Annual Report and Accounts 2012 - Speedy Hire plc

Annual Report and Accounts 2012 - Speedy Hire plc

Annual Report and Accounts 2012 - Speedy Hire plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

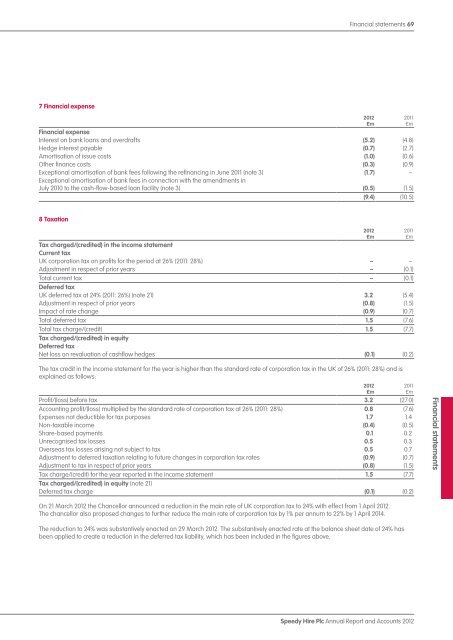

7 Financial expense<br />

Financial statements 69<br />

Financial expense<br />

Interest on bank loans <strong>and</strong> overdrafts (5.2) (4.8)<br />

Hedge interest payable (0.7) (2.7)<br />

Amortisation of issue costs (1.0) (0.6)<br />

Other finance costs (0.3) (0.9)<br />

Exceptional amortisation of bank fees following the refinancing in June 2011 (note 3) (1.7) –<br />

Exceptional amortisation of bank fees in connection with the amendments in<br />

July 2010 to the cash-flow-based loan facility (note 3) (0.5) (1.5)<br />

(9.4) (10.5)<br />

8 Taxation<br />

Tax charged/(credited) in the income statement<br />

Current tax<br />

UK corporation tax on profits for the period at 26% (2011: 28%) – –<br />

Adjustment in respect of prior years – (0.1)<br />

Total current tax – (0.1)<br />

Deferred tax<br />

UK deferred tax at 24% (2011: 26%) (note 21) 3.2 (5.4)<br />

Adjustment in respect of prior years (0.8) (1.5)<br />

Impact of rate change (0.9) (0.7)<br />

Total deferred tax 1.5 (7.6)<br />

Total tax charge/(credit) 1.5 (7.7)<br />

Tax charged/(credited) in equity<br />

Deferred tax<br />

Net loss on revaluation of cashflow hedges (0.1) (0.2)<br />

The tax credit in the income statement for the year is higher than the st<strong>and</strong>ard rate of corporation tax in the UK of 26% (2011: 28%) <strong>and</strong> is<br />

explained as follows:<br />

Profit/(loss) before tax 3.2 (27.0)<br />

Accounting profit/(loss) multiplied by the st<strong>and</strong>ard rate of corporation tax at 26% (2011: 28%) 0.8 (7.6)<br />

Expenses not deductible for tax purposes 1.7 1.4<br />

Non-taxable income (0.4) (0.5)<br />

Share-based payments 0.1 0.2<br />

Unrecognised tax losses 0.5 0.3<br />

Overseas tax losses arising not subject to tax 0.5 0.7<br />

Adjustment to deferred taxation relating to future changes in corporation tax rates (0.9) (0.7)<br />

Adjustment to tax in respect of prior years (0.8) (1.5)<br />

Tax charge/(credit) for the year reported in the income statement 1.5 (7.7)<br />

Tax charged/(credited) in equity (note 21)<br />

Deferred tax charge (0.1) (0.2)<br />

On 21 March <strong>2012</strong> the Chancellor announced a reduction in the main rate of UK corporation tax to 24% with effect from 1 April <strong>2012</strong>.<br />

The chancellor also proposed changes to further reduce the main rate of corporation tax by 1% per annum to 22% by 1 April 2014.<br />

The reduction to 24% was substantively enacted on 29 March <strong>2012</strong>. The substantively enacted rate at the balance sheet date of 24% has<br />

been applied to create a reduction in the deferred tax liability, which has been included in the figures above.<br />

<strong>2012</strong><br />

£m<br />

<strong>2012</strong><br />

£m<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

2011<br />

£m<br />

2011<br />

£m<br />

<strong>Speedy</strong> <strong>Hire</strong> Plc <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong><br />

Financial statements