TRENDS AND IMPACTS OF FOREIGN INVESTMENT IN DEVELOPING COUNTRY AGRICULTURE

TRENDS AND IMPACTS OF FOREIGN INVESTMENT IN DEVELOPING COUNTRY AGRICULTURE

TRENDS AND IMPACTS OF FOREIGN INVESTMENT IN DEVELOPING COUNTRY AGRICULTURE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GHANA<br />

Trends and impacts of foreign investment in<br />

developing country agriculture<br />

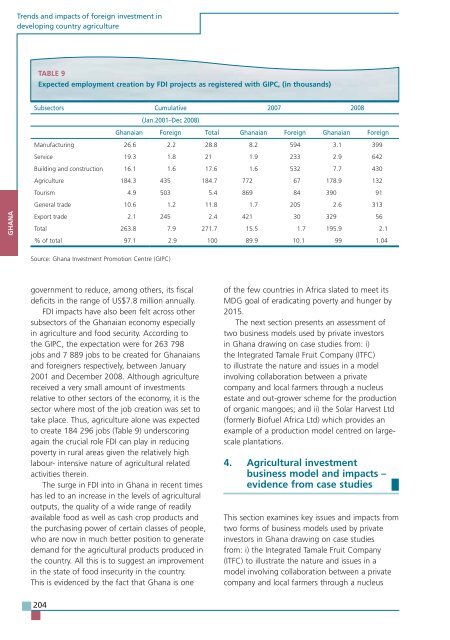

TABLE 9<br />

Expected employment creation by FDI projects as registered with GIPC, (in thousands)<br />

Subsectors Cumulative<br />

(Jan.2001–Dec 2008)<br />

2007 2008<br />

Ghanaian Foreign Total Ghanaian Foreign Ghanaian Foreign<br />

Manufacturing 26.6 2.2 28.8 8.2 594 3.1 399<br />

Service 19.3 1.8 21 1.9 233 2.9 642<br />

Building and construction 16.1 1.6 17.6 1.6 532 7.7 430<br />

Agriculture 184.3 435 184.7 772 67 178.9 132<br />

Tourism 4.9 503 5.4 869 84 390 91<br />

General trade 10.6 1.2 11.8 1.7 205 2.6 313<br />

Export trade 2.1 245 2.4 421 30 329 56<br />

Total 263.8 7.9 271.7 15.5 1.7 195.9 2.1<br />

% of total 97.1 2.9 100 89.9 10.1 99 1.04<br />

Source: Ghana Investment Promotion Centre (GIPC)<br />

government to reduce, among others, its fiscal<br />

deficits in the range of US$7.8 million annually.<br />

FDI impacts have also been felt across other<br />

subsectors of the Ghanaian economy especially<br />

in agriculture and food security. According to<br />

the GIPC, the expectation were for 263 798<br />

jobs and 7 889 jobs to be created for Ghanaians<br />

and foreigners respectively, between January<br />

2001 and December 2008. Although agriculture<br />

received a very small amount of investments<br />

relative to other sectors of the economy, it is the<br />

sector where most of the job creation was set to<br />

take place. Thus, agriculture alone was expected<br />

to create 184 296 jobs (Table 9) underscoring<br />

again the crucial role FDI can play in reducing<br />

poverty in rural areas given the relatively high<br />

labour- intensive nature of agricultural related<br />

activities therein.<br />

The surge in FDI into in Ghana in recent times<br />

has led to an increase in the levels of agricultural<br />

outputs, the quality of a wide range of readily<br />

available food as well as cash crop products and<br />

the purchasing power of certain classes of people,<br />

who are now in much better position to generate<br />

demand for the agricultural products produced in<br />

the country. All this is to suggest an improvement<br />

in the state of food insecurity in the country.<br />

This is evidenced by the fact that Ghana is one<br />

204<br />

of the few countries in Africa slated to meet its<br />

MDG goal of eradicating poverty and hunger by<br />

2015.<br />

The next section presents an assessment of<br />

two business models used by private investors<br />

in Ghana drawing on case studies from: i)<br />

the Integrated Tamale Fruit Company (ITFC)<br />

to illustrate the nature and issues in a model<br />

involving collaboration between a private<br />

company and local farmers through a nucleus<br />

estate and out-grower scheme for the production<br />

of organic mangoes; and ii) the Solar Harvest Ltd<br />

(formerly Biofuel Africa Ltd) which provides an<br />

example of a production model centred on largescale<br />

plantations.<br />

4. Agricultural investment<br />

business model and impacts –<br />

evidence from case studies <br />

This section examines key issues and impacts from<br />

two forms of business models used by private<br />

investors in Ghana drawing on case studies<br />

from: i) the Integrated Tamale Fruit Company<br />

(ITFC) to illustrate the nature and issues in a<br />

model involving collaboration between a private<br />

company and local farmers through a nucleus