TRENDS AND IMPACTS OF FOREIGN INVESTMENT IN DEVELOPING COUNTRY AGRICULTURE

TRENDS AND IMPACTS OF FOREIGN INVESTMENT IN DEVELOPING COUNTRY AGRICULTURE

TRENDS AND IMPACTS OF FOREIGN INVESTMENT IN DEVELOPING COUNTRY AGRICULTURE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Fund (PTF) for subsequent public floatation.<br />

This did not happen and by 2005, the CDC had<br />

100 percent ownership of the company. In a<br />

surprising turn of events, the MDC went into<br />

voluntary liquidation in 2006 and its assets were<br />

sold to other companies, the main one being ETC<br />

BioEnergy.<br />

The government’s equity stake in Kascol was<br />

partly through the Development Bank of Zambia,<br />

and partly through the Zambia Sugar Company;<br />

when the latter was sold to Tate and Lyle in 1995,<br />

Kascol was effectively privatized.<br />

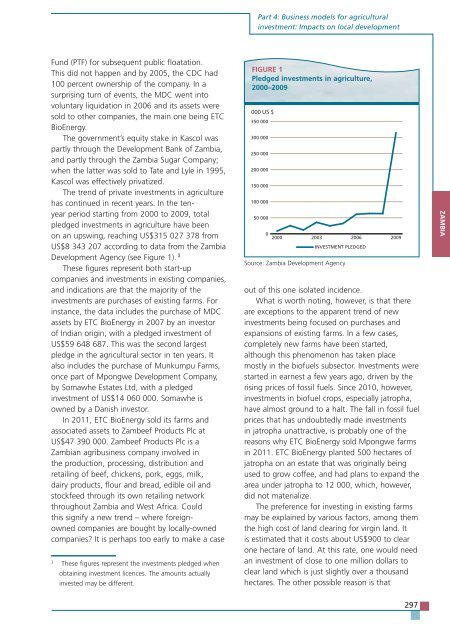

The trend of private investments in agriculture<br />

has continued in recent years. In the tenyear<br />

period starting from 2000 to 2009, total<br />

pledged investments in agriculture have been<br />

on an upswing, reaching US$315 027 378 from<br />

US$8 343 207 according to data from the Zambia<br />

Development Agency (see Figure 1). 3<br />

These figures represent both start-up<br />

companies and investments in existing companies,<br />

and indications are that the majority of the<br />

investments are purchases of existing farms. For<br />

instance, the data includes the purchase of MDC<br />

assets by ETC BioEnergy in 2007 by an investor<br />

of Indian origin, with a pledged investment of<br />

US$59 648 687. This was the second largest<br />

pledge in the agricultural sector in ten years. It<br />

also includes the purchase of Munkumpu Farms,<br />

once part of Mpongwe Development Company,<br />

by Somawhe Estates Ltd, with a pledged<br />

investment of US$14 060 000. Somawhe is<br />

owned by a Danish investor.<br />

In 2011, ETC BioEnergy sold its farms and<br />

associated assets to Zambeef Products Plc at<br />

US$47 390 000. Zambeef Products Plc is a<br />

Zambian agribusiness company involved in<br />

the production, processing, distribution and<br />

retailing of beef, chickens, pork, eggs, milk,<br />

dairy products, flour and bread, edible oil and<br />

stockfeed through its own retailing network<br />

throughout Zambia and West Africa. Could<br />

this signify a new trend – where foreignowned<br />

companies are bought by locally-owned<br />

companies? It is perhaps too early to make a case<br />

3 These figures represent the investments pledged when<br />

obtaining investment licences. The amounts actually<br />

invested may be different.<br />

Part 4: Business models for agricultural<br />

investment: Impacts on local development<br />

FIGURE 1<br />

Pledged investments in agriculture,<br />

2000–2009<br />

000 US $<br />

350 000<br />

300 000<br />

250 000<br />

200 000<br />

150 000<br />

100 000<br />

50 000<br />

0<br />

2000<br />

2003<br />

<strong><strong>IN</strong>VESTMENT</strong> PLEDGED<br />

Source: Zambia Development Agency<br />

2006<br />

2009<br />

out of this one isolated incidence.<br />

What is worth noting, however, is that there<br />

are exceptions to the apparent trend of new<br />

investments being focused on purchases and<br />

expansions of existing farms. In a few cases,<br />

completely new farms have been started,<br />

although this phenomenon has taken place<br />

mostly in the biofuels subsector. Investments were<br />

started in earnest a few years ago, driven by the<br />

rising prices of fossil fuels. Since 2010, however,<br />

investments in biofuel crops, especially jatropha,<br />

have almost ground to a halt. The fall in fossil fuel<br />

prices that has undoubtedly made investments<br />

in jatropha unattractive, is probably one of the<br />

reasons why ETC BioEnergy sold Mpongwe farms<br />

in 2011. ETC BioEnergy planted 500 hectares of<br />

jatropha on an estate that was originally being<br />

used to grow coffee, and had plans to expand the<br />

area under jatropha to 12 000, which, however,<br />

did not materialize.<br />

The preference for investing in existing farms<br />

may be explained by various factors, among them<br />

the high cost of land clearing for virgin land. It<br />

is estimated that it costs about US$900 to clear<br />

one hectare of land. At this rate, one would need<br />

an investment of close to one million dollars to<br />

clear land which is just slightly over a thousand<br />

hectares. The other possible reason is that<br />

297<br />

ZAMBIA