Annual Report and Accounts 2012 - Speedy Hire plc

Annual Report and Accounts 2012 - Speedy Hire plc

Annual Report and Accounts 2012 - Speedy Hire plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

88 Financial statements<br />

Notes to the Company financial statements<br />

continued<br />

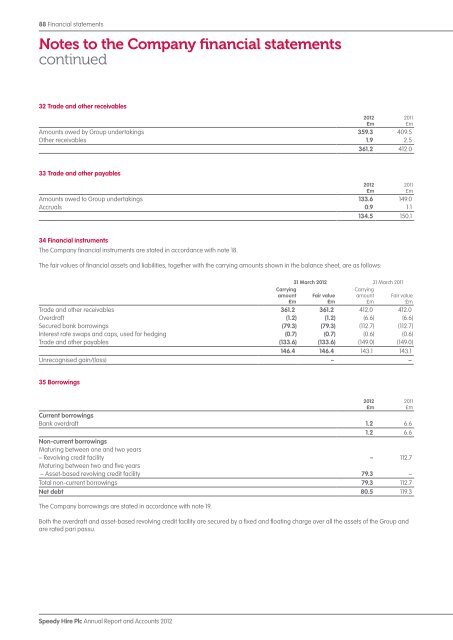

32 Trade <strong>and</strong> other receivables<br />

Amounts owed by Group undertakings 359.3 409.5<br />

Other receivables 1.9 2.5<br />

361.2 412.0<br />

33 Trade <strong>and</strong> other payables<br />

Amounts owed to Group undertakings 133.6 149.0<br />

Accruals 0.9 1.1<br />

134.5 150.1<br />

34 Financial instruments<br />

The Company financial instruments are stated in accordance with note 18.<br />

The fair values of financial assets <strong>and</strong> liabilities, together with the carrying amounts shown in the balance sheet, are as follows:<br />

<strong>Speedy</strong> <strong>Hire</strong> Plc <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong><br />

Carrying<br />

amount<br />

£m<br />

<strong>2012</strong><br />

£m<br />

<strong>2012</strong><br />

£m<br />

31 March <strong>2012</strong> 31 March 2011<br />

Fair value<br />

£m<br />

Carrying<br />

amount<br />

£m<br />

2011<br />

£m<br />

2011<br />

£m<br />

Fair value<br />

£m<br />

Trade <strong>and</strong> other receivables 361.2 361.2 412.0 412.0<br />

Overdraft (1.2) (1.2) (6.6) (6.6)<br />

Secured bank borrowings (79.3) (79.3) (112.7) (112.7)<br />

Interest rate swaps <strong>and</strong> caps, used for hedging (0.7) (0.7) (0.6) (0.6)<br />

Trade <strong>and</strong> other payables (133.6) (133.6) (149.0) (149.0)<br />

146.4 146.4 143.1 143.1<br />

Unrecognised gain/(loss) – –<br />

35 Borrowings<br />

Current borrowings<br />

Bank overdraft 1.2 6.6<br />

1.2 6.6<br />

Non-current borrowings<br />

Maturing between one <strong>and</strong> two years<br />

– Revolving credit facility – 112.7<br />

Maturing between two <strong>and</strong> five years<br />

– Asset-based revolving credit facility 79.3 –<br />

Total non-current borrowings 79.3 112.7<br />

Net debt 80.5 119.3<br />

The Company borrowings are stated in accordance with note 19.<br />

Both the overdraft <strong>and</strong> asset-based revolving credit facility are secured by a fixed <strong>and</strong> floating charge over all the assets of the Group <strong>and</strong><br />

are rated pari passu.<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m