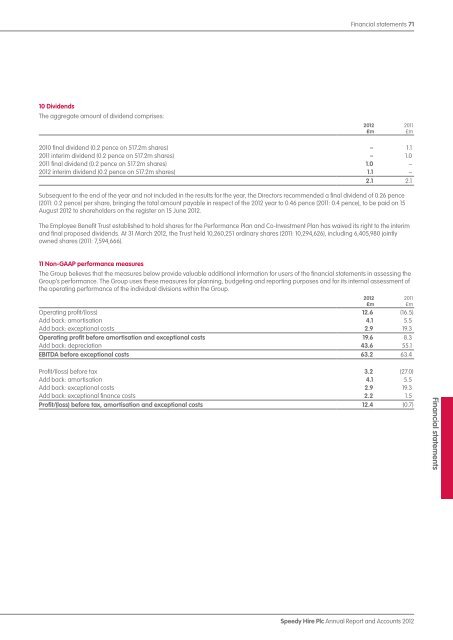

10 Dividends<br />

The aggregate amount of dividend comprises:<br />

Financial statements 71<br />

2010 final dividend (0.2 pence on 517.2m shares) – 1.1<br />

2011 interim dividend (0.2 pence on 517.2m shares) – 1.0<br />

2011 final dividend (0.2 pence on 517.2m shares) 1.0 –<br />

<strong>2012</strong> interim dividend (0.2 pence on 517.2m shares) 1.1 –<br />

2.1 2.1<br />

Subsequent to the end of the year <strong>and</strong> not included in the results for the year, the Directors recommended a final dividend of 0.26 pence<br />

(2011: 0.2 pence) per share, bringing the total amount payable in respect of the <strong>2012</strong> year to 0.46 pence (2011: 0.4 pence), to be paid on 15<br />

August <strong>2012</strong> to shareholders on the register on 15 June <strong>2012</strong>.<br />

The Employee Benefit Trust established to hold shares for the Performance Plan <strong>and</strong> Co-Investment Plan has waived its right to the interim<br />

<strong>and</strong> final proposed dividends. At 31 March <strong>2012</strong>, the Trust held 10,260,251 ordinary shares (2011: 10,294,626), including 6,405,980 jointly<br />

owned shares (2011: 7,594,666).<br />

11 Non-GAAP performance measures<br />

The Group believes that the measures below provide valuable additional information for users of the financial statements in assessing the<br />

Group’s performance. The Group uses these measures for planning, budgeting <strong>and</strong> reporting purposes <strong>and</strong> for its internal assessment of<br />

the operating performance of the individual divisions within the Group.<br />

Operating profit/(loss) 12.6 (16.5)<br />

Add back: amortisation 4.1 5.5<br />

Add back: exceptional costs 2.9 19.3<br />

Operating profit before amortisation <strong>and</strong> exceptional costs 19.6 8.3<br />

Add back: depreciation 43.6 55.1<br />

EBITDA before exceptional costs 63.2 63.4<br />

Profit/(loss) before tax 3.2 (27.0)<br />

Add back: amortisation 4.1 5.5<br />

Add back: exceptional costs 2.9 19.3<br />

Add back: exceptional finance costs 2.2 1.5<br />

Profit/(loss) before tax, amortisation <strong>and</strong> exceptional costs 12.4 (0.7)<br />

<strong>2012</strong><br />

£m<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

2011<br />

£m<br />

<strong>Speedy</strong> <strong>Hire</strong> Plc <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong><br />

Financial statements