- Page 1 and 2:

TRENDS AND IMPACTS OF FOREIGN INVES

- Page 3:

Trends and impacts of foreign inves

- Page 6 and 7:

Acronyms ABRAF Brazilian Associatio

- Page 8 and 9:

EAC East African Community EC Execu

- Page 10 and 11:

JV Joint Venture Kascol Kaleya Smal

- Page 12 and 13:

PTF Privatization Trust Fund PTS Pe

- Page 15:

Foreword Large-scale international

- Page 18 and 19:

xvi Page 4. The business climate fo

- Page 20 and 21:

xviii Page 4. Investments by transn

- Page 22 and 23:

xx Page 7. Conclusions and recommen

- Page 24 and 25:

xxii Page SENEGAL: ASSESSING THE NA

- Page 26 and 27:

xxiv Page PART 5: SYNTHESIS OF FIND

- Page 28 and 29:

TANZANIA: ANALYSIS OF PRIVATE INVES

- Page 30 and 31:

ZAMBIA: INVESTMENT IN AGRICULTURAL

- Page 32 and 33:

xxx Page Table 4 Foreign investment

- Page 34 and 35:

xxxii Page Table 5 Additional tax b

- Page 36 and 37:

PART 4: BUSINESS MODELS FOR AGRICUL

- Page 39:

P A R T O N E INTRODUCTION

- Page 42 and 43:

Trends and impacts of foreign inves

- Page 44 and 45:

Trends and impacts of foreign inves

- Page 46 and 47:

Trends and impacts of foreign inves

- Page 48 and 49:

Trends and impacts of foreign inves

- Page 50 and 51:

Trends and impacts of foreign inves

- Page 53 and 54:

1. Introduction 1 Foreign Direct

- Page 55 and 56:

FIGURE 2 Trends in FDI-African case

- Page 57 and 58:

FIGURE 6 Average annual growth in c

- Page 59 and 60:

FIGURE 9 Share of agriculture in to

- Page 61 and 62:

FIGURE 12 FDI flows to agriculture

- Page 63:

FIGURE 18 Agricultural Investment i

- Page 67 and 68:

Improving the business climate for

- Page 69 and 70:

BOX 1 A brief history of FDI in Bra

- Page 71 and 72:

BOX 2 TNCs and the Brazilian agrifo

- Page 73 and 74:

BOX 3 Monsanto Company Part 3: Poli

- Page 75 and 76:

BOX 5 International Paper Company P

- Page 77 and 78:

the same time, conserving natural r

- Page 79 and 80:

CHART 2 Factors that contributed to

- Page 81 and 82:

TABLE 3 Performance of Brazil for s

- Page 83 and 84:

BOX 6 Checklist for Foreign Direct

- Page 85 and 86:

factors that affect, lead to succes

- Page 87 and 88:

CHART 4 PROMECIF phases cycle Phase

- Page 89 and 90:

the priority indicators within thes

- Page 91 and 92:

73 rd in a total of 182 countries e

- Page 93 and 94:

Sutainable Development: Lessons fro

- Page 95:

World Bank. 2009. Awakening Africa

- Page 98 and 99:

TANZANIA Trends and impacts of fore

- Page 100 and 101:

TANZANIA Trends and impacts of fore

- Page 102 and 103:

TANZANIA Trends and impacts of fore

- Page 104 and 105:

TANZANIA Trends and impacts of fore

- Page 106 and 107:

TANZANIA Trends and impacts of fore

- Page 108 and 109:

TANZANIA Trends and impacts of fore

- Page 110 and 111:

TANZANIA Trends and impacts of fore

- Page 112 and 113:

TANZANIA Trends and impacts of fore

- Page 114 and 115:

TANZANIA Trends and impacts of fore

- Page 116 and 117:

TANZANIA Trends and impacts of fore

- Page 118 and 119:

TANZANIA Trends and impacts of fore

- Page 120 and 121:

TANZANIA Trends and impacts of fore

- Page 122 and 123:

TANZANIA Trends and impacts of fore

- Page 124 and 125:

TANZANIA Trends and impacts of fore

- Page 126 and 127: TANZANIA Trends and impacts of fore

- Page 129 and 130: : Foreign investment and agricultur

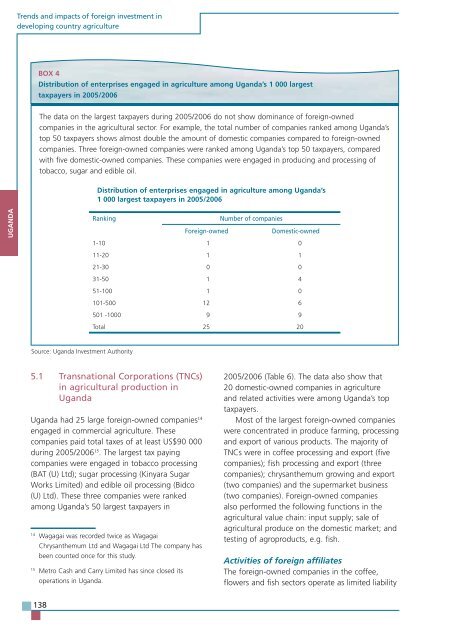

- Page 131 and 132: the two data sources are compiled o

- Page 133 and 134: survey (accounting to approximately

- Page 135 and 136: Students are entitled to tuition fe

- Page 137 and 138: Free Trade Agreement (TAFTA), was s

- Page 139 and 140: Germany, Switzerland, United Kingdo

- Page 141 and 142: FIGURE 1 Investment promotion polic

- Page 143 and 144: percent of GDP in 2001considerably

- Page 145 and 146: Philippines indicate their signific

- Page 147 and 148: TABLE 4 Foreign investment approved

- Page 149 and 150: TABLE 6 Export-oriented FDI in the

- Page 151 and 152: followed by fisheries, livestock an

- Page 153 and 154: FDI and employment The impact of FD

- Page 155 and 156: TABLE 12 Employment generated by fo

- Page 157 and 158: BOI investment promotion policy are

- Page 159 and 160: National Food Institute of Thailand

- Page 161 and 162: : Analysis of private investment in

- Page 163 and 164: FIGURE 3 Value of planned foreign i

- Page 165 and 166: TABLE 1 Investment incentives, Ugan

- Page 167 and 168: TABLE 3 Summary of enterprises in c

- Page 169 and 170: Over 95 percent of the total annual

- Page 171 and 172: CHART 1 Uganda coffee value chain C

- Page 173 and 174: CHART 2 Value chain of chrysanthemu

- Page 175: CHART 3 Value chain for fish proces

- Page 179 and 180: (a) the decreasing fish stocks and

- Page 181 and 182: TABLE 5 Sources of investment finan

- Page 183 and 184: Part 3: Policies for attracting FDI

- Page 185 and 186: TABLE 6 Market destinations for sel

- Page 187 and 188: BOX 9 Community services provided b

- Page 189 and 190: BOX 10 Examples of environmental im

- Page 191 and 192: contributed to opening internationa

- Page 193: Websites 1. faostat.fao.org 2. htt

- Page 197 and 198: Local impacts of selected foreign a

- Page 199 and 200: linkages; unsecured land ownership;

- Page 201 and 202: hectare and 1.5 tonnes per hectare,

- Page 203 and 204: 3.2 FDI in agriculture by nationali

- Page 205 and 206: form of pure Korean ownership or pa

- Page 207 and 208: of the discrepancies between CDC da

- Page 209 and 210: TABLE 7 Distribution of ELCs by nat

- Page 211 and 212: the country’s economy. It is ther

- Page 213 and 214: on forest use 13 . Across the count

- Page 215 and 216: The National Strategic Development

- Page 217 and 218: team in December 2010 in the Kompon

- Page 219 and 220: order to transport materials and wo

- Page 221 and 222: other agricultural purposes, but la

- Page 223 and 224: stream (one that is 20-30 m wide) a

- Page 225 and 226: MAFF, prohibited the import of live

- Page 227 and 228:

7.5 NGOs/Civil society Local NGOs

- Page 229 and 230:

: business models in Ghanaian agri

- Page 231 and 232:

TABLE 3 FDI agricultural projects a

- Page 233 and 234:

Part 4: Business models for agricul

- Page 235 and 236:

level of foreign ownership for each

- Page 237 and 238:

land disputes, slowing and complica

- Page 239 and 240:

TABLE 6 Ease of doing business in G

- Page 241 and 242:

TABLE 8 Selected indicators of the

- Page 243 and 244:

estate and out-grower scheme for th

- Page 245 and 246:

vice-chairman, secretary, assistant

- Page 247 and 248:

are exported, 40 percent are sold t

- Page 249 and 250:

strong advocate of bush fire preven

- Page 251 and 252:

chiefs, irrespective of whose land

- Page 253 and 254:

The Assemblyman of Jimle, a locally

- Page 255 and 256:

TABLE 12 Key features of the Solar

- Page 257 and 258:

given the lengthy time frame involv

- Page 259 and 260:

ESD (Environmentally Sustainable De

- Page 261 and 262:

Large-scale agricultural investment

- Page 263 and 264:

Touré, 2009). So, agricultural mod

- Page 265 and 266:

the lineage holdings to one family

- Page 267 and 268:

BOX 2 Content of agricultural inves

- Page 269 and 270:

of largescale land acquisitions. 6

- Page 271 and 272:

percent); and students, undoubtedly

- Page 273 and 274:

BOX 4 The conclusions of the feasib

- Page 275 and 276:

Malians. Significant players includ

- Page 277 and 278:

out in the absence of strategic pla

- Page 279 and 280:

ESIAs. The mass influx of foreign i

- Page 281 and 282:

objectives, but the contract makes

- Page 283 and 284:

in the sugar sector. The aim was to

- Page 285 and 286:

stresses the government’s respons

- Page 287 and 288:

covering 857 hectares of land, plus

- Page 289 and 290:

Final remarks about project design

- Page 291 and 292:

As a result, activities to implemen

- Page 293 and 294:

and rural electrification (Agence M

- Page 295 and 296:

shareholders began to ask questions

- Page 297 and 298:

so far. The revenues received from

- Page 299 and 300:

were allocated to investment projec

- Page 301:

family farmers to have access to le

- Page 304 and 305:

SENEGAL Trends and impacts of forei

- Page 306 and 307:

SENEGAL Trends and impacts of forei

- Page 308 and 309:

SENEGAL Trends and impacts of forei

- Page 310 and 311:

SENEGAL Trends and impacts of forei

- Page 312 and 313:

SENEGAL Trends and impacts of forei

- Page 314 and 315:

SENEGAL Trends and impacts of forei

- Page 316 and 317:

SENEGAL Trends and impacts of forei

- Page 318 and 319:

SENEGAL Trends and impacts of forei

- Page 320 and 321:

SENEGAL Trends and impacts of forei

- Page 322 and 323:

SENEGAL Trends and impacts of forei

- Page 324 and 325:

SENEGAL Trends and impacts of forei

- Page 326 and 327:

SENEGAL Trends and impacts of forei

- Page 328 and 329:

ZAMBIA Trends and impacts of foreig

- Page 330 and 331:

ZAMBIA Trends and impacts of foreig

- Page 332 and 333:

ZAMBIA Trends and impacts of foreig

- Page 334 and 335:

ZAMBIA Trends and impacts of foreig

- Page 336 and 337:

ZAMBIA Trends and impacts of foreig

- Page 338 and 339:

ZAMBIA Trends and impacts of foreig

- Page 340 and 341:

ZAMBIA Trends and impacts of foreig

- Page 342 and 343:

ZAMBIA Trends and impacts of foreig

- Page 344 and 345:

ZAMBIA Trends and impacts of foreig

- Page 346 and 347:

ZAMBIA Trends and impacts of foreig

- Page 348 and 349:

ZAMBIA Trends and impacts of foreig

- Page 350 and 351:

ZAMBIA Trends and impacts of foreig

- Page 352 and 353:

ZAMBIA Trends and impacts of foreig

- Page 354 and 355:

ZAMBIA Trends and impacts of foreig

- Page 356 and 357:

ZAMBIA Trends and impacts of foreig

- Page 358 and 359:

ZAMBIA Trends and impacts of foreig

- Page 361 and 362:

The findings of the studies present

- Page 363 and 364:

3. The significance of business mod

- Page 365 and 366:

were introduced to enhance producti

- Page 367 and 368:

The presence of enabling factors is

- Page 369:

5.8 Type of production system and c

- Page 373 and 374:

The available data confirm that the

- Page 375 and 376:

the project. This situation increas

- Page 377 and 378:

debates on resource-seeking foreign

- Page 379 and 380:

programmes for government officials

- Page 382:

EDITED BY: Pascal Liu Suffyan Korom