TRENDS AND IMPACTS OF FOREIGN INVESTMENT IN DEVELOPING COUNTRY AGRICULTURE

TRENDS AND IMPACTS OF FOREIGN INVESTMENT IN DEVELOPING COUNTRY AGRICULTURE

TRENDS AND IMPACTS OF FOREIGN INVESTMENT IN DEVELOPING COUNTRY AGRICULTURE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

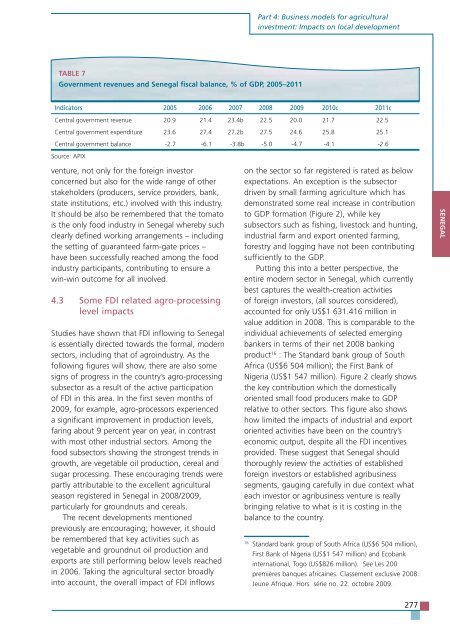

TABLE 7<br />

Government revenues and Senegal fiscal balance, % of GDP, 2005–2011<br />

venture, not only for the foreign investor<br />

concerned but also for the wide range of other<br />

stakeholders (producers, service providers, bank,<br />

state institutions, etc.) involved with this industry.<br />

It should be also be remembered that the tomato<br />

is the only food industry in Senegal whereby such<br />

clearly defined working arrangements – including<br />

the setting of guaranteed farm-gate prices –<br />

have been successfully reached among the food<br />

industry participants, contributing to ensure a<br />

win-win outcome for all involved.<br />

4.3 Some FDI related agro-processing<br />

level impacts<br />

Studies have shown that FDI inflowing to Senegal<br />

is essentially directed towards the formal, modern<br />

sectors, including that of agroindustry. As the<br />

following figures will show, there are also some<br />

signs of progress in the country’s agro-processing<br />

subsector as a result of the active participation<br />

of FDI in this area. In the first seven months of<br />

2009, for example, agro-processors experienced<br />

a significant improvement in production levels,<br />

faring about 9 percent year on year, in contrast<br />

with most other industrial sectors. Among the<br />

food subsectors showing the strongest trends in<br />

growth, are vegetable oil production, cereal and<br />

sugar processing. These encouraging trends were<br />

partly attributable to the excellent agricultural<br />

season registered in Senegal in 2008/2009,<br />

particularly for groundnuts and cereals.<br />

The recent developments mentioned<br />

previously are encouraging; however, it should<br />

be remembered that key activities such as<br />

vegetable and groundnut oil production and<br />

exports are still performing below levels reached<br />

in 2006. Taking the agricultural sector broadly<br />

into account, the overall impact of FDI inflows<br />

Part 4: Business models for agricultural<br />

investment: Impacts on local development<br />

Indicators 2005 2006 2007 2008 2009 2010c 2011c<br />

Central government revenue 20.9 21.4 23.4b 22.5 20.0 21.7 22.5<br />

Central government expenditure 23.6 27.4 27.2b 27.5 24.6 25.8 25.1<br />

Central government balance<br />

Source: APIX<br />

-2.7 -6.1 -3.8b -5.0 -4.7 -4.1 -2.6<br />

on the sector so far registered is rated as below<br />

expectations. An exception is the subsector<br />

driven by small farming agriculture which has<br />

demonstrated some real increase in contribution<br />

to GDP formation (Figure 2), while key<br />

subsectors such as fishing, livestock and hunting,<br />

industrial farm and export oriented farming,<br />

forestry and logging have not been contributing<br />

sufficiently to the GDP.<br />

Putting this into a better perspective, the<br />

entire modern sector in Senegal, which currently<br />

best captures the wealth-creation activities<br />

of foreign investors, (all sources considered),<br />

accounted for only US$1 631.416 million in<br />

value addition in 2008. This is comparable to the<br />

individual achievements of selected emerging<br />

bankers in terms of their net 2008 banking<br />

product 16 : The Standard bank group of South<br />

Africa (US$6 504 million); the First Bank of<br />

Nigeria (US$1 547 million). Figure 2 clearly shows<br />

the key contribution which the domestically<br />

oriented small food producers make to GDP<br />

relative to other sectors. This figure also shows<br />

how limited the impacts of industrial and export<br />

oriented activities have been on the country’s<br />

economic output, despite all the FDI incentives<br />

provided. These suggest that Senegal should<br />

thoroughly review the activities of established<br />

foreign investors or established agribusiness<br />

segments, gauging carefully in due context what<br />

each investor or agribusiness venture is really<br />

bringing relative to what is it is costing in the<br />

balance to the country.<br />

16 Standard bank group of South Africa (US$6 504 million),<br />

First Bank of Nigeria (US$1 547 million) and Ecobank<br />

international, Togo (US$826 million). See Les 200<br />

premières banques africaines. Classement exclusive 2008.<br />

Jeune Afrique. Hors série no. 22. octobre 2009.<br />

277<br />

SENEGAL