Annual Report and Accounts 2012 - Speedy Hire plc

Annual Report and Accounts 2012 - Speedy Hire plc

Annual Report and Accounts 2012 - Speedy Hire plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

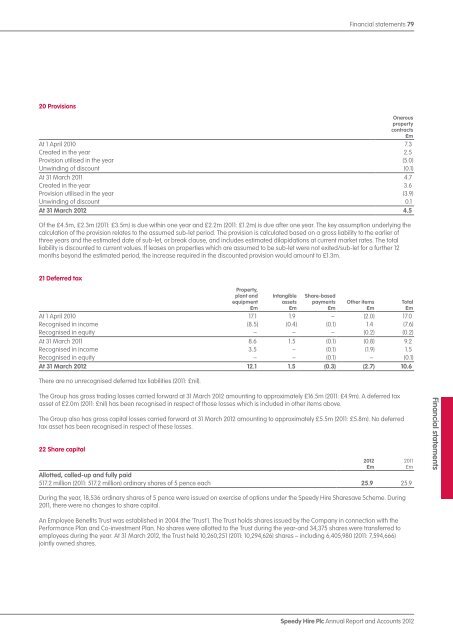

20 Provisions<br />

Financial statements 79<br />

Onerous<br />

property<br />

contracts<br />

£m<br />

At 1 April 2010 7.3<br />

Created in the year 2.5<br />

Provision utilised in the year (5.0)<br />

Unwinding of discount (0.1)<br />

At 31 March 2011 4.7<br />

Created in the year 3.6<br />

Provision utilised in the year (3.9)<br />

Unwinding of discount 0.1<br />

At 31 March <strong>2012</strong> 4.5<br />

Of the £4.5m, £2.3m (2011: £3.5m) is due within one year <strong>and</strong> £2.2m (2011: £1.2m) is due after one year. The key assumption underlying the<br />

calculation of the provision relates to the assumed sub-let period. The provision is calculated based on a gross liability to the earlier of<br />

three years <strong>and</strong> the estimated date of sub-let, or break clause, <strong>and</strong> includes estimated dilapidations at current market rates. The total<br />

liability is discounted to current values. If leases on properties which are assumed to be sub-let were not exited/sub-let for a further 12<br />

months beyond the estimated period, the increase required in the discounted provision would amount to £1.3m.<br />

21 Deferred tax<br />

Property,<br />

plant <strong>and</strong><br />

equipment<br />

£m<br />

Intangible<br />

assets<br />

£m<br />

Share-based<br />

payments<br />

£m<br />

Other items<br />

£m<br />

At 1 April 2010 17.1 1.9 – (2.0) 17.0<br />

Recognised in income (8.5) (0.4) (0.1) 1.4 (7.6)<br />

Recognised in equity – – – (0.2) (0.2)<br />

At 31 March 2011 8.6 1.5 (0.1) (0.8) 9.2<br />

Recognised in income 3.5 – (0.1) (1.9) 1.5<br />

Recognised in equity – – (0.1) – (0.1)<br />

At 31 March <strong>2012</strong> 12.1 1.5 (0.3) (2.7) 10.6<br />

There are no unrecognised deferred tax liabilities (2011: £nil).<br />

The Group has gross trading losses carried forward at 31 March <strong>2012</strong> amounting to approximately £16.5m (2011: £4.9m). A deferred tax<br />

asset of £2.0m (2011: £nil) has been recognised in respect of those losses which is included in other items above.<br />

The Group also has gross capital losses carried forward at 31 March <strong>2012</strong> amounting to approximately £5.5m (2011: £5.8m). No deferred<br />

tax asset has been recognised in respect of these losses.<br />

22 Share capital<br />

Allotted, called-up <strong>and</strong> fully paid<br />

517.2 million (2011: 517.2 million) ordinary shares of 5 pence each 25.9 25.9<br />

During the year, 18,536 ordinary shares of 5 pence were issued on exercise of options under the <strong>Speedy</strong> <strong>Hire</strong> Sharesave Scheme. During<br />

2011, there were no changes to share capital.<br />

An Employee Benefits Trust was established in 2004 (the ‘Trust’). The Trust holds shares issued by the Company in connection with the<br />

Performance Plan <strong>and</strong> Co-investment Plan. No shares were allotted to the Trust during the year-<strong>and</strong> 34,375 shares were transferred to<br />

employees during the year. At 31 March <strong>2012</strong>, the Trust held 10,260,251 (2011: 10,294,626) shares – including 6,405,980 (2011: 7,594,666)<br />

jointly owned shares.<br />

<strong>2012</strong><br />

£m<br />

Total<br />

£m<br />

2011<br />

£m<br />

<strong>Speedy</strong> <strong>Hire</strong> Plc <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong><br />

Financial statements