Annual Report and Accounts 2012 - Speedy Hire plc

Annual Report and Accounts 2012 - Speedy Hire plc

Annual Report and Accounts 2012 - Speedy Hire plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

66 Financial statements<br />

Notes to the financial statements<br />

continued<br />

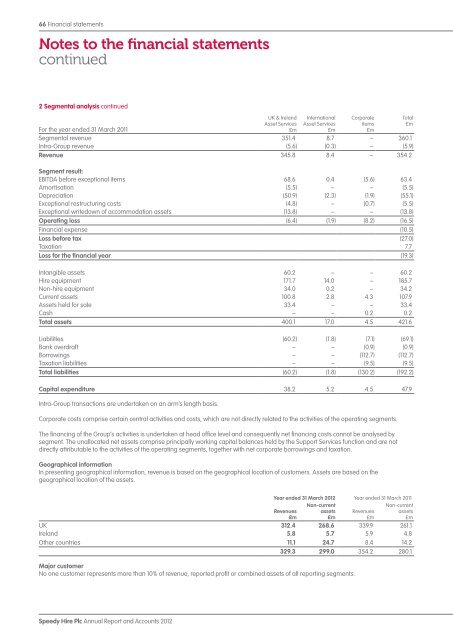

2 Segmental analysis continued<br />

For the year ended 31 March 2011<br />

<strong>Speedy</strong> <strong>Hire</strong> Plc <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong><br />

UK & Irel<strong>and</strong><br />

Asset Services<br />

£m<br />

International<br />

Asset Services<br />

£m<br />

Corporate<br />

items<br />

£m<br />

Segmental revenue 351.4 8.7 – 360.1<br />

Intra-Group revenue (5.6) (0.3) – (5.9)<br />

Revenue 345.8 8.4 – 354.2<br />

Segment result:<br />

EBITDA before exceptional items 68.6 0.4 (5.6) 63.4<br />

Amortisation (5.5) – – (5.5)<br />

Depreciation (50.9) (2.3) (1.9) (55.1)<br />

Exceptional restructuring costs (4.8) – (0.7) (5.5)<br />

Exceptional writedown of accommodation assets (13.8) – – (13.8)<br />

Operating loss (6.4) (1.9) (8.2) (16.5)<br />

Financial expense (10.5)<br />

Loss before tax (27.0)<br />

Taxation 7.7<br />

Loss for the financial year (19.3)<br />

Intangible assets 60.2 – – 60.2<br />

<strong>Hire</strong> equipment 171.7 14.0 – 185.7<br />

Non-hire equipment 34.0 0.2 – 34.2<br />

Current assets 100.8 2.8 4.3 107.9<br />

Assets held for sale 33.4 – – 33.4<br />

Cash – – 0.2 0.2<br />

Total assets 400.1 17.0 4.5 421.6<br />

Liabilities (60.2) (1.8) (7.1) (69.1)<br />

Bank overdraft – – (0.9) (0.9)<br />

Borrowings – – (112.7) (112.7)<br />

Taxation liabilities – – (9.5) (9.5)<br />

Total liabilities (60.2) (1.8) (130.2) (192.2)<br />

Capital expenditure 38.2 5.2 4.5 47.9<br />

Intra-Group transactions are undertaken on an arm’s length basis.<br />

Corporate costs comprise certain central activities <strong>and</strong> costs, which are not directly related to the activities of the operating segments.<br />

The financing of the Group’s activities is undertaken at head office level <strong>and</strong> consequently net financing costs cannot be analysed by<br />

segment. The unallocated net assets comprise principally working capital balances held by the Support Services function <strong>and</strong> are not<br />

directly attributable to the activities of the operating segments, together with net corporate borrowings <strong>and</strong> taxation.<br />

Geographical information<br />

In presenting geographical information, revenue is based on the geographical location of customers. Assets are based on the<br />

geographical location of the assets.<br />

Total<br />

£m<br />

Year ended 31 March <strong>2012</strong> Year ended 31 March 2011<br />

Revenues<br />

£m<br />

Non-current<br />

assets<br />

£m<br />

Revenues<br />

£m<br />

Non-current<br />

assets<br />

£m<br />

UK 312.4 268.6 339.9 261.1<br />

Irel<strong>and</strong> 5.8 5.7 5.9 4.8<br />

Other countries 11.1 24.7 8.4 14.2<br />

329.3 299.0 354.2 280.1<br />

Major customer<br />

No one customer represents more than 10% of revenue, reported profit or combined assets of all reporting segments.