TRENDS AND IMPACTS OF FOREIGN INVESTMENT IN DEVELOPING COUNTRY AGRICULTURE

TRENDS AND IMPACTS OF FOREIGN INVESTMENT IN DEVELOPING COUNTRY AGRICULTURE

TRENDS AND IMPACTS OF FOREIGN INVESTMENT IN DEVELOPING COUNTRY AGRICULTURE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

agribusiness restructuring obtained in Senegal<br />

relative to Ghana suggests that there exists a<br />

higher propensity for foreign investors to trust a<br />

business partner in Ghana than in Senegal. There<br />

is a need to promote good corporate governance<br />

practices in the industry in order to create a more<br />

trust-building environment in Senegal.<br />

Increased risks of seeing Senegal small<br />

farmers lose available fertile land areas<br />

Like Senegal’s other identified, diminishing natural<br />

resources such as forests and fisheries, arable land<br />

too is becoming a scarce productive input as a<br />

result of a growing land demand pressure. With<br />

3.3 person per hectare, Senegal appears as one<br />

the most land-scarce countries relative to possible<br />

FDI competing destinations such as Côte d’Ivoire<br />

(1.1 person/hectare), Ghana (1.9 person/hectare)<br />

and Nigeria (1.2 person per hectare).<br />

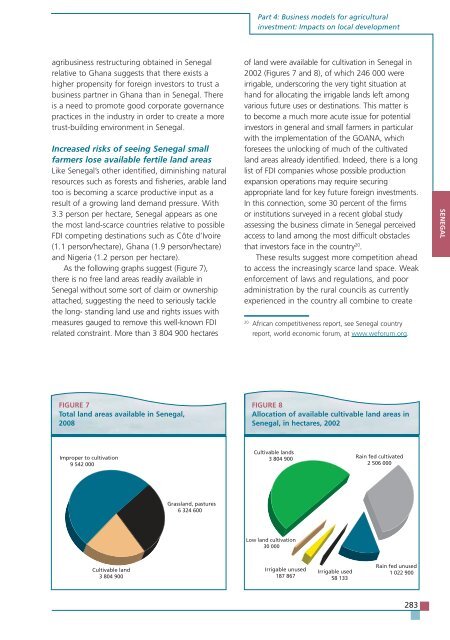

As the following graphs suggest (Figure 7),<br />

there is no free land areas readily available in<br />

Senegal without some sort of claim or ownership<br />

attached, suggesting the need to seriously tackle<br />

the long- standing land use and rights issues with<br />

measures gauged to remove this well-known FDI<br />

related constraint. More than 3 804 900 hectares<br />

FIGURE 7<br />

Total land areas available in Senegal,<br />

2008<br />

Improper to cultivation<br />

9 542 000<br />

Cultivable land<br />

3 804 900<br />

Grassland, pastures<br />

6 324 600<br />

Part 4: Business models for agricultural<br />

investment: Impacts on local development<br />

of land were available for cultivation in Senegal in<br />

2002 (Figures 7 and 8), of which 246 000 were<br />

irrigable, underscoring the very tight situation at<br />

hand for allocating the irrigable lands left among<br />

various future uses or destinations. This matter is<br />

to become a much more acute issue for potential<br />

investors in general and small farmers in particular<br />

with the implementation of the GOANA, which<br />

foresees the unlocking of much of the cultivated<br />

land areas already identified. Indeed, there is a long<br />

list of FDI companies whose possible production<br />

expansion operations may require securing<br />

appropriate land for key future foreign investments.<br />

In this connection, some 30 percent of the firms<br />

or institutions surveyed in a recent global study<br />

assessing the business climate in Senegal perceived<br />

access to land among the most difficult obstacles<br />

that investors face in the country 20 .<br />

These results suggest more competition ahead<br />

to access the increasingly scarce land space. Weak<br />

enforcement of laws and regulations, and poor<br />

administration by the rural councils as currently<br />

experienced in the country all combine to create<br />

20 African competitiveness report, see Senegal country<br />

report, world economic forum, at www.weforum.org.<br />

FIGURE 8<br />

Allocation of available cultivable land areas in<br />

Senegal, in hectares, 2002<br />

Cultivable lands<br />

3 804 900<br />

Low land cultivation<br />

30 000<br />

Irrigable unused<br />

187 867<br />

Irrigable used<br />

58 133<br />

Rain fed cultivated<br />

2 506 000<br />

Rain fed unused<br />

1 022 900<br />

283<br />

SENEGAL