Annual Report and Accounts 2012 - Speedy Hire plc

Annual Report and Accounts 2012 - Speedy Hire plc

Annual Report and Accounts 2012 - Speedy Hire plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements 75<br />

18 Financial instruments<br />

The Group holds <strong>and</strong> uses financial instruments to finance its operations <strong>and</strong> to manage its interest rate <strong>and</strong> liquidity risks. The Group<br />

primarily finances its operations using share capital, retained profits <strong>and</strong> borrowings. The main risks arising from the Group’s financial<br />

instruments are credit, interest rate, foreign currency <strong>and</strong> liquidity risk. The Board reviews <strong>and</strong> agrees the policies for managing each of<br />

these risks on an annual basis. A full description of the Group’s approach to managing these risks is set out below.<br />

The Group does not engage in trading or speculative activities using derivative financial instruments. A Group offset arrangement exists in<br />

order to minimise the interest costs on outst<strong>and</strong>ing debt.<br />

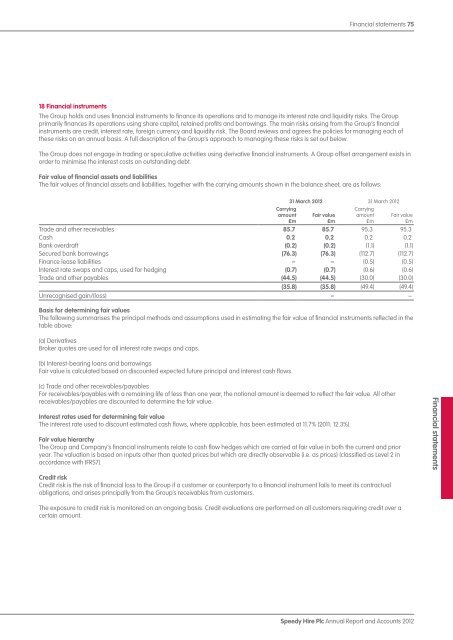

Fair value of financial assets <strong>and</strong> liabilities<br />

The fair values of financial assets <strong>and</strong> liabilities, together with the carrying amounts shown in the balance sheet, are as follows:<br />

Carrying<br />

amount<br />

£m<br />

31 March <strong>2012</strong> 31 March <strong>2012</strong><br />

Fair value<br />

£m<br />

Carrying<br />

amount<br />

£m<br />

Fair value<br />

£m<br />

Trade <strong>and</strong> other receivables 85.7 85.7 95.3 95.3<br />

Cash 0.2 0.2 0.2 0.2<br />

Bank overdraft (0.2) (0.2) (1.1) (1.1)<br />

Secured bank borrowings (76.3) (76.3) (112.7) (112.7)<br />

Finance lease liabilities – – (0.5) (0.5)<br />

Interest rate swaps <strong>and</strong> caps, used for hedging (0.7) (0.7) (0.6) (0.6)<br />

Trade <strong>and</strong> other payables (44.5) (44.5) (30.0) (30.0)<br />

(35.8) (35.8) (49.4) (49.4)<br />

Unrecognised gain/(loss) – –<br />

Basis for determining fair values<br />

The following summarises the principal methods <strong>and</strong> assumptions used in estimating the fair value of financial instruments reflected in the<br />

table above:<br />

(a) Derivatives<br />

Broker quotes are used for all interest rate swaps <strong>and</strong> caps.<br />

(b) Interest-bearing loans <strong>and</strong> borrowings<br />

Fair value is calculated based on discounted expected future principal <strong>and</strong> interest cash flows.<br />

(c) Trade <strong>and</strong> other receivables/payables<br />

For receivables/payables with a remaining life of less than one year, the notional amount is deemed to reflect the fair value. All other<br />

receivables/payables are discounted to determine the fair value.<br />

Interest rates used for determining fair value<br />

The interest rate used to discount estimated cash flows, where applicable, has been estimated at 11.7% (2011: 12.3%).<br />

Fair value hierarchy<br />

The Group <strong>and</strong> Company’s financial instruments relate to cash flow hedges which are carried at fair value in both the current <strong>and</strong> prior<br />

year. The valuation is based on inputs other than quoted prices but which are directly observable (i.e. as prices) (classified as Level 2 in<br />

accordance with IFRS7).<br />

Credit risk<br />

Credit risk is the risk of financial loss to the Group if a customer or counterparty to a financial instrument fails to meet its contractual<br />

obligations, <strong>and</strong> arises principally from the Group’s receivables from customers.<br />

The exposure to credit risk is monitored on an ongoing basis. Credit evaluations are performed on all customers requiring credit over a<br />

certain amount.<br />

<strong>Speedy</strong> <strong>Hire</strong> Plc <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong><br />

Financial statements