Annual Report and Accounts 2012 - Speedy Hire plc

Annual Report and Accounts 2012 - Speedy Hire plc

Annual Report and Accounts 2012 - Speedy Hire plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

82 Financial statements<br />

Notes to the financial statements<br />

continued<br />

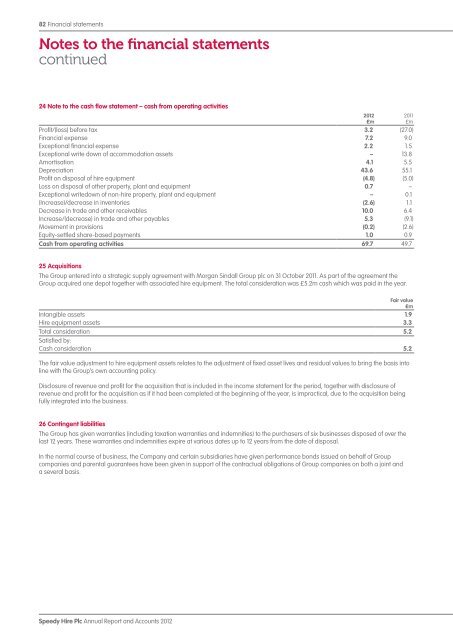

24 Note to the cash flow statement – cash from operating activities<br />

Profit/(loss) before tax 3.2 (27.0)<br />

Financial expense 7.2 9.0<br />

Exceptional financial expense 2.2 1.5<br />

Exceptional write down of accommodation assets – 13.8<br />

Amortisation 4.1 5.5<br />

Depreciation 43.6 55.1<br />

Profit on disposal of hire equipment (4.8) (5.0)<br />

Loss on disposal of other property, plant <strong>and</strong> equipment 0.7 –<br />

Exceptional writedown of non-hire property, plant <strong>and</strong> equipment – 0.1<br />

(Increase)/decrease in inventories (2.6) 1.1<br />

Decrease in trade <strong>and</strong> other receivables 10.0 6.4<br />

Increase/(decrease) in trade <strong>and</strong> other payables 5.3 (9.1)<br />

Movement in provisions (0.2) (2.6)<br />

Equity-settled share-based payments 1.0 0.9<br />

Cash from operating activities 69.7 49.7<br />

25 Acquisitions<br />

The Group entered into a strategic supply agreement with Morgan Sindall Group <strong>plc</strong> on 31 October 2011. As part of the agreement the<br />

Group acquired one depot together with associated hire equipment. The total consideration was £5.2m cash which was paid in the year.<br />

Fair value<br />

£m<br />

Intangible assets 1.9<br />

<strong>Hire</strong> equipment assets 3.3<br />

Total consideration 5.2<br />

Satisfied by:<br />

Cash consideration 5.2<br />

The fair value adjustment to hire equipment assets relates to the adjustment of fixed asset lives <strong>and</strong> residual values to bring the basis into<br />

line with the Group’s own accounting policy.<br />

Disclosure of revenue <strong>and</strong> profit for the acquisition that is included in the income statement for the period, together with disclosure of<br />

revenue <strong>and</strong> profit for the acquisition as if it had been completed at the beginning of the year, is impractical, due to the acquisition being<br />

fully integrated into the business.<br />

26 Contingent liabilities<br />

The Group has given warranties (including taxation warranties <strong>and</strong> indemnities) to the purchasers of six businesses disposed of over the<br />

last 12 years. These warranties <strong>and</strong> indemnities expire at various dates up to 12 years from the date of disposal.<br />

In the normal course of business, the Company <strong>and</strong> certain subsidiaries have given performance bonds issued on behalf of Group<br />

companies <strong>and</strong> parental guarantees have been given in support of the contractual obligations of Group companies on both a joint <strong>and</strong><br />

a several basis.<br />

<strong>Speedy</strong> <strong>Hire</strong> Plc <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong><br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m