TRENDS AND IMPACTS OF FOREIGN INVESTMENT IN DEVELOPING COUNTRY AGRICULTURE

TRENDS AND IMPACTS OF FOREIGN INVESTMENT IN DEVELOPING COUNTRY AGRICULTURE

TRENDS AND IMPACTS OF FOREIGN INVESTMENT IN DEVELOPING COUNTRY AGRICULTURE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

UG<strong>AND</strong>A<br />

Trends and impacts of foreign investment in<br />

developing country agriculture<br />

BOX 5<br />

Reasons for investing in coffee, flowers and fish sectors in Uganda, 2009<br />

140<br />

Coffee Processing and Export<br />

Uganda is a good volume<br />

producer of coffee and has a<br />

liberalized market. Multinationals<br />

were invited to invest n<br />

the coffee industry following<br />

liberalization in the 1990s.<br />

Source: Field interviews.<br />

Flowers and Cuttings<br />

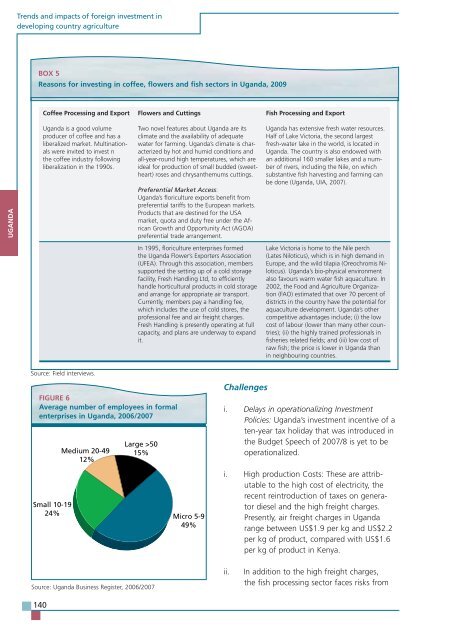

FIGURE 6<br />

Average number of employees in formal<br />

enterprises in Uganda, 2006/2007<br />

Small 10-19<br />

24%<br />

Medium 20-49<br />

12%<br />

Two novel features about Uganda are its<br />

climate and the availability of adequate<br />

water for farming. Uganda’s climate is characterized<br />

by hot and humid conditions and<br />

all-year-round high temperatures, which are<br />

ideal for production of small budded (sweetheart)<br />

roses and chrysanthemums cuttings.<br />

Preferential Market Access:<br />

Uganda’s floriculture exports benefit from<br />

preferential tariffs to the European markets.<br />

Products that are destined for the USA<br />

market, quota and duty free under the African<br />

Growth and Opportunity Act (AGOA)<br />

preferential trade arrangement.<br />

In 1995, floriculture enterprises formed<br />

the Uganda Flower’s Exporters Association<br />

(UFEA). Through this association, members<br />

supported the setting up of a cold storage<br />

facility, Fresh Handling Ltd, to efficiently<br />

handle horticultural products in cold storage<br />

and arrange for appropriate air transport.<br />

Currently, members pay a handling fee,<br />

which includes the use of cold stores, the<br />

professional fee and air freight charges.<br />

Fresh Handling is presently operating at full<br />

capacity, and plans are underway to expand<br />

it.<br />

Large >50<br />

15%<br />

Source: Uganda Business Register, 2006/2007<br />

Micro 5-9<br />

49%<br />

Challenges<br />

Fish Processing and Export<br />

Uganda has extensive fresh water resources.<br />

Half of Lake Victoria, the second largest<br />

fresh-water lake in the world, is located in<br />

Uganda. The country is also endowed with<br />

an additional 160 smaller lakes and a number<br />

of rivers, including the Nile, on which<br />

substantive fish harvesting and farming can<br />

be done (Uganda, UIA, 2007).<br />

Lake Victoria is home to the Nile perch<br />

(Lates Niloticus), which is in high demand in<br />

Europe, and the wild tilapia (Oreochromis Niloticus).<br />

Uganda’s bio-physical environment<br />

also favours warm water fish aquaculture. In<br />

2002, the Food and Agriculture Organization<br />

(FAO) estimated that over 70 percent of<br />

districts in the country have the potential for<br />

aquaculture development. Uganda’s other<br />

competitive advantages include; (i) the low<br />

cost of labour (lower than many other countries);<br />

(ii) the highly trained professionals in<br />

fisheries related fields; and (iii) low cost of<br />

raw fish; the price is lower in Uganda than<br />

in neighbouring countries.<br />

i. Delays in operationalizing Investment<br />

Policies: Uganda’s investment incentive of a<br />

ten-year tax holiday that was introduced in<br />

the Budget Speech of 2007/8 is yet to be<br />

operationalized.<br />

i. High production Costs: These are attributable<br />

to the high cost of electricity, the<br />

recent reintroduction of taxes on generator<br />

diesel and the high freight charges.<br />

Presently, air freight charges in Uganda<br />

range between US$1.9 per kg and US$2.2<br />

per kg of product, compared with US$1.6<br />

per kg of product in Kenya.<br />

ii. In addition to the high freight charges,<br />

the fish processing sector faces risks from