TRENDS AND IMPACTS OF FOREIGN INVESTMENT IN DEVELOPING COUNTRY AGRICULTURE

TRENDS AND IMPACTS OF FOREIGN INVESTMENT IN DEVELOPING COUNTRY AGRICULTURE

TRENDS AND IMPACTS OF FOREIGN INVESTMENT IN DEVELOPING COUNTRY AGRICULTURE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

percent of GDP in 2001considerably 2009 and,<br />

at the same time, increased from 7.03 percent to<br />

35.98 percent of Gross Fixed Capital Formation<br />

(See Table 8). Interestingly, FDI increased up to<br />

50.97 percent in 1996-2000. This helps explain<br />

the possible effects of the Asian financial crisis<br />

in 1997 on FDI inflow data. It was reported that<br />

parent companies (MNEs) injected capital into<br />

their subsidiaries in Thailand coping with Thai<br />

Baht devaluation and serious liquidity problems<br />

(www.bot.or.th).<br />

In the 1990s, countries that contributed<br />

greatly to Thailand’s economy via FDI, apart<br />

from the United States and the European<br />

Union, were Japan (one of the most advanced<br />

internationalizing economies in the region) and<br />

Asia’s newly industrialized countries (NICs) like<br />

Singapore, Hong Kong, Republic of Korea and<br />

Taiwan Province of China. This was caused by<br />

the appreciation of their currencies after the<br />

1985 Plaza Accord. In addition, their MNEs had<br />

located their value-adding activities in developing<br />

countries like Thailand where costs of operations<br />

and resources had been low since the late 1970s.<br />

Most Asian countries’ international investment<br />

was made in countries less developed than their<br />

own, typically with lower wage rates and less<br />

sophisticated development (Lecraw 1992). After<br />

the Asian financial crisis in 1997, there were the<br />

recent surges in FDI inflows as shown by figures<br />

for the 2000s. For instance, Japan’s FDI reached<br />

US$4 303.07 million (more than seven times the<br />

value in the 1990s), while Singapore’s FDI was<br />

US$3 896.95 million (more than four times that<br />

of the 1990s). Such influxes of FDI into Thailand<br />

were reactions of these countries’ MNEs to take<br />

advantage of economic opportunities in making<br />

investments at cheaper costs (i.e. buying up<br />

local firms in difficulty). Nevertheless, some were<br />

forced by the situation to inject more money into<br />

their own subsidiaries in difficult times.<br />

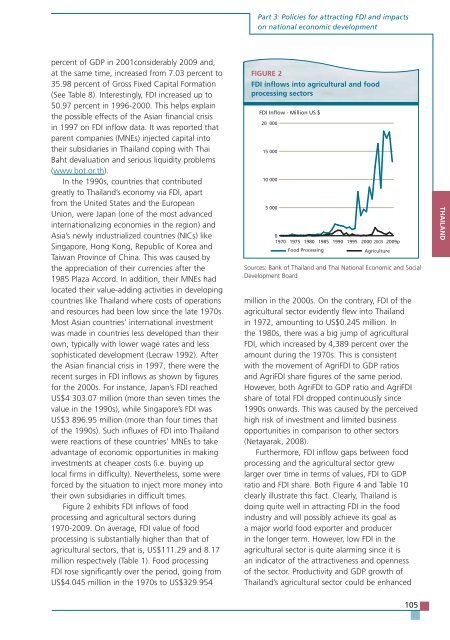

Figure 2 exhibits FDI inflows of food<br />

processing and agricultural sectors during<br />

1970-2009. On average, FDI value of food<br />

processing is substantially higher than that of<br />

agricultural sectors, that is, US$111.29 and 8.17<br />

million respectively (Table 1). Food processing<br />

FDI rose significantly over the period, going from<br />

US$4.045 million in the 1970s to US$329.954<br />

Part 3: Policies for attracting FDI and impacts<br />

on national economic development<br />

FIGURE 2<br />

FDI inflows into agricultural and food<br />

processing sectors<br />

FDI Inflow - Million US $<br />

20 000<br />

15 000<br />

10 000<br />

5 000<br />

0<br />

1970<br />

1975 1980 1985 1990 1995 2000 2005<br />

Food Processing Agriculture<br />

2009p<br />

Sources: Bank of Thailand and Thai National Economic and Social<br />

Development Board<br />

million in the 2000s. On the contrary, FDI of the<br />

agricultural sector evidently flew into Thailand<br />

in 1972, amounting to US$0.245 million. In<br />

the 1980s, there was a big jump of agricultural<br />

FDI, which increased by 4,389 percent over the<br />

amount during the 1970s. This is consistent<br />

with the movement of AgriFDI to GDP ratios<br />

and AgriFDI share figures of the same period.<br />

However, both AgriFDI to GDP ratio and AgriFDI<br />

share of total FDI dropped continuously since<br />

1990s onwards. This was caused by the perceived<br />

high risk of investment and limited business<br />

opportunities in comparison to other sectors<br />

(Netayarak, 2008).<br />

Furthermore, FDI inflow gaps between food<br />

processing and the agricultural sector grew<br />

larger over time in terms of values, FDI to GDP<br />

ratio and FDI share. Both Figure 4 and Table 10<br />

clearly illustrate this fact. Clearly, Thailand is<br />

doing quite well in attracting FDI in the food<br />

industry and will possibly achieve its goal as<br />

a major world food exporter and producer<br />

in the longer term. However, low FDI in the<br />

agricultural sector is quite alarming since it is<br />

an indicator of the attractiveness and openness<br />

of the sector. Productivity and GDP growth of<br />

Thailand’s agricultural sector could be enhanced<br />

105<br />

THAIL<strong>AND</strong>